I saw 10 more companies at the second day of the ICR conference; Thoughts on Helen of Troy and other companies; BBBY soars on disastrous earnings; Penguins in Antarctica

1) Yesterday I attended the second day of the annual ICR conference, at which more than 200 public retail, restaurant, and consumer companies meet with analysts and investors.

Every half hour from 8:00 a.m. to 4:00 p.m., three to five companies present or do "fireside chats" (Q&A sessions with an analyst) in one of the ballrooms and, separately, do small-group breakout sessions.

Here were the 10 companies I saw yesterday, in chronological order: Crox (CROX), Titan Machinery (TITN), On Holding (ONON), Denny's (DENN), Planet Fitness (PLNT), Presto Automation (PRST), MarineMax (HZO), Helen of Troy (HELE), Bowlero (BOWL), and Wolverine World Wide (WWW).

2) I couldn't have told you anything about Helen of Troy prior to seeing CEO Julien Mininberg's presentation yesterday (which you can watch here – it requires a free registration), but I'm certainly familiar with its brands: Oxo kitchen products, Hydro Flask water bottles, Pur water filters, Revlon hair dryers, Osprey backpacks, and many more.

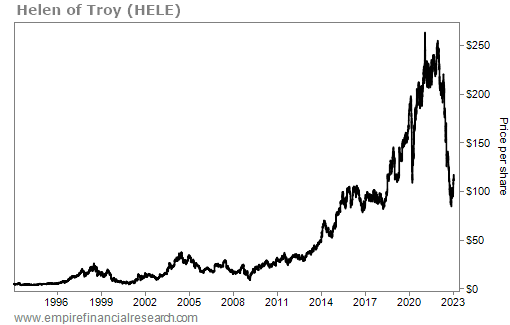

The company has been around since 1968 and, as you can see from the 30-year stock chart below, HELE shares have had a wild ride: from $4 to nearly $30 from 1995 to 1998, then down to $5 in 2001, back to above $30 in 2004, back down to $10 during the global financial crisis, and then an enormous run up to $254 just over a year ago – but then they tumbled to a low of under $90 in October and closed yesterday at $111.50:

My takeaway from this chart is that investors who have historically bought after the stock has pulled back substantially have been very well rewarded...

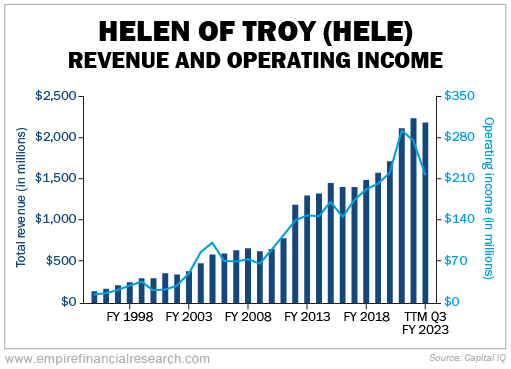

As you can see in this chart of the company's revenue and operating income since 1994, Helen of Troy has been an incredible growth story:

In summary, I'm going to do more work on the company because it appears to be a high-quality, well-managed, shareholder-friendly business whose stock has taken a beating due to what may be short-term factors (this is where I'll focus my research).

3) My quick take on some of the other companies I saw yesterday:

- Crox, On Holding (ONON), and Planet Fitness (PLNT) are wonderful growth stories – but their stock prices reflect this.

- Titan Machinery's (TITN) earnings have soared thanks to strength in the agricultural sector, which has taken its stock to all-time highs. Though it's trading at reasonable multiples (0.6 times sales, 7.2 times EBITDA, and 8.8 times trailing earnings), I worry it's cyclical at peak earnings – and I have no insight into whether/when the cycle might turn.

- Similarly, MarineMax's (HZO) earnings have exploded since the pandemic hit, though the stock has been cut in half since reaching an all-time high 18 months ago. As a result of these two factors, the stock appears ridiculously cheap at 0.3 times sales, 2.4 times EBITDA, and 3.6 times trailing earnings. Maybe that's cheap enough to be interesting, but I worry that the slowing economy may crush sales of expensive new boats.

4) I don't recall ever writing that a stock "soared yesterday after reporting truly disastrous earnings that all but guarantee it will soon file for bankruptcy," but that's what I have to say about Bed Bath & Beyond (BBBY)...

The company reported earnings for its fiscal third quarter that ended on November 26 that were as terrible as it had warned: Sales collapsed by 33%, cash flow from operations was negative $308 million, and the company spent an additional $96 million on capital expenditures, resulting in a total cash burn of $404 million.

It's clear why Bed Bath & Beyond told investors last week that it may soon need to "obtain relief under the U.S. Bankruptcy Code," in which case the stock will be worthless.

So why did BBBY shares soar 28% yesterday to close at $2.07, giving the company a market cap of nearly $200 million?

My best guess is that it's due to speculative buying by the same crowd of clueless retail investors on Reddit who briefly pushed the stock above $23 per share in August.

To understand how worthless Bed Bath & Beyond's stock is, consider that the company's August 2024 3.749% bonds, which traded at par as recently as March, are now trading for less than eight cents!

Here's what this means: The sophisticated investors in the debt markets not only think it's certain that Bed Bath & Beyond will file for bankruptcy, but that the company is so far under water that there will be almost no recovery on the lower tranches of debt – because it will file for Chapter 7 (liquidation) rather than the more common Chapter 11 (reorganization/rehabilitation).

I think this is correct because I don't see a viable business here, even if Bed Bath & Beyond shrinks its store base and reduces its debt load in bankruptcy. Like Circuit City and Blockbuster Video, it just needs to go away...

That said, I wouldn't short this stock because the retail crowd could jam it to $10 per share or more in a heartbeat – as these folks did with Revlon (REVRQ) in June (it now trades for $0.45 per share).

But I'm certain of the outcome: Bed Bath & Beyond's stock is worthless.

5) During our Antarctica trip, we saw lots of penguins almost every day, both on land and in the water. I recall three types: gentoo, chinstrap, and adélie. They were the cutest little things! Here are five videos I took...

- Penguins on land

- Penguins swimming

- Baby penguins at Hannah Point

- Adélie penguins sliding on bellies

- Penguins at Port Lockroy

Here's my favorite picture: four penguins walking along a "penguin highway," with our ship and spectacular scenery in the background:

Here they are coming toward me, waddling from a penguin colony on the top of the hill to the one at the bottom of the hill (behind me in the second picture below):

I posted 28 more penguin pictures on Facebook here.

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.