'Whisper Trades' presentation; Amazon earnings; GDP Report Shows Economic Growth Slowed in First Quarter; Wages Continue to Grow; Mortgage payment required to buy a house hits all-time high; Interesting chart; Two new puppies

1) If you missed it yesterday, you can still watch the replay of my special "Whisper Trades" presentation...

In it, I explain how to use the "whispers" from company insiders – like board members, directors, and beneficial holders (i.e., investors who own 10% or more of the stock) – to your advantage. It's a 100% legal and ethical way to book potentially 10x profits this year and beyond.

2) My two favorite tech stocks, Meta Platforms (META) and Alphabet (GOOGL), reported earnings earlier this week... and my third-favorite, Amazon (AMZN), reported yesterday after the close (earnings release here and slide presentation here).

Initially the stock popped after hours on stronger-than-expected performance in the first three quarters of the year: revenue (adjusted for changes in foreign exchange rates) rose 11%, operating income increased 30%, and operating cash flow was $4.8 billion versus negative $2.8 billion in the same quarter last year.

But then the stock gave back all its gains and then some – it was down 4% this morning – because CEO Andy Jassy revealed during the earnings call that Amazon Web Services, a key contributor to the company's profitability, has seen revenue growth this month fall to about 11%. That's down from the nearly 16% increase in the first quarter.

This compares unfavorably to Microsoft (MSFT), which on Tuesday reported 27% growth in its Azure cloud business, and the cloud unit at Alphabet's Google, which reported 28% growth (albeit from smaller bases, as Amazon still holds roughly 34% of the cloud market, according to Synergy Research Group).

While Amazon isn't the kind of stock that you can just buy and forget about, like Berkshire Hathaway (BRK-B) is, it's pretty close... Nothing in yesterday's earnings report changes my view that Amazon will continue to be a long-term winner.

3) The data around the economy and inflation continues to be murky, which makes it hard to predict the likelihood of a recession and when the Fed is going to stop tightening.

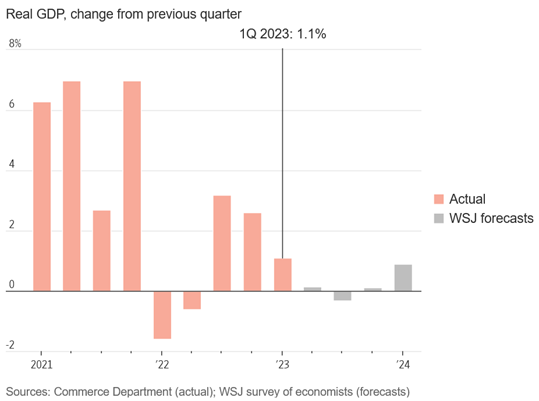

Yesterday, we got this news from the U.S. Commerce Department: GDP Report Shows Economic Growth Slowed in First Quarter. Excerpt:

U.S. economic growth slipped in the first quarter in the midst of still-high inflation and rising interest rates, adding to worries about a possible recession later this year.

U.S. gross domestic product, a measure of the value of all the goods and services produced in the country, rose at an inflation- and seasonally-adjusted 1.1% annual rate from January to March, a significant slowdown from 2.6% growth in the fourth quarter, the Commerce Department said Thursday.

4) But then this morning, we got this news from the U.S. Labor Department: Wages Continue to Grow, Good for Workers but a Worry for the Fed. Excerpt:

Wage growth remained strong in early 2023 – good news for workers trying to keep up with the rising cost of living, but a likely source of concern for Federal Reserve officials as they try to tamp down inflation without causing a recession.

Wages and salaries for private-sector U.S. workers were up 5.1% in March from a year earlier, and up 1.2% from December, the Labor Department said Friday. That was the same growth rate as in December, and defied forecasters' expectations of a modest slowdown. A broader measure of compensation growth, which includes the value of benefits as well as pay, actually accelerated slightly in the first quarter...

But inflation has come down more slowly than many forecasters had expected, and many economists say that while the labor market may no longer be boiling over, it is still at an uncomfortably high simmer. The wage figures released Friday tell a similar story: Pay is no longer rising as rapidly as it was in the middle of last year, but it is still rising much faster than before the pandemic.

Given that inflation-adjusted wages of average Americans have stagnated for decades, while productivity and profits have grown strongly – meaning that corporations, not workers, have pocketed the lion's share of the gains – I think it's a wonderful development that wages are rising strongly while inflation is falling rapidly...

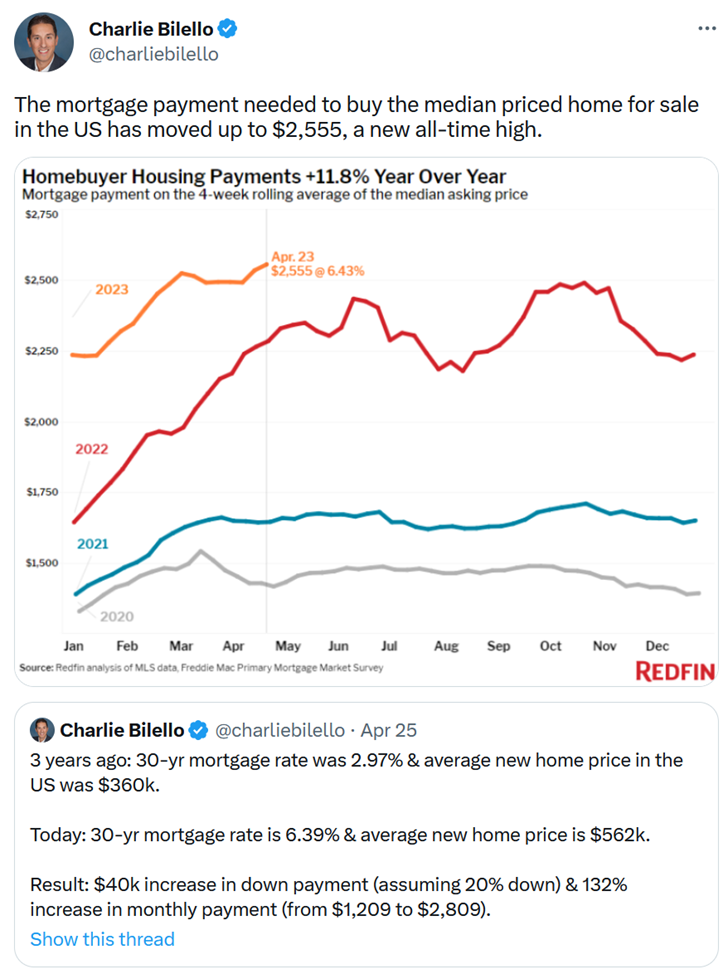

5) The housing market is particularly weak, mostly because the unprecedented spike in interest rates has made buying a house increasingly unaffordable, as Charlie Bilello shows in this tweet:

6) I'm a huge dog lover – so much so that my wife sometimes gets annoyed when she's in a hurry and I'm stopping to pet various dogs that walk past us...

My parents' dog, Tuffy, just gave birth to two new puppies on Sunday. I can't wait to meet them when we travel to Kenya for a visit in December!

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.