The next big moneymaking opportunity; How Elon Musk Damaged Twitter and Left It Worse Off; How a Delaware judge is likely to view Musk; HCA Healthcare presentation; Avoid checking a bag

1) There's an opportunity to make a great deal of money in the markets in the coming weeks – right in the midst of the huge shake-up we've seen this year.

I'm not alone in making this prediction, either. My colleague Louis Navellier – a $2 billion money manager whose fund saw a 4,000% return over 15 years – has joined me to make this big prediction.

Get the details on this big event right here.

2) This front-page story in today's New York Times, How Elon Musk Damaged Twitter and Left It Worse Off, is undoubtedly correct. Excerpt:

For years, Twitter (TWTR) was a runner-up social media company. It never grew to the size and scale of a Facebook or an Instagram. It simply muddled along.

Then, Elon Musk, a power user of the service, stormed in. He offered $44 billion to buy Twitter and declared that the company could perform far better if he were in charge. He disparaged Twitter's executives, ridiculed its content policies, complained about the product, and confused its more than 7,000 employees with his pronouncements. As Mr. Musk revealed the company's lack of business and financial prospects, Twitter's stock plunged more than 30%.

Now, as Mr. Musk, a billionaire, tries to back out of the blockbuster deal, he is inexorably leaving Twitter worse off than it was when he said he would buy it. With each needling tweet and public taunt, Mr. Musk has eroded trust in the social media company, walloped employee morale, spooked potential advertisers, emphasized its financial difficulties, and spread misinformation about how Twitter operates.

"His engagement with Twitter took a severe toll on the company," said Jason Goldman, a member of Twitter's founding team who has also served on its board of directors. "Employees, advertisers and the market at large cannot have conviction in a company whose path is unknowable and which will now go to court to complete a transaction with a bad-faith actor."

But rather than making me bearish on the stock, it makes me bullish. Here's why...

Over my nearly two decades as a hedge fund manager, I invested in a handful of companies whose stock value depended on the outcome of a case before the Delaware Court of Chancery, where Musk and Twitter are set to face off. I even took the train to Delaware once to sit in on a hearing.

So I speak with some experience when I say that these judges are no-nonsense and not subject to Musk's bullying, which has worked so well with other (gutless) regulators.

I think whichever Delaware judge that's assigned to this case will take an extremely dim view of Musk's actions from a legal perspective, with his laughable excuses to try to weasel his way out of the contract he signed.

But what Musk (and investors) aren't fully appreciating, in my view, is that these judges are humans, so their feelings – not just their unemotional analysis of the facts and the law –have a significant impact on their rulings.

And in this area, they are going to hate Musk and his juvenile shenanigans. For example, just yesterday, he tweeted this, acting as if this was some big joke or game:

And then he added this tweet, which shows his overwhelming arrogance:

My take: Musk is in a terrible legal position, and his antics are making a bad situation even worse.

Consequently, I think a Delaware judge is going to look to make an example of him and come down on him like a ton of bricks – mostly likely by forcing him to consummate the transaction he agreed to (at $54.20 per share) or pay a massive fine of $10 billion or more.

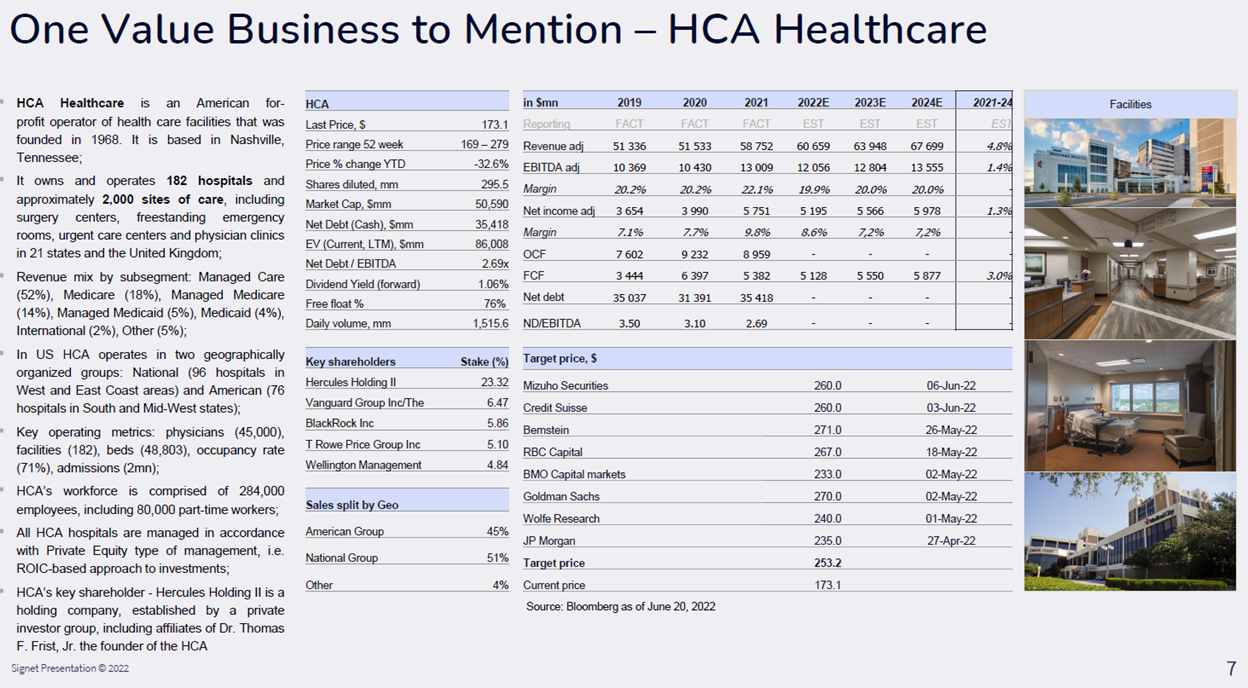

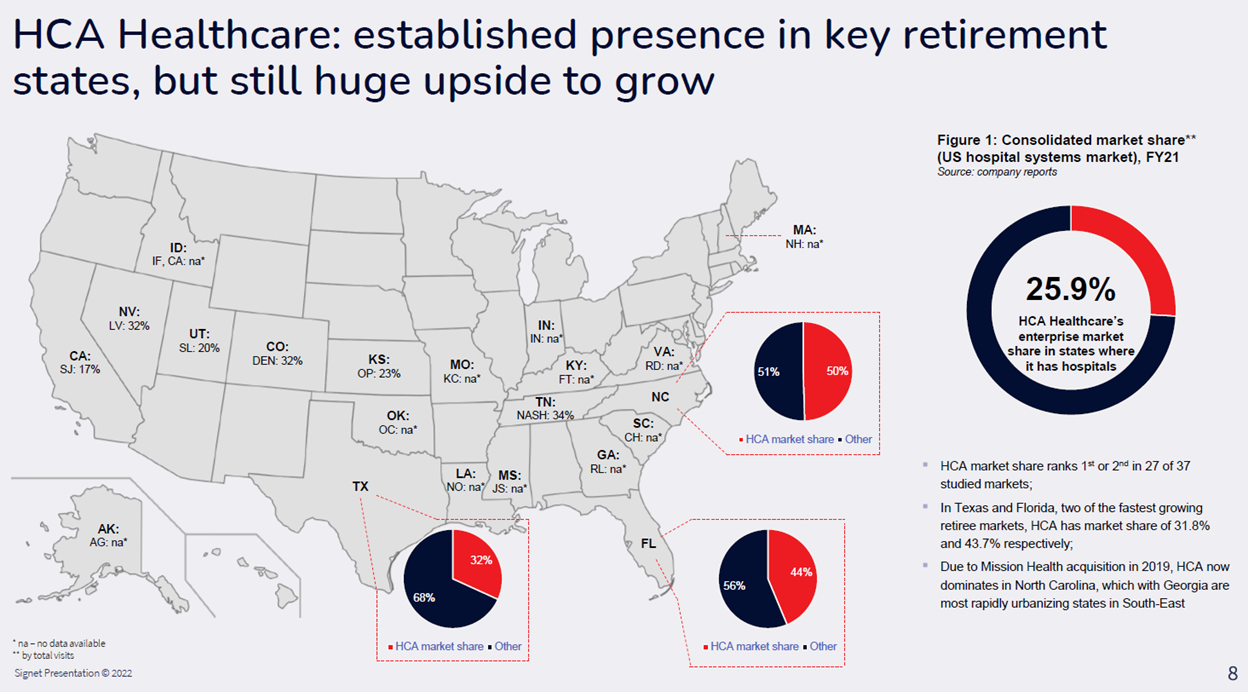

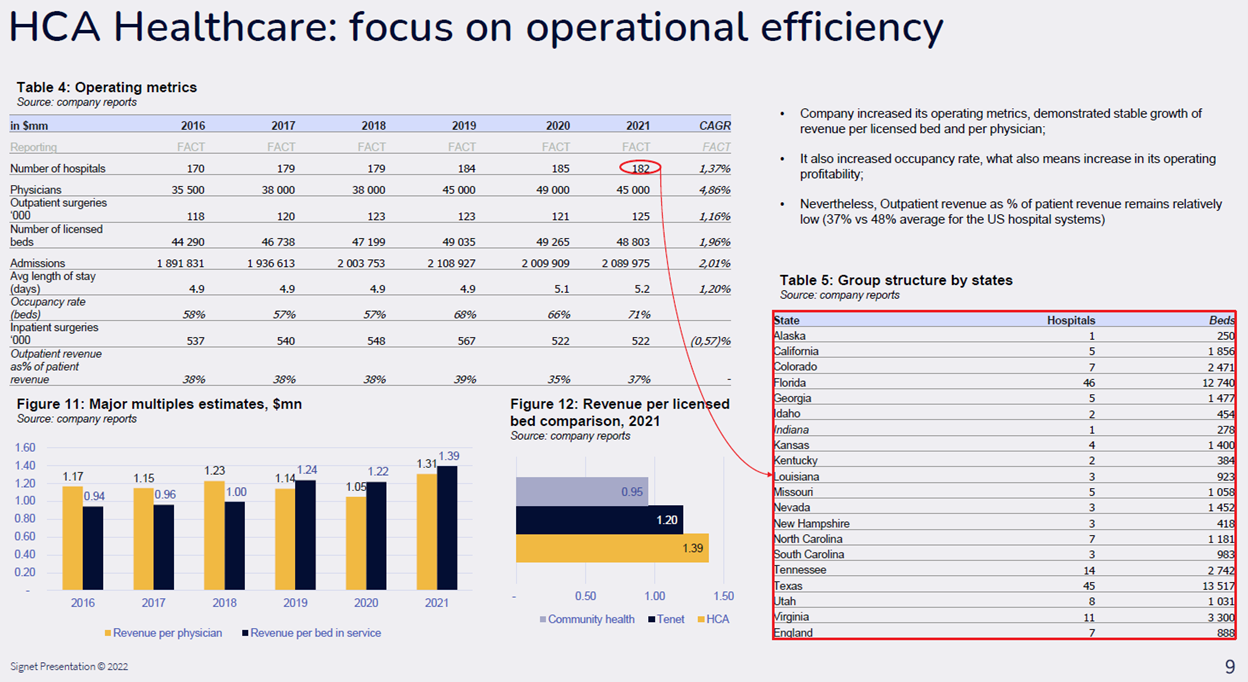

3) An interesting idea that caught my eye at last week's Value Investing Seminar in Italy was HCA Healthcare (HCA), the largest hospital operator in the U.S., which was pitched by Anatoly Fedorov, portfolio manager of the Signet Equity Fund.

You can see his presentation here, and below are his three slides on HCA:

4) Here's another travel tip from my recent 16-day trip to Europe (and my countless previous ones) that's especially true today: DO NOT CHECK A BAG!

It's a nightmare out there – numerous people on our Backroads trip reported that, on the way home, the airlines lost their bags, and two of them think it'll be months before they receive them, if ever.

Here's an article about the overall baggage problems: Amid the Summer Flying 'Meltdown,' Add Lost Luggage. Excerpt:

Surging air travel demand and airport staffing shortages have made this a bedeviling summer when it comes to lost and delayed checked luggage. Incidents like the recent baggage system malfunction at London's Heathrow Airport, which caused such big backups that flights were canceled to give workers a chance to sort out the mess, have only added to the misery.

While the number of mishandled bags had been decreasing over the past decade, partly because of new technology, the last few years have changed that trajectory. The number of delayed or lost bags rose to 6 out of 1,000 bags this February, from 5 out of 1,000 in February 2020, according to the most recent report from the Department of Transportation.

The system is now operating beyond its capacity, said William McGee, the senior fellow for aviation at the American Economic Liberties Project, a nonpartisan organization that promotes equal access to economic markets. "This is the worst summer meltdown for airline customer service in the 37 years I've spent working in, writing about and advocating about the airlines," he said.

In tomorrow's e-mail, I'll share my minimalist packing tips.

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.