Low short interest; Carson Block and Solutions 30; Recent business books; Amazon Unbound; Once Tech's Favorite Economist, Now a Thorn in Its Side; Apple's AirTag trackers; Calling Marshall

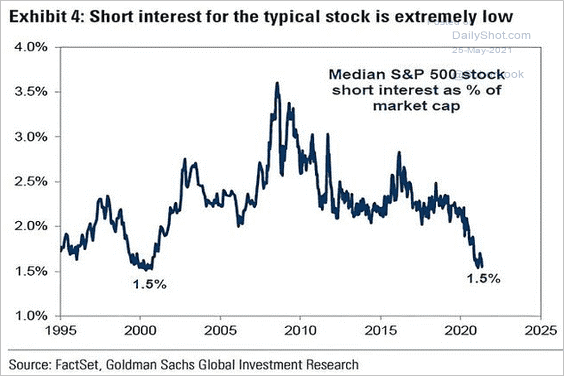

1) A hat tip to my friend Doug Kass for flagging this chart, which shows a historically low level of short interest among stocks in the S&P 500 Index – a bearish indicator:

2) While short sellers have taken a beating during the long bull market over the past dozen years – resulting in the low short interest shown in the chart above – they're even more important than ever in a frothy market like this one, which is why I regularly highlight their work.

Speaking of which, kudos to my friend Carson Block of Muddy Waters Research, who just added yet another notch in his belt as the stock of European telecom support services company Solutions 30 (S30.PA) has blown sky high. Here's a link to his latest report, Locked Doors, which concludes:

In Solutions 30, we find a number of analogs to Wirecard aside from having a cast of shady characters. Both have gotten as far as they have due to European issues: willful blindness of investors to glaring problems, a culture of extreme credulousness of companies along with a disdain for their critics, and a patchwork legal and regulatory framework that makes Europe fertile ground for corporate misbehavior.

To be clear, the United States markets are riddled with venality and corruption, including approximately 400 companies from China that are above the law and exert their corrosive influence on American markets with each stock tick. The difference is that in America there is a recognition of these problems (albeit with a very depressing acceptance). We look forward to suggesting improvements to various laws and regulations in the future.

And here's an Institutional Investor article about it: Shares of Solutions 30, a Muddy Waters Short, Tank After Auditor Raises Concerns. Excerpt:

The suspense surrounding a two-week halt in the trading of one of Muddy Waters' longest held, most obscure short targets is over – and the stock is tanking.

Two weeks ago, Solutions 30, a European IT services company that the short seller has accused of having ties to organized crime, asked the Paris stock exchange to suspend trading in its shares – then trading around 10 euros.

By the end of last week, the company said it would reopen for trading Monday, while admitting that its auditor could not complete the audit for its annual report. By the time the trading day ended Monday in Paris, Solutions 30 had fallen more than 70 percent, closing the day at 3 euros.

3) To be a successful investor, I think it's important to understand a wide range of successful (and, occasionally, unsuccessful) CEOs and businesses, so every year I read dozens of in-depth articles and books in this area.

Just in the past month, for instance, I've listened to the following books (at 2.75 times speed, as always):

- Inside Money: Brown Brothers Harriman and the American Way of Power

- Test Gods: Virgin Galactic and the Making of a Modern Astronaut

- Liftoff: Elon Musk and the Desperate Early Days that Launched SpaceX

- Empire of Pain: The Secret History of the Sackler Dynasty

Finally, love him or hate him, Amazon (AMZN) founder and CEO Jeff Bezos is one of the most successful and consequential entrepreneurs in history, so I eagerly read the new book about him, Amazon Unbound: Jeff Bezos and the Invention of a Global Empire.

It's by Brad Stone and follows up on his brilliant 2013 book, The Everything Store: Jeff Bezos and the Age of Amazon. Here's the review in the New York Times: To Understand Amazon, We Must Understand Jeff Bezos. Excerpt:

Stone's new volume is on its surface a business book that seeks to explain the rise of America's most important private enterprise, a giant company also notable for its opacity. In that sense, it is a sequel of sorts to his 2013 best seller, The Everything Store, which introduced Bezos and explained his relentless and single-minded drive to take over online commerce. Amazon Unbound is particularly valuable in explaining how the company makes money, and the day-to-day decisions that end up having a big effect on consumers: Is it worth it, for example, to sell pallets of bottled water, with their low cost and expensive shipping?

Stone looks at turning points in Amazon's history, like the failure of the Fire phone and the rise of Amazon Web Services, its internet hosting division, as the engine of the company's financial success. This is the inside story, a kind of corollary to the outside one Alec MacGillis recently sketched in Fulfillment, his grim look at how the country has become atomized by Amazon's economic model. I was, though, left wishing at times for a third book that made a tighter connection between the inside of the juggernaut and its effects on the world.

Amazon Unbound shows how the company increasingly wields its enormous scale against potential rivals. After acquiring a key robot manufacturer, for instance, it stopped shipping the machines to competitors. And it used its vast trove of data from third-party Amazon vendors to make competing "private label" products, then simply lied about it.

Significantly, the book is also very much a biography of Bezos. And that makes it timely at a moment when our economy is dominated by giant firms headed by a small handful of men, whose personalities and whims we need to understand whether we like it or not.

4) While I'm generally bullish on the Big Tech stocks, despite the drumbeat of negative news (such as this front-page story in today's Wall Street Journal: Amazon Policy Punishes Consumers, D.C. Suit Claims), I'm glad people like Paul Romer are holding these companies' feet to the fire for their often egregious behavior (also, it's very unusual and admirable for a high-profile person like him to change his views – and air them). Once Tech's Favorite Economist, Now a Thorn in Its Side. Excerpt:

Paul Romer was once Silicon Valley's favorite economist. The theory that helped him win a Nobel prize – that ideas are the turbocharged fuel of the modern economy – resonated deeply in the global capital of wealth-generating ideas. In the 1990s, Wired magazine called him "an economist for the technological age." The Wall Street Journal said the tech industry treated him "like a rock star."

Not anymore.

Today, Mr. Romer, 65, remains a believer in science and technology as engines of progress. But he has also become a fierce critic of the tech industry's largest companies, saying that they stifle the flow of new ideas. He has championed new state taxes on the digital ads sold by companies like Facebook and Google, an idea that Maryland adopted this year.

And he is hard on economists, including himself, for long supplying the intellectual cover for hands-off policies and court rulings that have led to what he calls the "collapse of competition" in tech and other industries.

"Economists taught, 'It's the market. There's nothing we can do,'" Mr. Romer said. "That's really just so wrong."

Mr. Romer's current call for government activism, he said, reflects "a profound change in my thinking" in recent years. It also fits into a broader re-evaluation about the tech industry and government regulation among prominent economists.

They see markets – search, social networks, online advertising, e-commerce – not behaving according to free-market theory. Monopoly or oligopoly seems to be the order of the day.

5) Speaking of Big Tech, Apple (AAPL) needs to fix this fast: Apple's AirTag trackers made it frighteningly easy to 'stalk' me in a test. Excerpt:

Apple's new AirTags, $30 wireless devices that help you locate things, work well. Frighteningly well.

Clip a button-sized AirTag onto your keys, and it'll help you find where you accidentally dropped them in the park. But if someone else slips an AirTag into your bag or car without your knowledge, it could also be used to covertly track everywhere you go. Along with helping you find lost items, AirTags are a new means of inexpensive, effective stalking.

6) This is a powerful and spot-on essay by NYU marketing professor Scott Galloway: Calling Marshall. Excerpt:

The opportunity is clear – for the United States to demonstrate the might of American capitalism and character. It's time for a second Marshall Plan, a global investment in the fight against COVID-19 with the world's premier health-care professionals and superior vaccines. Staunching the pandemic in India and Brazil could save millions of lives. Millions.

As in the recovery from World War II, this would reflect both altruism and enlightened self-interest. The longer the virus is allowed to reproduce, the more likely it becomes a permanent scourge. On the Prof G Pod this week, my guest was historian and author Niall Ferguson, who was emphatic about this: "The failure to have a coherent global strategy for vaccination is going to cost us all in the end."

These investments could forestall a catastrophe and cement future prosperity. Both India and Brazil are among the top 10 economies, and the largest in their respective regions. India is the world's fastest-growing major economy, a swing vote between the U.S. and China on economic and political issues, and a key part of the global tech stack. Boasting the second-highest number of enrolled STEM students in the U.S. (just after China), it's an increasing source of senior leadership, including the CEOs of Google, IBM, and Microsoft. At NYU, where I teach, many of the brightest minds and best teachers are from one place: India.

Rising Tide

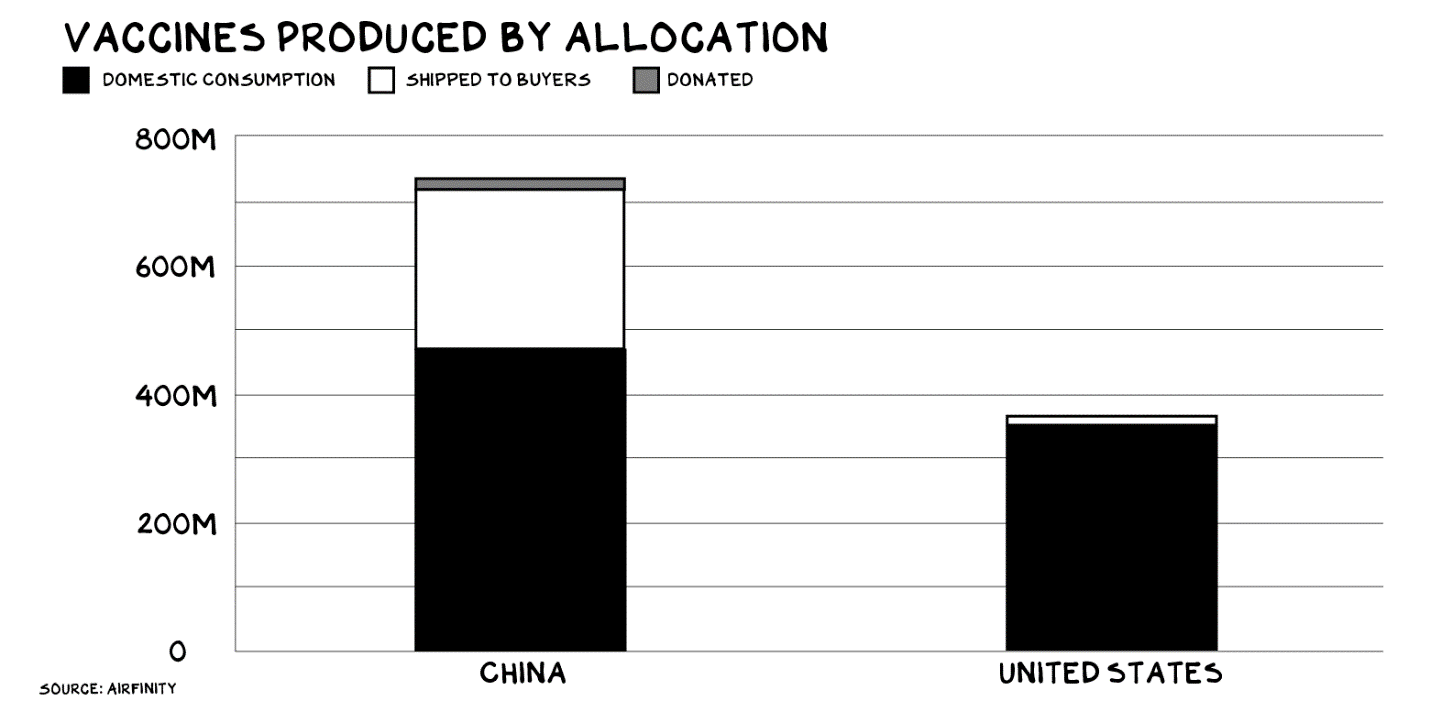

Coming to the aid of Brazil and India (and ultimately, of other countries in crisis) will define 21st century global leadership. This time, however, it's not the United States answering the call, but China. China, not the U.S., is vaccinating the world. According to tracking done by science analytics company Airfinity, China has already exported 252 million vaccine doses pursuant to purchase agreements with 44 countries and donated another 17 million doses to 60 countries. And it has dispatched medical teams to 27 foreign countries to aid their response to COVID.

U.S. manufacturers, by contrast, have shipped a mere 3 million paid-for doses to Mexico and Canada. And while President Biden has promised to donate 80 million doses abroad, not one has shipped.

The Power Triangle

The vaccine gap reflects a larger trend: a slow ceding of leadership by the United States.

Best regards,

Whitney