Make This Critical Portfolio Move Today

Let me start today with an important question...

Is it more important to pick the right stocks, or is it more important to have smart asset allocation within a portfolio?

In other words, are you going to be more successful if you're a good stock-picker or if you're a good portfolio manager?

Two men with finance PhDs – Roger Ibbotson and Paul Kaplan – asked that exact question. They looked at a whole bunch of mutual funds and pension funds and analyzed a years' worth of data. They found that 90% of a fund's return over time was due to its asset allocation, not the specific stocks it held.

Here's why asset allocation is so important...

Stocks, bonds, real estate, gold, and other investments move in different directions and are influenced by different economic factors. By holding multiple asset classes, you reduce your risk and increase the return you get per "unit" of risk you take on.

When you obsess about your risk, and not your return, you end up with a strategy that works over the long haul.

That's what Dr. Steve Sjuggerud, Austin Root, and I are doing with Stansberry Portfolio Solutions...

We're obsessing about risk so you don't have to. We're putting all our research together for you – and giving you allocated, diversified portfolios that are incredibly simple to follow.

Instead of you having to do the work of reading newsletters, deciding which ideas are best, and allocating them into a portfolio... we do it all for you.

We build the portfolio for you, so that you end up with our best ideas... don't put too much into our more speculative recommendations... and allocate properly among our strategies. I'm confident that we can greatly increase your average return.

And unlike a financial adviser who meets with you maybe once or twice a year, our team meets monthly to review each portfolio. So when there are unforeseen market events (as there always are), our team immediately addresses how they impact your portfolio and relays that information to you.

Steve, Austin, and I recently sat down and explained why we've created this "done for you" portfolio. We even shared our top predictions for 2021.

If you haven't already, catch all the details here.

As we do every Friday, let's answer some of your burning questions. And please keep sending them our way. We read every e-mail... feedback@healthandwealthbulletin.com.

Q: Doc, you shared tips on shoveling, but I can't seem to find them again. Can you point me in the right direction? – R.M.

A: You found this advice in the January issue of my Retirement Millionaire newsletter...

A sudden change in activity level in very cold temperatures can be dangerous. Even walking through wet, heavy snow is taxing on your heart. Shoveling it the wrong way can be deadly.

As we like to remind readers, moderation is critical to good health and a long life. And nowhere is that truer than when it comes to clearing your driveway this winter. Don't test your largest shovel's maximum capacity – instead, use a smaller shovel and lift smaller, more frequent amounts of snow.

Also, do what I do and breathe through your nose, slowly exhaling to keep your breath in control. Take frequent breaks, too. If you're too winded to talk to someone, you're overstressing yourself. If you were working out for the first time in a gym, your coach would tell you to do the same. And if you don't move your body significantly on a daily basis, this is not the place to start – ask someone else to help shovel your snow.

Here are some more shoveling safety tips... Stay hydrated by drinking plenty of water. Don't drink alcohol, which will make you feel warmer than you are and disguise the dangers of cold weather. Don't eat a heavy meal before or after shoveling – it will make your heart work too hard. Comfort foods and warming yourself with spirits are common winter activities, but save them for after the outdoor chores are done. And wear warm clothing to avoid hypothermia or the dramatic temperature changes that scientists believe can trigger heart attacks.

Q: I am a multiple-service subscriber. I like your service, with one exception: I think your policy of not allowing your writers to own the stocks they recommend is a clear mistake. The format you dictate amounts to "Let's you and him fight." I would have much more faith in what you recommend if I knew that your money was where your mouths are. Nothing breeds confidence like skin in the game. – W.E.W.

A: Since I started with my publisher, this has been our company policy...

Stansberry Research forbids our investment analysts from owning any stock they write about. In addition, other employees of Stansberry Research and associated individuals may not purchase recommended securities until 24 hours after the recommendations have been distributed to our subscribers on the Internet, or 72 hours after a direct-mail publication is sent.

The main reason is to avoid a conflict of interest. Wouldn't you rather an analyst recommend a company solely because he thinks it's a good investment for his readers and not simply to line his own pockets? Stansberry has hundreds of thousands of readers around the world... enough to cause big moves in some stocks.

The industry has a history of sleazy analysts making big bucks off recommendations they don't actually believe in. (If you're not familiar with "pumping and dumping," I suggest you read about the scheme here.) We don't want our readers to have any doubt about what we're doing.

Having said that, you might wonder, "Doc, does that mean you hold back the best recommendations for yourself?"

My research analysts can tell you that there are times they've suggested a stock to recommend to readers and I was tempted to invest in it myself instead. But my goal isn't to sit here and make millions by depriving my subscribers of the best stock insights. If all I wanted was to get rich from the stock market, I would have stayed on Wall Street. Instead, I felt a need to help society, and so I went to medical school and beyond... But the question of what I do with my own money remains a good one.

Personally, I am quite conservative in style and so often use mutual funds, open and closed, to give me stock and bond exposure. Occasionally, I'll sell options in my IRA or 401(k) on exchange-traded funds ("ETFs") that allow it. But in general, I set my risk profile up so I can sleep well at night and so my team and I can give you our best and unbiased advice.

My goal is to give you the best information possible to empower you to live a healthier, wealthier life. That's why, if you read our newsletters, you'll notice we take pages and pages explaining why we're recommending a certain investment.

But here's where our "skin in the game" comes in...

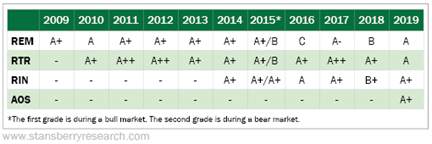

Every year, our publisher puts out an annual report card. It's a brutally honest assessment that measures how each Stansberry Research publication has performed. While we don't have money in the investments we recommend, if we get failing grades, well, who'd want to subscribe to our newsletters? That's plenty of incentive to recommend investments that do well and keep our readers happy (and wealthy).

Plenty of analysts have gotten failing grades over the years. But I think the grades for my newsletters every year speak for themselves...

Rest assured – I'm not holding anything back.

And if you also subscribe to the Stansberry Digest, be on the lookout for my 2020 grades this month. The grade for Retirement Millionaire is scheduled to come out this evening, and I'll be reading right along with you.

What We're Interneting...

- Did you miss it? Is it time to buy GameStop?

- Something different (video): What's driving California's mass exodus?

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

February 5, 2021