FTX Had a Death Spiral; My reactions; Crypto's FTX Moment Shows Danger of Centralized Finance With No Central Bank; Magazine cover indicator; My dad is doing well

1) Following up on yesterday's e-mail about the epic battle royale between two of the leading players in the crypto sector, Changpeng Zhao ("CZ"), the co-founder and CEO of Binance, and Sam Bankman-Fried ("SBF"), the founder and CEO of FTX, it appeared that Binance was going to acquire FTX... But after looking at its books and seeing a massive hole, Zhao wisely walked away: Binance Walks Away From Deal to Rescue FTX. Excerpt:

Crypto exchange Binance reversed course on a rescue offer for FTX Wednesday, leaving the prominent digital firm with an uncertain future as it faces a shortfall of up to $8 billion, according to people familiar with the matter.

Binance chose not to go ahead with the nonbinding offer following a review of the company's finances, the exchange said. "In the beginning, our hope was to be able to support FTX's customers to provide liquidity, but the issues are beyond our control or ability to help," Binance said in a statement.

For a brief explanation of what happened, see this Heard on the Street column in the Wall Street Journal: Crypto Has Reinvented Bank Runs.

For a more in-depth analysis, see this essay by Bloomberg's Matt Levine: FTX Had a Death Spiral. Excerpt:

But the most informed view is probably that of CZ himself, who tweeted this morning:

Two big lessons:

1: Never use a token you created as collateral.

2: Don't borrow if you run a crypto business. Don't use capital "efficiently". Have a large reserve.

Binance has never used BNB for collateral, and we have never taken on debt.

"Never use a token you created as collateral" suggests, to me, that FTX accepted its FTT token as collateral, probably from Alameda, probably in exchange for borrowing assets that it owes to customers. And that that went wrong in roughly the way I have outlined.

One other point here is that if this is the story, then it is not a liquidity crisis but a solvency one. That is, the problem is not a timing mismatch, in which FTX's customers asked for their cash back but FTX did not have enough ready cash because it had long-term but money-good loans out. The problem is that FTX took its customers' money and traded it for a pile of magic beans, and now the beans are worthless and there's a huge hole in the balance sheet.

2) My initial reactions are twofold:

a) How could SBF be so reckless and stupid?

The obvious answer: This is exactly how one would expect a naïve and inexperienced 30-year-old to behave...

And b) How could regulators allow the crypto sector to balloon to a $3 trillion market cap (now under $1 trillion) with essentially zero oversight?

The obvious answer: This is exactly how regulators usually behave – totally clueless and conflicted, rushing to shut the barn door after the horse has fled (see: SEC, DOJ Investigating Crypto Platform FTX)...

3) This is a smart essay with good advice for regulators: Crypto's FTX Moment Shows Danger of Centralized Finance With No Central Bank. Excerpt:

Having compressed most of the mistakes made by finance over the centuries into just over a decade, cryptocurrency speculators may finally be discovering the fundamental flaw of trying to build an alternative to government-backed finance: no government backing.

This week the founder of the largest crypto exchange, Binance, provisionally agreed to rescue top-five rival FTX after it was abandoned by clients in the equivalent of a bank run. On Wednesday, Changpeng Zhao walked away, saying the problems were too big. FTX's future now looks grim, with likely knock-on effects across crypto.

Even if the deal had gone through, it would have left an obvious danger: There's no one big enough to rescue Binance. Without the deal, a potentially systemic crisis in crypto will be left to play out by itself...

The reliance on trust that Nakamoto was trying to avoid has been reintroduced – and one of the biggest lessons of financial history is that where there's a need for trust, there are also dire consequences when trust breaks down. Mr. Bankman-Fried experienced that firsthand this week as his attempts to reassure clients were ignored.

The fundamental flaw of centralized finance is that it needs central banks to end chaotic bank runs, and crypto has reinvented centralized finance. As a result, FTX and the broader crypto ecosystem now face serious uncertainty, and maybe disaster.

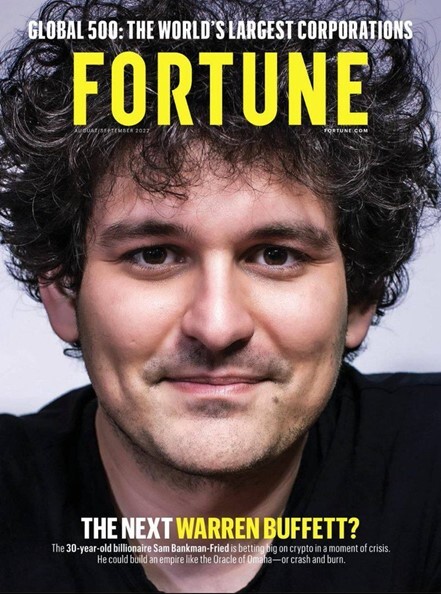

4) This is yet another example of the famous magazine cover indicator, as Fortune put SBF on its cover a few months ago with the question, "The Next Warren Buffett?"

Forbes also put SBF on its cover 13 months ago:

This reminds me of what I wrote on February 24 last year about Chamath Palihapitiya:

... my observation over the past two decades is that anytime a "new economy" guru compares himself to – while also trash talking – the Oracle of Omaha, the market soon punishes his hubris! The King of SPACs Wants You to Know He's the Next Warren Buffett.

(It goes without saying that every company associated with Palihapitiya has imploded...)

5) My dad's second ablation yesterday morning went well, and he's resting comfortably at Dartmouth Hitchcock Medical Center in New Hampshire!

Here's a picture of us (pretty similar to the one of us before the procedure!):

Normally, he would have come home yesterday, but they're "loading" him with a new drug, Tikosyn, which requires monitoring and periodic EKGs over three days, so he won't be discharged until Friday afternoon.

I'll let you know if anything changes, but for now everything looks good.

Thanks again for the many kind wishes!

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.