Carnage among bonds in the past two years; Top 10 stocks drive nearly all S&P 500 gains this year; Depressed downtowns; We saw Messi score; A shameless plug for my daughter

1) Continuing the discussion in my past two e-mails about the economy, inflation, and interest rates, all of this has major implications for bond investors...

This interesting chart shows how unusual last year was – it was one of only three years in the past 97 in which both stocks and bonds declined:

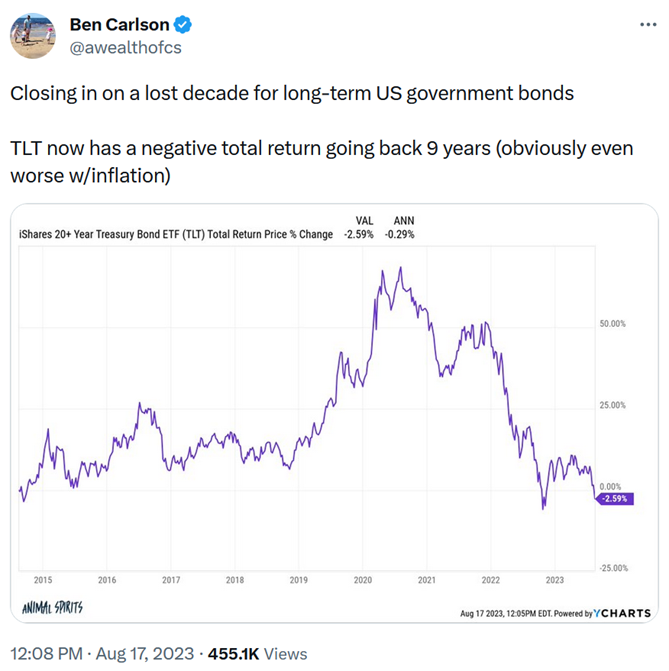

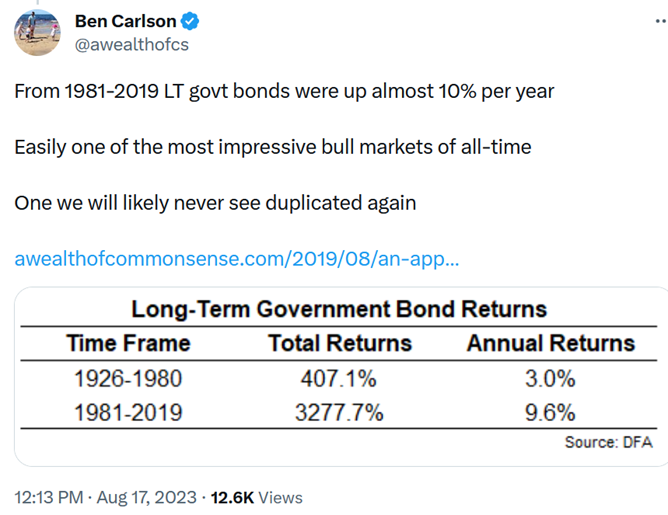

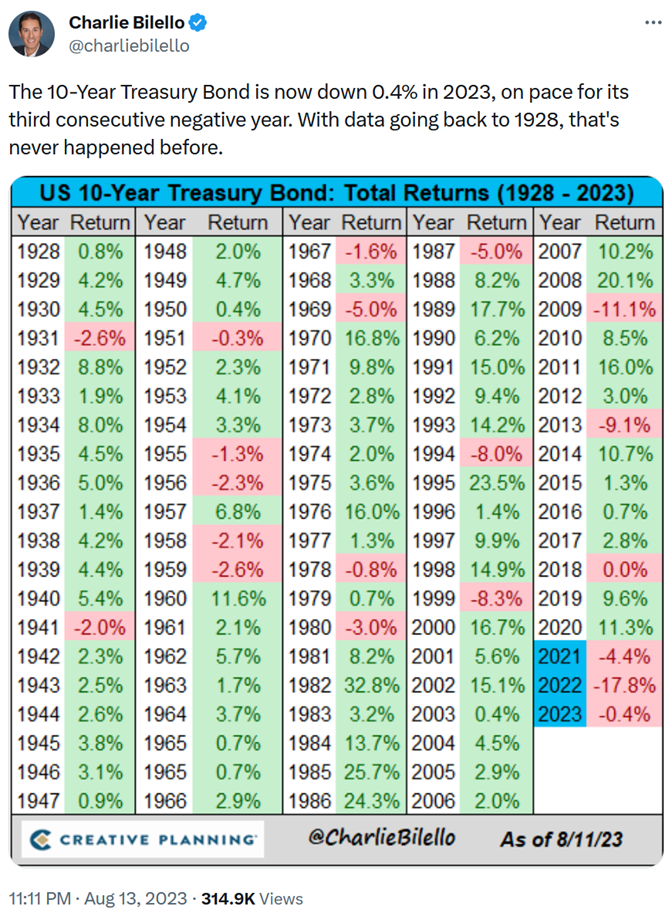

Here are three related tweets:

And:

And:

So, what does all this mean?

It's simple: rising rates reduce the value of bonds (which are paying lower rates that prevailed when they were issued), which goes a long way to explaining the banking crisis earlier this year.

But this is actually good news for investors today because they no longer face the TINA ("there is no alternative") dilemma when thinking about whether to invest in stocks or bonds/cash because both are now attractive. (I just bought short-term U.S. Treasury bills, as I described in last Monday's e-mail.)

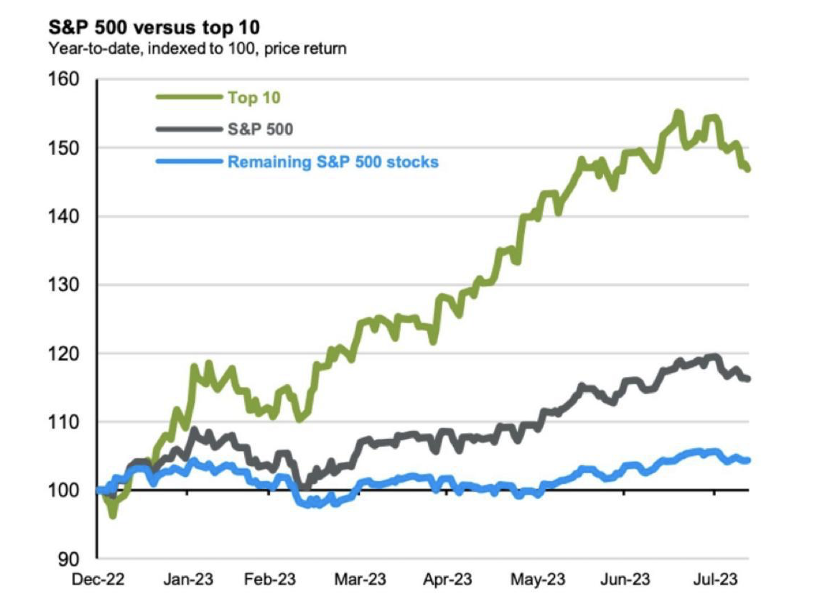

2) Here's an interesting chart showing how the top 10 stocks have driven nearly all of the S&P 500's gains this year:

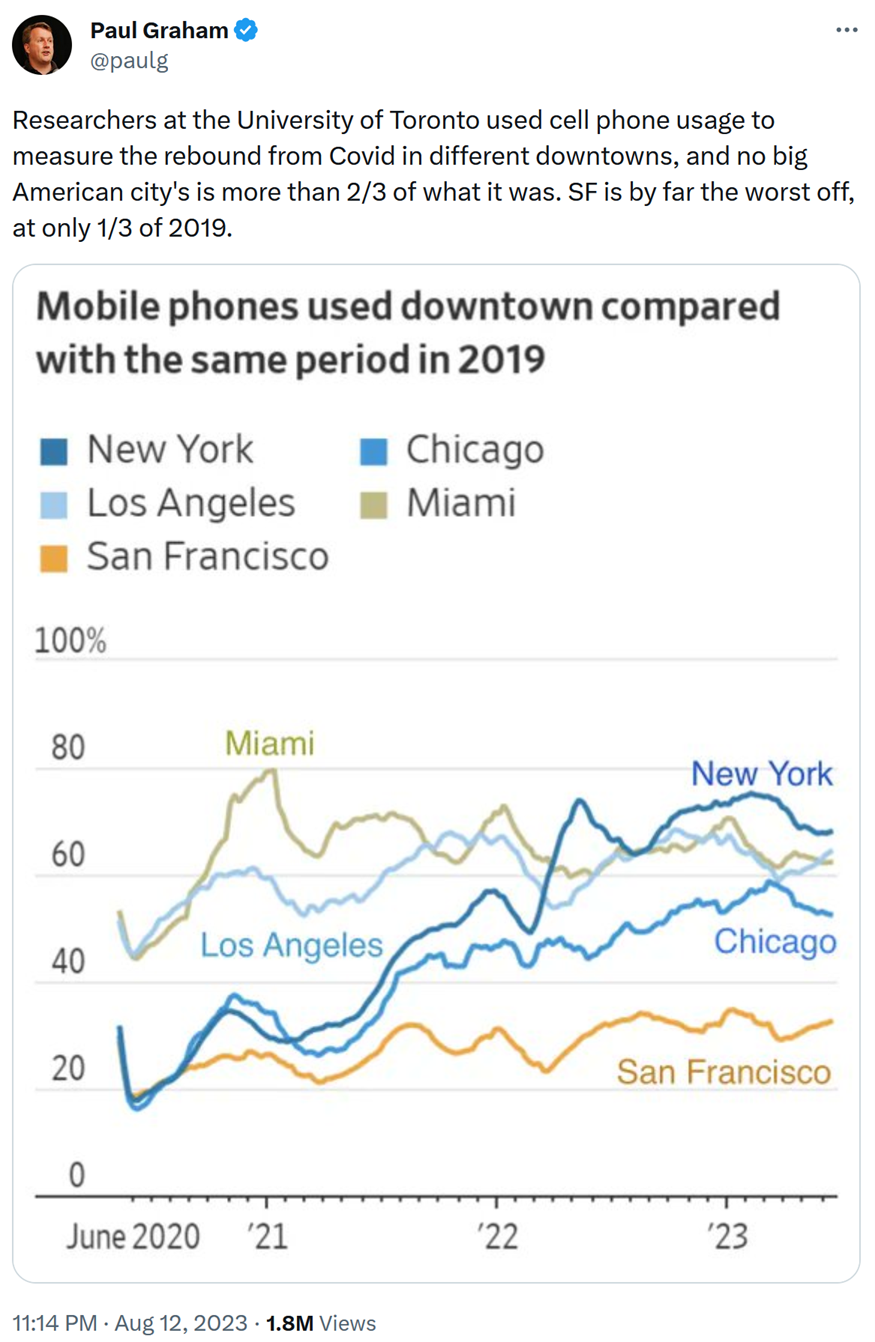

3) This is an interesting analysis showing how the downtowns of five major cities, especially San Francisco, remain depressed:

4) On Saturday night Susan and I took our middle daughter Emily and her boyfriend David to see the New York Red Bulls soccer game against Inter Miami CF and its star, one of the greatest players of all time, Lionel Messi. Here's a picture of us:

There were reports that Inter Miami's manager might rest Messi and we were all disappointed to see that he wasn't in the starting lineup. Throughout the first half, the crowd was chanting, "We want Messi!"

A wave of excitement went through the crowd early in the second half as he came out to warm up, and we all went nuts when he entered the game in the 60th minute. He didn't do much as Inter Miami clung to a 1-0 lead, but in the last minutes of the game, we all got what we were looking for: a brilliant goal! Emily caught it on video, which I posted here, and here's the official video.

Speaking of Emily, please forgive the shameless plug... but she recently started a new job – and is looking for clients!

After working at Madison Square Garden for nearly two years managing more than 1,000 season ticket holders for the New York Knicks and New York Rangers, she transitioned to the travel industry, where she now works for a company called Magma Global – an independently owned luxury and corporate travel concierge.

From almost the day she was born, we've dragged Emily all over the world... She has been to more than 30 countries, and she's personable, organized, and accustomed to working with demanding, wealthy folks – so this new job is perfect for her.

An important part of Emily's new job is building her own book of business, so she (and I) would be grateful if you would consider letting her help with your future travel plans (and please feel free to forward this to anyone you think might be interested in connecting with Emily).

Magma has partnerships with brands such as Four Seasons, Aman, Marriott, Hilton, Rosewood, Mandarin, and Hyatt, which gives Emily access to special rates, discounts, amenities, and upgrades to pass on to her clients, who pay nothing for Magma's services. In addition to hotels, Emily can help with flights, transfers, trains, tours, activities, restaurant reservations, etc. Magma handles all types of travel, corporate accounts, and groups of any size, and is entirely full-service.

We're Emily's first clients and she has already booked us a trip to meet up with our youngest daughter, Katharine, at the end of her semester at the University of Cape Town and spend two weeks traveling in South Africa, Botswana, and Namibia. She also planned and booked a three-week adventure in Southern Australia and Tasmania for Susan's parents in January.

You can reach Emily at emily@magmagt.com.

Thank you!

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.