Capitulation Part Deux? I Think So!; Melvin Capital to Close Funds, Return Cash to Investors; I'm playing at the National Senior Games

1) Even with the market down the last two days, the Nasdaq closed yesterday slightly above last Wednesday, when I called a bottom.

Another grizzled veteran, my old friend Doug Kass of Seabreeze Partners, shares my view, for reasons he laid out in this missive yesterday...

Capitulation Part Deux? I Think So!

* Many statistics suggest opportunities develop after large sell-offs

* I am embracing multiplying opportunities as an incrementalist – slowly expanding my long exposure

Capitulation takes many forms – I thought last Thursday's capitulation was staring us in the face.

It appears I was premature as we are seeing Capitulation Part Deux now.

I have a contrarian streak and I always possess a calculator in hand for the purpose of developing a reward vs. risk model with an eye on a "margin of safety."

Contrarian analysis does not mean looking at a self-selected sample and assuming everyone else is stupid. Bubbles do form and pop even when "everyone" is wondering if we're in a bubble. And investors often do capitulate even when "everyone" is looking for capitulation. As proof, do a Google search on the words bubble and capitulation – they often rise exponentially near tops (bubble) and bottoms (capitulation).

Here are some possible market stabilizers and signposts that we are approaching a bottom and capitulation – Part Deux:

* The differential between the S&P earnings yield and bond yields is finally narrowing:

* The Nasdaq market cap loss in 2022 through the end of April, it has worsened since, was $7.5 trillion compared to a loss in the Covid sell-off of $4.5 trillion, the dot.com collapse of $4.6 trillion, and only $2.5 trillion loss in the great financial crisis of 2007-09. Startling.

* Nearly everyone has degrossed and derisked. I spoke to Lee Cooperman last weekend and he thinks the S&P 500 Index can fall 40% from the high if we have a recession. Or consider Dan Loeb, one of the greatest investors ever – in his Third Point first quarter letter to investors he said he was over 75% net long at year end, 41% net long at the end of the first quarter and only 23% net long last week!

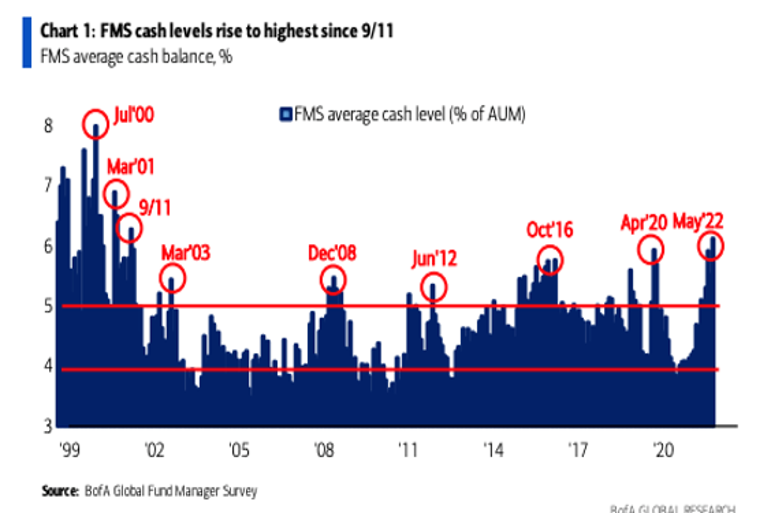

* Cash levels are higher than at the height of the pandemic:

* As discussed with Tom Keene and Paul Sweeney yesterday, at the end of April (again it has worsened in May) the 60 (stocks)/40 (bonds) strategy was -12% year to date. The worst performance in the last century and 3x worse than the second worst year (-4%)!

* Last week Investors Intelligence indicated that Bulls fell to just 29.8, the lowest since early 2016 while Bears rose to 40.8, the highest since March 2020.

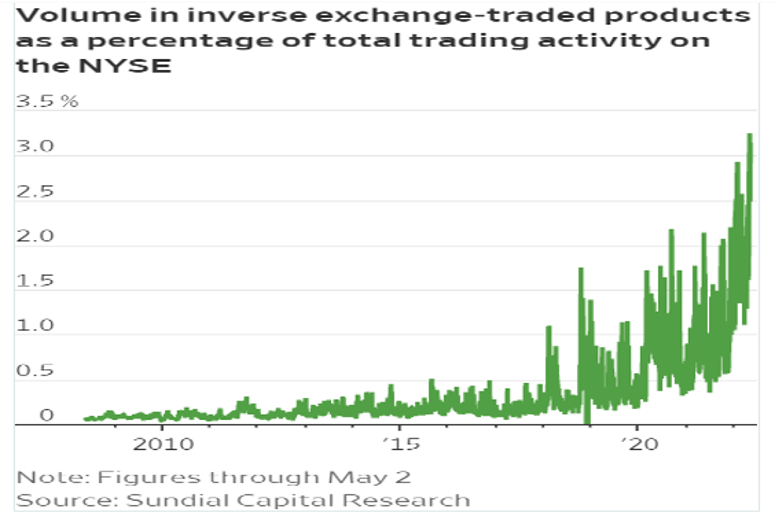

* The volume in inverse ETFs (at 3.25% of total trading) is at an all-time high.

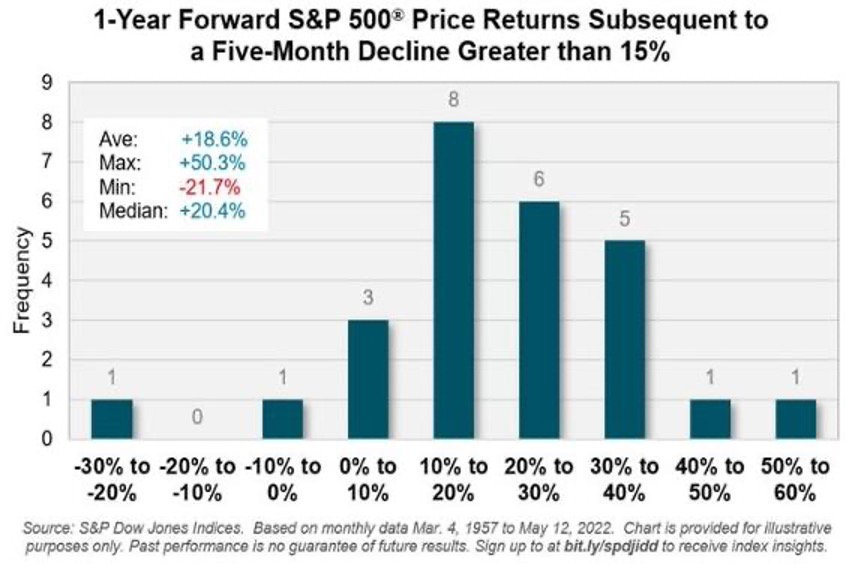

* Going back to 1957: a decline of 15% or more for the S&P 500 Index has been followed by positive returns in the ensuing 12 months in all but two occasions over the past 65 years.

* As of the end of April, more than 29% of issues on the NYSE had hit a 52-week low. On the Nasdaq, it was more than 33%. There have been only 18 similar days since 1984. The S&P 500 showed a loss a year later once, for -0.2%. Its median return was +32.0%.

* The S&P Oscillator is deeply oversold at -7.13% and the CNN Fear and Greed Indicator is expressing extreme fear (at 9/100).

2) Another common sign of a market bottom is the shuttering of large fund, like this: Melvin Capital to Close Funds, Return Cash to Investors. Excerpt:

Melvin Capital plans to close its funds and return the cash to its investors, capping a stunning reversal for a firm that lost big on the surge in meme stocks last year and on wagers on growth stocks this year.

In a letter to investors that was reviewed by the Wall Street Journal, Gabe Plotkin, Melvin's founder, wrote that he reached his decision after conferring with Melvin's board of directors during a monthslong process of reassessing his business.

"The past 17 months has been an incredibly trying time for the firm and you, our investors," he wrote. "I have given everything I could, but more recently that has not been enough to deliver the returns you should expect. I now recognize that I need to step away from managing external capital."

Melvin had been, until last year, one of the top-performing hedge funds – its track record of about 30% a year after fees before 2021 was among the best on Wall Street. It was especially known for its prowess in shorting, or betting against, stocks. In 2015, gains from Melvin's shorts made up two-thirds of the fund's 67% returns before fees. Mr. Plotkin bought a minority stake in the National Basketball Association's Charlotte Hornets, plus a $44 million oceanfront mansion in Miami Beach.

But Melvin's short positions blew up in January 2021 when individual investors on online forums such as Reddit's WallStreetBets banded together to push up prices of shares, like those of GameStop (GME), that Melvin was betting against. At the worst point that month, Melvin, which managed $12.5 billion at the start of last year, was hemorrhaging more than $1 billion a day.

While Melvin had made up some of those losses by the end of the year, its focus on fast-growing companies dealt it further setbacks this year as investors soured on such stocks in the face of rising interest rates. Stock pickers also have blamed losses this year on macroeconomic factors like inflation and the war in Ukraine that have hit the market, instead of companies' own fundamentals. Melvin's losses widened.

Melvin this year through April had lost 23%, on top of a 39.3% loss in 2021 – a huge hole investors expected could take years to make up if Mr. Plotkin didn't shut down in the interim. Since its start, it has averaged an 11.9% return.

3) Greetings from Fort Lauderdale! I'm here for a few days, competing in the National Senior Games in singles and doubles tennis with my cousin Steve.

We both played singles yesterday morning. I ran into a buzzsaw, a high-level former college player, who smoked me 6-2, 6-2, but Steve eked out a narrow victory to make the semi-finals.

Then we played our first doubles match yesterday afternoon – against the team that beat us 6-4, 6-4 in the gold medal match three years ago – and I'm pleased to report that we got revenge, winning 6-2, 7-5!

This will likely put us back in the gold medal match on Sunday against the No. 1 seeds. Wish us luck!

Here are pictures of us on the court yesterday, on the podium three years ago, with our shopping cart full of goodies from our Costco (COST) run, and hanging out at the pool:

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.