D1 and Tiger Global clobbered; Coatue investor presentation; Four Insights From an Investing Legend on What's Happening in the Markets

1) Very few investors were clever enough to ride the tech/growth stock bubble all the way to its peak last year and get out before the collapse that started in earnest in November.

For example, hedge fund D1 Capital Partners has gotten obliterated, as this Bloomberg article notes: Hedge Fund D1 Borrowed Billions for a Hot Bet That Now Faces Reckoning. Excerpt:

Hedge funds were tallying gains on their hottest bet in years when Dan Sundheim reached an unusual deal with JPMorgan Chase (JPM) to go even further.

With the bank's help in August 2020, Sundheim's D1 Capital Partners used its stakes in private companies as collateral for borrowing $2 billion that the firm could put toward yet more of those stakes, among other things. Last year that focus on private companies looked brilliant, as D1 updated its valuations and posted a whopping 70% gain in that part of its portfolio.

Now, the industry is bracing for a reckoning.

2) One of the largest hedge funds in the world, Tiger Global, suffered a comparable drubbing, as this article notes: Masters of the Bubbleverse. Excerpt:

What this investor could not have imagined is that the geeky tech analyst would one day run one of the world's largest private-investment firms and that he would also become both a central player in a frenzied years-long global tech bubble – one driven by "unicorn" companies trading at absurd valuations – and its bursting over the past six months. The guy who started as a shy analyst would put up impressive gains for years, then suffer mind-boggling losses: $25 billion (and counting) as of June, a record figure even in the lofty world of hedge funds.

The meltdown at Coleman's firm, named Tiger Global in a nod to his mentor, is one for the ages. "Their losses look to be the biggest in the history of hedge funds," says one hedge fund manager, ticking off other notable contenders for that unfortunate title.

3) No wonder this meme is circulating widely:

4) One large Tiger cub hedge fund, however, navigated the downturn remarkably well: Philippe Laffont's Coatue Management.

A month ago, Coatue released a 42-slide presentation outlining the steps it took to protect its investors' capital, the challenges and opportunities it sees, and its three favorite stocks, Tesla (TSLA), Nvidia (NVDA), and Datadog (DDOG).

Coatue's performance was so impressive that I hear it's raised $5 billion for its new "structured equity" fund, which it outlined at the end of its presentation.

In a recent essay, my colleague Enrique Abeyta discussed the highlights from Coatue's presentation. Here it is below...

Four Insights From an Investing Legend on What's Happening in the Markets

![]() One of the great benefits from a career in investing at some of the highest levels for 25-plus years is the opportunity to have grown up with and met many great investors...

One of the great benefits from a career in investing at some of the highest levels for 25-plus years is the opportunity to have grown up with and met many great investors...

One of those investors – with whom I used to frequently speak more than 20 years ago – is Philippe Laffont of famed hedge fund Coatue Management. After working at legendary hedge fund Tiger Management, Philippe founded and launched Coatue in 1999 – starting with $45 million under management.

From there, he has grown it into an empire... with recent estimates of more than $70 billion in assets across both public and private investments.

Philippe and I used to speak back during the Tech Bubble of 2001 and mostly on the short side. At the time, I was mostly focused on telecom and media stocks while he was more focused on technology stocks... but we had a steady dialogue.

As part of some recent marketing, Philippe and his team put together a fantastic presentation outlining their recent actions as well as some insights on what is happening and what to do next...

In today's essay, we'll share some great insights. Let's get started...

- The fund is currently almost all cash

This gets to a point we have made several times in my trading publications over the past few months. With a thoughtful long-term investment strategy and discipline, it's almost inevitable that you can succeed... But you need to stay alive.

If you find yourself preoccupied with the market – changing your personal finances as a result of your stock market returns and finding that it's affecting your personal life – scale down and move to the sidelines.

Only take on as much risk as you can afford.

And not just financially, but also psychologically... You need to put yourself in a position mentally to win.

In a true bear market, pretty much everything goes down. If you're going to trade, be nimble and take profits quickly and/or look at short opportunities.

If you're investing for your long-term portfolios, ignore the noise.

Either way, don't let the market take over your life. Even with 8%-plus inflation, you likely will sleep better sitting on cash!

- Big counter-trend rallies can happen

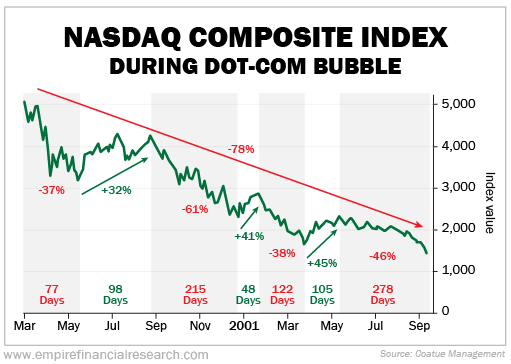

Interestingly enough, we haven't seen major rallies so far in 2022. The largest trough-to-peak rally in the tech-heavy Nasdaq Composite Index was 15%... but during the sell-off as the dot-com bubble burst, we saw much steeper rallies. Take a look...

The Nasdaq was down a massive 78% across this period – compared with being down more than 30% in 2022 – but had rallies of 32%, 41%, and 45%. These were incredible opportunities for traders... but they needed to be disciplined to execute. Note that these moves also took several months, so they were very tradeable.

What's interesting is that the current sell-off hasn't had one of these major counter-trend rallies. Regardless of whether you think we are in a correction or a full-on, severe bear market – one of these is coming...

- The first part of the bear market is price... Is the next part earnings?

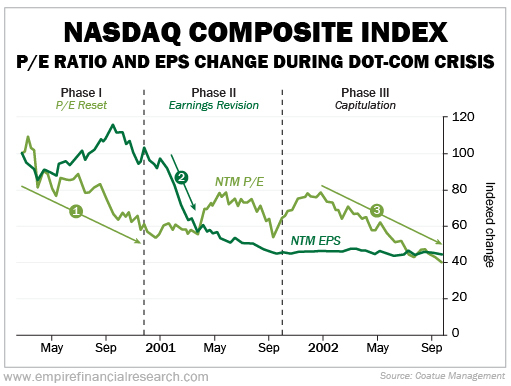

This next chart from Coatue covering the dot-com crisis shows the Nasdaq's valuation and earnings estimates.

During the first stage of the multiple falling – from the peak in March 2000 to January 2001 – the multiple on the Nasdaq went from almost 60 times to 27 times.

Then we saw earnings estimates fall almost 60% from the peak and finally bottom out in late 2001. That's near when the Nasdaq bottomed around 1,400, although the actual bottom wasn't until a year later at 1,120, or 13% lower.

This comes back to the big question – and what we have been talking about all year – what happens to earnings?

At this point, the stock market clearly thinks that earnings estimates are going lower... and we don't disagree, given the headwinds of inflation.

If, however, they aren't going much lower – maybe a drop of 10% to 15% – then the majority of the damage is done to the stock market. If they're going to reprise the 2001 to 2003 period, then we have much more downside ahead.

We still believe earnings are unlikely to fall that much... but time will tell. This is the single variable to watch.

And that brings us to our last insight from Coatue...

- If earnings collapse, there will be (almost) no place to hide

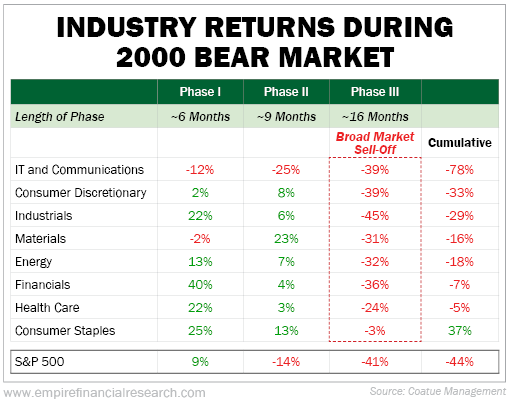

The below table from Coatue shows the stock market downturn back then in three different phases, with the stock performance of different industry groups.

As you can see, for the first 15 months of the downturn, it was really only tech stocks that went down. In fact, large parts of the stock market went up... and some were up substantially.

In the last phase – when earnings collapsed – then everything collapsed. Only consumer staples held on, although the cumulative performance of health care and financials wasn't so bad.

This gets back to our point: Earnings.

Watch what happens to the earnings for the S&P 500 Index and the Nasdaq... and this will ultimately dictate what happens to stocks from here.

► And yet, investors are already in full-blown panic mode – pulling billions out of the markets...

If you're worried about a larger crash or years-long recession taking hold, tired of losing money in your sleep to record inflation, or having flashbacks of 2008... I get it.

It's natural to feel scared, and that's OK.

But what's not OK is throwing in the towel and letting those fears paralyze you into making mistakes that will cripple your portfolio. Unfortunately, investors across America are making the types of mistakes that will haunt them for years to come.

Whether it's standing on the sidelines and letting your savings get slashed, buying the wrong stocks on the wrong dip, or selling your entire portfolio for a loss and admitting defeat... these are all huge, avoidable mistakes.

But if you're still relying on the investing comfort zone you've been using for years, it will only guarantee that you get left behind when the economy inevitably recovers.

In fact, there's one way to boost your income and beat the markets... and it uses a strategy that the vast majority of investors don't know about.

I just put together a brand-new presentation with all the details – watch it right here.

Regards,

Enrique Abeyta

I received the full presentation from another source – I've posted it here. Enjoy!

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.