How the best-performing stocks of 2020 have done since then; The biggest hedge fund hotels; DWAC crashing; Natera: Pioneers In Deceptive Medical Billing; Spot-on meme

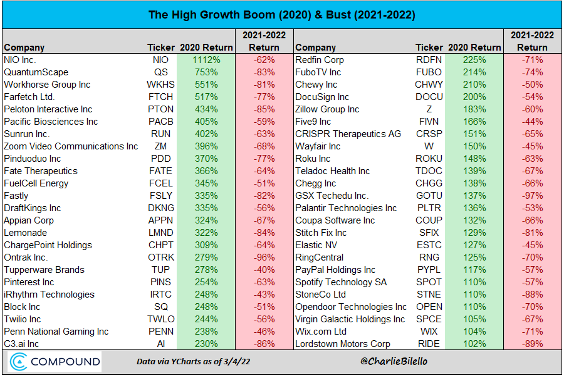

1) Following up on yesterday's e-mail about the battering growth stocks have taken, here's a table (hat tip to my friend Doug Kass) showing 48 of them that at least doubled in 2020 and how they've done since (through March 4... with the Nasdaq Composite Index down 5.5% since then, many are down another 10% or more):

Given that the Nasdaq is only down 2.4% in the 14 and a half months from the end of 2020 through yesterday's close, I would have expected plenty of them to be down only slightly and quite a few to be up – but instead, all 48 have collapsed. Even the best performer, Tupperware Brands (TUP), is down 45%!

The only thing I've seen that exceeds the carnage we're seeing today is tech/Internet stocks in October 2002 after the bursting of the Internet bubble and financial stocks in March 2009 at the market bottom during the global financial crisis.

Note, however, that at the very bottom of these historical busts, stocks were down a lot more than the current crop are. For example, Booking Holdings (BKNG) fell more than 99% from 1999 to 2001, Amazon (AMZN) fell 94%, Cisco (CSCO) fell 89%, Intel (INTC) fell 82%, and Microsoft (MSFT), one of the better performers, "only" fell 64%.

During the financial crisis, many companies like Lehman Brothers went bankrupt and even the survivors saw huge declines: AIG (AIG) fell 99.4% from its 2008 high to its early 2009 low, MBIA (MBI) fell 97%, Bank of America (BAC) fell 93%, General Electric (GE) fell 83%, Wells Fargo (WFC) fell 80%, Goldman Sachs (GS) fell 79%, and JPMorgan Chase (JPM) "only" fell 68%.

So are today's fallen angels destined to fall just as much?

I doubt it... The economy is much stronger, interest rates are lower, and we're drowning in liquidity, so it's a good time to start sifting through the rubble, which, as I wrote yesterday, my colleague Enrique Abeyta is doing in his Empire Elite Growth newsletter – you can learn more about it here.

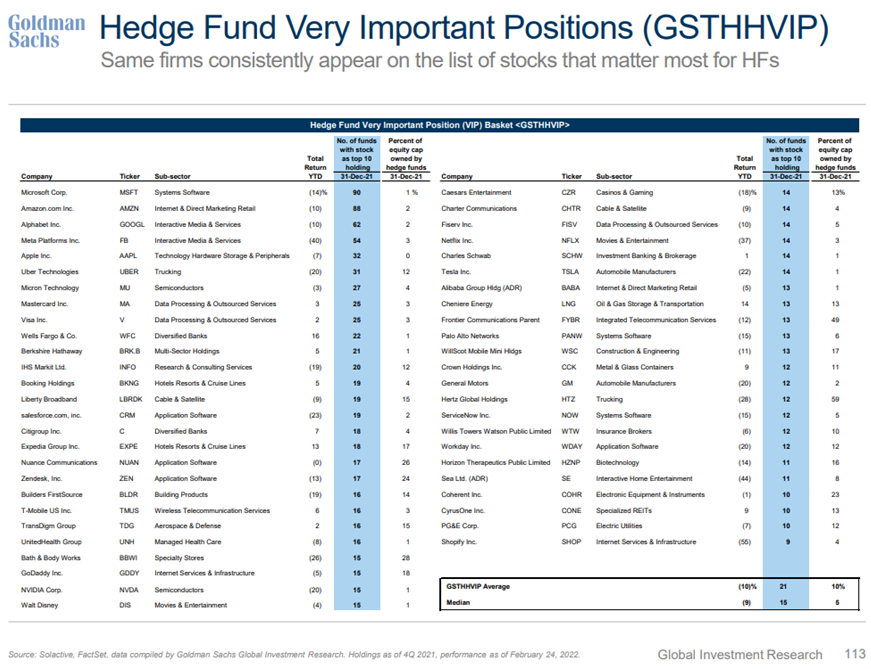

2) Another follow-up to yesterday's e-mail, in which I included a chart showing how the big "Tiger Cub" hedge funds own a lot of the same stocks, which increases their riskiness in the event of a big unwind. Here's a table from Goldman Sachs, identifying the biggest "hedge fund hotels":

3) Speaking of crashing stocks, exactly three weeks ago on February 22, I wrote:

My No. 1 stock to avoid in 2022, Digital World Acquisition (DWAC), is spiking this morning after former President Trump's new social media venture, Truth Social, became the top free app on Apple's (AAPL) App Store shortly after it launched late on Sunday (and still is, according to this tracking site).

I was certainly early in predicting the collapse of this stock... but my view hasn't changed that this will be the ultimate outcome, for various reasons I've outlined in prior e-mails (archive here).

This is a classic "buy the rumor, sell the news" situation, so this morning's spike to $99 per share smells like a blow-off top to me...

DWAC shares were well above $100 pre-market when I wrote that, and they were above $99 that day – and they've been all downhill ever since, closing yesterday down another 13% at $62.

We are only in the early innings of the demise of one of the worst stocks ever to pollute our markets.

Hopefully the SEC will do the right thing to protect investors and block this merger, which is carefully engineered to destroy average investors...

4) Speaking of another cratering stock (down 72% since September), kudos to Nate Anderson of Hindenburg Research, who in his latest report, Natera: Pioneers In Deceptive Medical Billing, once again showed why he was the No. 1 short activist in both 2020 and 2021, as ranked by Activist Insight. Excerpt:

- has never generated a profit and posted a $468.2 million loss from operations in 2021 compared to $216.3 million in 2020. It has an accumulated deficit of $1.4 billion and currently has $914.5 million in cash and equivalents and $330.4 million in debt...

- In late 2017, payors imposed "prior authorization" requirements for Natera's tests to curb excessive billing. Natera's risk disclosures warned that the additional step could severely hamper revenue growth.

- Just 3 months after the warning, a new, opaque, and supposedly non-profit entity called "My Genome My Life" ("MGML") appeared. Natera's sales reps suddenly began pitching doctors on free prior authorization help through the entity...

- MGML masks that it is a third party by submitting information to insurance companies under practitioners' login credentials, according to a person we interviewed familiar with MGML's operations. This practice is in direct contravention of longstanding HHS anti-kickback guidance calling for transparency by third party prior authorization providers...

- Outside of MGML, Natera lures patients in with promises of low testing costs and the prospect of learning a child's gender early, leading many expectant mothers to unknowingly agree to an expensive added screen for "microdeletions" that is rarely covered by insurance...

- Microdeletion testing was recently featured in a scathing New York Times exposé that reported how high rates of false positives result in tragic consequences, such as termination of pregnancies later found to be healthy.

- Around 75%-80% of Natera's key Panorama screenings include microdeletions, with the company hyping the potential revenue opportunity to investors. Virtually no payors cover the test for the above reasons.

- Natera more than doubles the bill for screenings to $8,000 by adding microdeletions, despite patients often being unaware they are even taking the added screen, and practitioners unaware of the surging bills...

- These opaque and deceptive billing practices have unleashed a tsunami of social media and Better Business Bureau ("BBB") complaints from patients, who have called the company's business practices "pure stealing" and "absolute fraud"...

- All told, Natera has employed a dizzying array of billing deceptions to fuel sales growth. Despite it all, the company is starkly unprofitable. We expect its "growth" and prospects will rapidly fizzle as payors and patients wise up to its practices.

5) Meanwhile, regulators continue their counterproductive investigation of activist short sellers. This meme perfectly captures the absurdity of the situation:

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.