Do You Know the Value of a Dollar?

Doc's note: Time... It's one of the greatest threats that's eating away at your wealth. A dollar today doesn't get you near as much as it did decades ago. But time is also the greatest ally you have when it comes to growing your wealth.

Today, our newest colleague – from our corporate affiliate Wide Moat Research – Brad Thomas explains the value of a dollar and how time plays a crucial role in it. He also explains the money advice you should never squander...

![]()

"Sonny doesn't know the value of a dollar."

I used to hear that from my mom often enough growing up. And unfortunately, it was true.

"Sonny" was the nickname my grandfather gave my dad as a kid. And it stuck well into adulthood...

As did my father's tendency to spend whatever money he got as soon as he got it. He really just didn't understand how to handle finances.

Ultimately, those poor shopping decisions were on him. We're each responsible for our own actions – especially after we're fully grown with spouses and children to provide for.

But I do have to give my dad this: He came from a distinctly underprivileged background, growing up in circumstances that didn't necessarily lend well to financial intelligence.

In short, he came from money. And, yes, that can be a major disadvantage to a person's long-term happiness.

There's an ancient Chinese proverb that says, "Wealth does not pass three generations." The first works hard to make a lot out of a little. The second witnesses that work to some degree and, therefore, hopefully knows how to value it and its results.

But the grandchildren? The ones who inherit everything without experiencing or observing any effort?

They squander what they've got. Which is precisely what happened with my dad.

In fact, my dad was only a second-generation recipient of wealth. His father was a hard worker who built up his own little real estate empire through motels along King's Highway down the South Carolina shore...

By the time my own dad died, he had almost nothing to pass on. My brother and I didn't see a dime from him because he didn't have a dime to give.

It was tragic – not because I expected him to provide for me. I knew the financial state he was in well before he passed.

The tragedy was how he wasted so much of his time, money, and efforts on things that didn't last.

All because he didn't know the value of a dollar.

Eat, Drink, and Be Intelligent – for You'll Probably Have to Deal With Tomorrow

I'm not trying to pick on rich kids here, for the record. Inheriting money can and should be an absolute blessing – and more power to the people who can handle that blessing well!

In fact, I'm hoping to be able to pass on wealth to my two grandchildren, the newest of whom was just born last week. (I've now got a grandson and a granddaughter!)

But too often, passed-on wealth becomes a burden that gets people into trouble.

That's why I'm truly grateful for my own upbringing. After my parents divorced, my mom had to raise my brother and me pretty much by herself.

I got to see her work hard. I had to hear the word "no." And I was encouraged to get a job at an early age.

It taught me the value of a dollar, and I'm exceptionally grateful for it.

So what is its value?

I could quip that, these days, it isn't much. We all know the ravages of inflation have taken a significant toll on our American currency over the decades.

So much so that OfficialData.org reported earlier this year:

$1 in 1980 is equivalent in purchasing power to about $3.82 today... the dollar had an average inflation rate of 3.09% per year between 1980 and today, producing a cumulative price increase of 282.03%.

This means that today's prices are 3.82 times as high as average prices since 1980, according to the Bureau of Labor Statistics consumer price index. A dollar today only buys 26.178% of what it could buy back then.

So why even bother, right? Eat, drink, and be merry, for tomorrow we die!

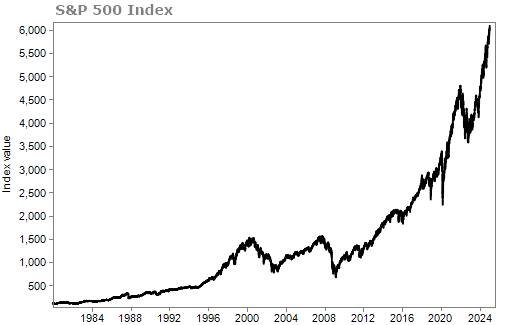

Before you adopt that mantra, however, here's another statistic for you, courtesy of the S&P 500:

If you had invested that same dollar into the S&P 500 in 1980, you could have a whopping 5,277% profit today... showing that the value of a dollar really centers on what you do with it.

If you have an easy-come, easy-go mentality, it will yield very temporary worth to you, not to mention future generations. But if you think smartly and put it to good use, it can become more valuable than you can possibly fathom in that beginning moment.

Squander This Advice

Ultimately, it doesn't matter whether you're clawing your way up from the bottom... you've already made it of your own accord... or you got handed everything right from birth, silver spoon and all.

You need to be aware of what you spend, always striving to put money aside for investments and rainy days.

Over the years, I've tried to teach my kids the importance of that kind of saving. It's fine to allocate some money to new apparel, hanging out with friends, and the like.

But not at the expense of their future.

If you have children, too – especially teenagers – ask them how long they're really going to use a desired item after purchasing it. Will the allure of a new toy or a "must have" fashion trend wear off in a day?

A month?

Or will it last them for years?

For the record, those are the same questions we should be asking ourselves as adults:

- Do we really need to fly first class when business has plenty of extra room?

- Can't we bring our own lunch to work twice a week instead of eating out every time?

- Does that home upgrade truly need to happen, or is the slightly dated décor something we can, in fact, live with?

More often than we might care to admit, we can actually make do with less. The world won't end. We will survive.

Even better, we'll have more to sustain ourselves with down the road.

This doesn't mean you should always encourage yourself or your children to go cheap. I strongly urge my readers to look for value instead.

For instance, if a more expensive car will last you for the next 15 years versus the "bargain" choice that might give you four, then the more expensive one might very well be right for you.

I'll even go so far as to say that if you've got the money, it's fine to splurge sometimes. Book the occasional upscale vacation. Get yourself that pricey item you've been dreaming about since you were a kid. Surprise a loved one with a once-in-a-lifetime gift.

You don't want to be a miser. Money actually has no value to them since they don't enjoy their profits and don't want anyone else to either.

Just make sure not to fall into the opposite trap where you make instant gratification your way of life, as my father unfortunately did.

You (or your kids) might not like it in the moment. But if you want to achieve Chinese-proverb-beating wealth, you have to know how to value a dollar.

And nine times out of 10, a dollar can be worth so much more down the road.

Regards,

Brad Thomas

Editor's note: Last week, Brad warned that today's economic environment is set for a major rotation out of popular stocks like the Magnificent Seven – and those unprepared could be blindsided by the fallout.

But one select group of stocks could offer one of the biggest and most bullish opportunities today. Click here to learn more.