Amazon's earnings; First-quarter revenue growth of major tech companies; Mixed data on inflation; California woman drops phone into outhouse

1) My three favorite tech giants, Alphabet (GOOGL) (which I discussed in Wednesday's e-mail), Meta Platforms (FB) (which I discussed yesterday), and Amazon (AMZN), reported earnings this week – the latter after the close yesterday (see the earnings release here and the slides here).

It was a surprisingly weak quarter on many dimensions, which is why the stock is down more than 10% this morning:

- Revenue rose 7% to $116.4 billion, the slowest rate for any quarter since the dot-com bust in 2001 and the second straight period of single-digit growth.

- Net income, adjusted for a non-cash markdown of Amazon's investment in Rivian Automotive (RIVN), was $7.38 per share versus $8.36 expected.

- Operating margin was 3.2% versus expectations of 4.7% and 8.2% a year earlier.

- Operating cash flow was negative $2.8 billion versus positive $4.2 billion.

- Amazon Web Services was a lone bright spot, with revenue and operating income growing 37% and 57%, respectively.

- The company guided for second-quarter revenue of $116 billion to $121 billion compared with the consensus expectation for $125.5 billion, which would represent only 3% to 7% growth.

Like Alphabet and Meta, Amazon is attributing much of the slowdown to macroeconomic conditions and Russia's invasion of Ukraine. In addition, I think all three businesses benefited from a spike in usage/demand due to the pandemic, which has now dissipated as the world reopens.

For example, during the first quarter a year ago, Amazon's revenue grew a staggering 44%, driven by people stuck at home flush with their "stimmies" (stimulus checks), ordering everything they would have gone out to purchase. In light of the almost-back-to-normal world we're in today, it's a minor miracle that Amazon was able to grow its revenue at all.

My take: I'm not worried about Amazon – its future remains bright. And with its stock now down 30% since its all-time high six months ago, this looks like a good buying opportunity...

2) Here's Charlie Bilello with an interesting tweet:

3) There are so many conflicting data points about inflation. On the one hand, I recently ran into an old friend who is buying large amounts of food for Ukraine.

I said, "Wow, you must be seeing food inflation up close..."

His eyes got big and he replied, "I think food prices around the world are going up 30% to 40%."

Wow...

In addition, I'm in shock at how much airfares have jumped. I looked at flying from LaGuardia to Reagan National last Wednesday, barely a 30-minute flight, and it was $598 (so I took the train)! And I had to pay $450 for a one-way flight home from Minneapolis to LaGuardia last Sunday. Those prices are double normal levels...

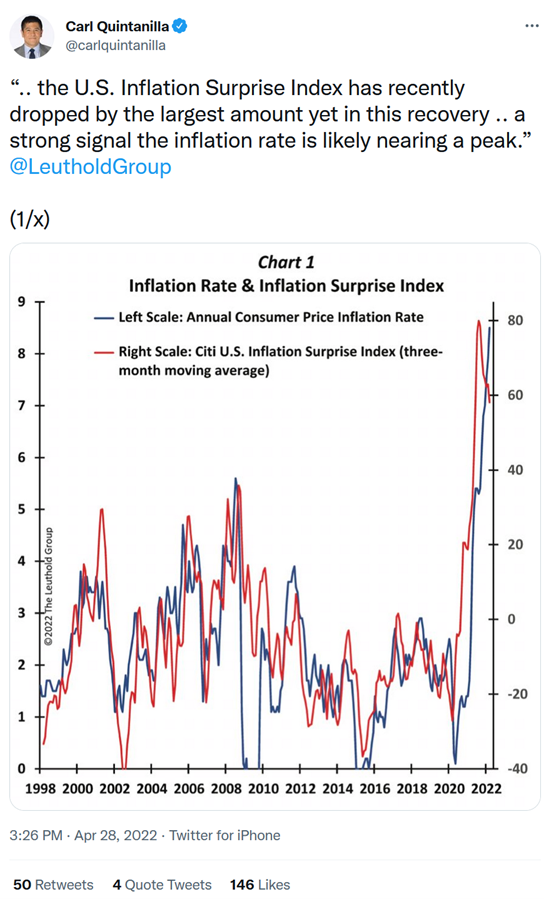

On the other hand, however, CNBC anchor Carl Quintanilla tweeted this:

My take: I still think inflation falls to around 4% by year-end (which is up from my original estimate of 3%), but my level of confidence around this is lower. It could easily be 5%...

Lastly, we can all breathe a sigh of relief that we're not Argentina! Inflation Got You Down? At Least You Don't Live in Argentina. Excerpt:

Shopkeeper Jonathan Faez has a word of advice to people around the world obsessing about inflation: Chill out.

"I have friends in the United States and Spain and they're telling me they're going crazy with their annual inflation of 5% or 7%," says Mr. Faez, owner of a lingerie store. "Here, we reach 4% almost every month!"

Welcome to Argentina, where high, nearly uncontrollable inflation – now at an estimated 55.1% over the past year – is as natural as the country's juicy sirloins and sensual tango shows.

With the rest of the world experiencing higher inflation – byproduct of supply chain crunches, heavy stimulus spending and the war in Ukraine – Argentina offers something of a window to those who fret about just how high inflation will go and what it will mean to their everyday lives.

They've had practice: In the late '80s, runaway government spending sent inflation soaring above 3,000%, and after a period of relative stability the figure has been creeping up again, reaching 6.7% in March alone, the highest in 20 years.

"Here 40% is normal," says Mr. Faez. "And when we get past 50%, it doesn't scare us, it simply bothers us."

4) I both laughed and shuddered when I read this story because I use outhouses often during my outdoor adventures, and I've always been afraid of this happening to me... (Yes, I would have done something similar to try to retrieve my phone, but I'd like to think I wouldn't have fallen in!) California woman drops phone into outhouse, falls in headfirst and gets stuck. Excerpt:

A woman who accidentally dropped her phone into the hole of a vault toilet fell in while trying to retrieve it and was trapped for more than an hour...

The woman, described only as a Californian in her 40s, was trying to retrieve the phone that had fallen into the toilet.

She disassembled and removed the seat so she could lie down and lean into the hole, clinging with one hand to the dog leash she had tied to a support. The leash "failed, and she slid into and fell into the vault headfirst," the fire department's report said.

After about 20 minutes of unsuccessfully attempting to climb out, she used her phone to call 911.

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.