Our Lifetime Partnership offer; The difference between Empire Investment Report and Empire Stock Investor; Reader feedback; Performance of my bearish calls in 2021; One stock to avoid in 2022; Pandemic updates; Lamu pictures

1) One of my readers, Dan M., recently asked me two questions that I've heard from others, so I wanted to share:

Regarding your offer to join as a Lifetime Partner, without in any way meaning to conjure ill, what happens if you fall off the next mountain you climb or just get hit by a bus in NYC? Not much of a "lifetime." Or you decide to give up the headaches of running a stock-picking business and move on to your many other interests? I realize as I write this that neither you, nor anyone, can make guarantees about the future, but can you make the case that the Lifetime Partnership is really a better long-term bet?

What is the difference between your Empire Investment Report and Empire Stock Investor? I read that the former is more focused on smaller stocks, but I see Alphabet, Facebook, Amazon, and Berkshire Hathaway in that portfolio – hardly small caps!

I replied:

Thanks for your interest, Dan. To your great questions:

1) I love what I do and am not going anywhere. Do you know anyone with a higher quality of life?

If I get hit by the proverbial bus, the team will carry on.

So for sure our Lifetime Partnership is the best (and most cost effective) way to benefit from the collective 100-plus years of experience that Enrique, Berna, Herb, and I have. You'll not only receive all of our current newsletters, but everything we ever publish in the future.

Right now we're offering a special deal on our Lifetime Partnership, but it expires at midnight on December 31, so please act before then. Click here for details.

2) Empire Investment Report focuses on the types of stocks that I used to own in my hedge fund – typically $1 billion to $5 billion in market cap, that we think can double in two to three years.

Empire Stock Investor picks are generally $20-plus billion market cap companies that we'd put in our parents' retirement accounts, that we think are good bets to double in three to five years.

The reason we started Empire Investment Report with Berkshire and the three tech giants is because it was our only newsletter at the time and we wanted a solid foundation.

Thank you and happy holidays!

2) Speaking of reader feedback, I have to chuckle at the vastly different responses I get from my readers every day. Here are two recent examples...

- "Hi Whitney, I'm a statistics professor, consultant, and data junkie. Where do I look for the latest pandemic data and information? Your newsletter, of course. That along with the great videos of your travels, like the elephant and giraffe sanctuaries, are necessary as I have my morning cup of coffee." – Mike O.

- "It's so reassuring that you believe the shot is the reason that Omicron is less deadly. Remind me again where you went to med school??? What the hell do you know about any of this? The doctors don't know. Fauci has been wrong about Everything from the beginning. He funded this mess. Everyone knows that. Even you. Once again, it's NOT a vaccine. It's a shot. Stop bullsh*tting everyone" – Richard L.

3) Last Wednesday, my colleague Berna Barshay reviewed her Best and Worst Picks of 2021 in her Empire Financial Daily. The performance of her recommendations, especially the stocks she said to avoid (we don't recommend shorting for most investors), is nothing short of extraordinary!

Taking a page from her book, I'd like to review my best and worst picks in my free Whitney Tilson's Daily e-mail, starting with the stocks I said to avoid. There were a lot of them this year and I, like Berna, crushed it, despite the strong performance of the major indices.

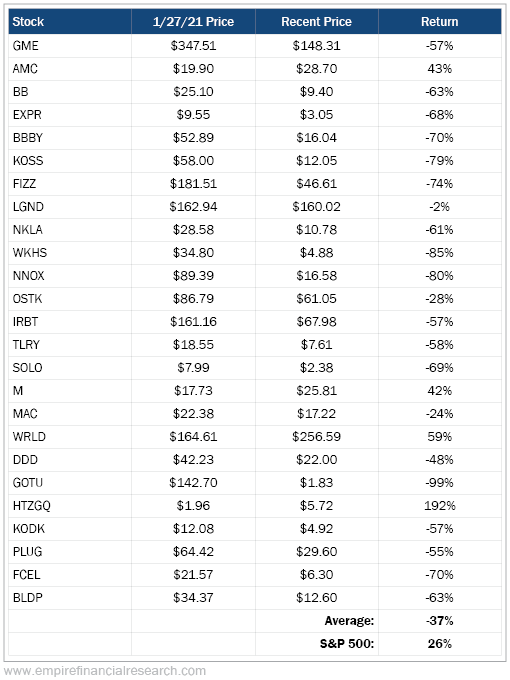

My biggest call was identifying a 25-stock "Short Squeeze Bubble Basket," in which I nailed the top of the meme stock bubble almost to the hour on January 27. Here's a table showing the performance of these stocks (through last Thursday afternoon, with the exception of Hertz, which I removed from the list on May 13):

As you can see, 21 of the stocks are down, most by a large amount, and the average decline of all 25 is 37% during a period in which the S&P 500 Index rose 26%.

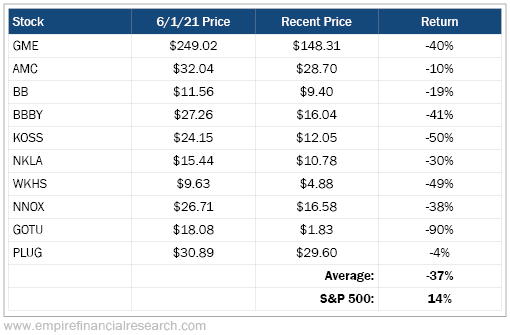

After most of these stocks quickly collapsed – at one point, the entire basket was down 50% – they rallied strongly in May, which gave me a second bite at this apple. In my June 2 e-mail, I named the 10 biggest stinkers in a column entitled: I'm calling another top on 10 stocks in my Short Squeeze Bubble Basket. Here's how they've done since then:

All have declined versus the S&P 500's 14% gain – nine are down by double digits, and the average decline is a staggering 37%.

I also called the top almost to the day of scam cryptocurrency Dogecoin (DOGE-USD), writing on May 7:

Among the most absurd cryptos is dogecoin – a cryptocurrency that was created as a joke (I think it's pronounced "doezhe-coin" but I insist on pronouncing it "doggy-coin")...

I will make my usual prediction related to absurd bubbles that my "Spidey sense" tells me are at a top: from $0.5853 (the price of dogecoin when I wrote this), it will be down 30% within a month, 50% within three months, and 80% within a year.

Since then, it has crashed by 73%.

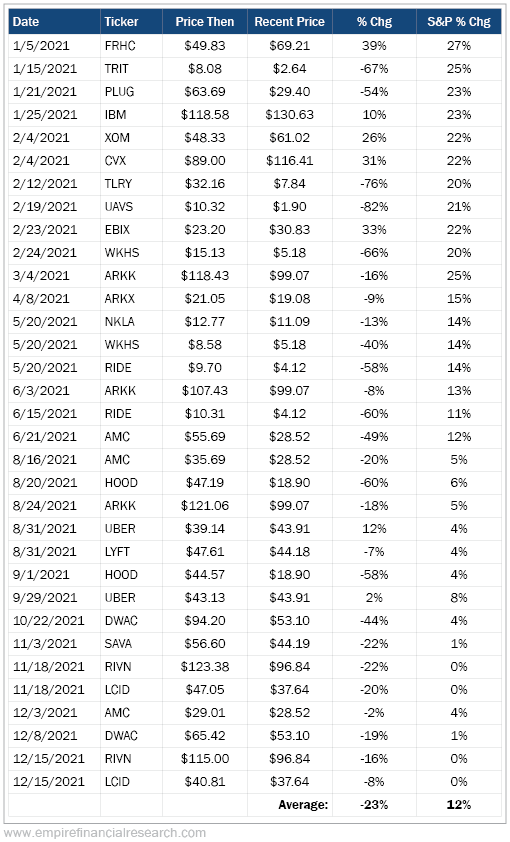

Finally, throughout the year, I made bearish calls 33 times on 23 different stocks. This table shows the performance of each one relative to the S&P 500:

As you can see, 27 declined with an average loss among all 33 of 23% versus a 12% gain for the S&P 500.

I'm particularly proud of nailing pot stock Tilray (TLRY) again (down 76%), as I also nailed it the hour it peaked at $300 back in September 2018, when I called it "the largest short squeeze ever." It subsequently declined by 99%.

I was also glad to see the collapse of three electric-vehicle ("EV") promotions, Workhorse (WKHS), Lordstown Motors (RIDE), and Nikola (NKLA). My calls of EV makers Rivian Automotive (RIVN) and Lucid (LCID) also performed well, but I don't think they're promotions – the stocks were (and are) simply massively overvalued.

I was happiest to see the most disgusting stock in this entire group, Robinhood (HOOD), get hammered. I wrote about it many times – here's an excerpt from my September 29 e-mail:

The reason investing legend Charlie Munger calls Robinhood a "gambling parlor" that is "beneath contempt" is that the company's entire business model depends on encouraging its users to speculate madly by day-trading options and worthless garbage that I've nicknamed Doggycoin (DOGE-USD) and GameStink (GME).

4) If I were to pick one stock to avoid in 2022, it's Digital World Acquisition (DWAC), a special purpose acquisition company ("SPAC") that has announced a deal to partner with a company owned by former President Donald Trump, Trump Media & Technology, to launch a social media company called TRUTH Social. I first wrote about it on October 22 and then followed up on December 8, 15, and 20.

I think it's highly likely that the SEC blocks this revolting deal, which has been carefully engineered to rip the faces off retail investors and/or Trump supporters. If so, DWAC's stock will likely trade back to its cash value of $10, representing more than 80% downside.

5) I sent in-depth missives to my coronavirus e-mail list on Friday, Sunday, and yesterday, which you can read here, here, and here (to subscribe, simply send a blank e-mail to: cv-subscribe@mailer.kasecapital.com). Here are the topics I covered on Friday:

- The mRNA vaccines do work against omicron

- Everyone is not getting COVID-19

- London and NYC data

- Promising drugs

- Regular boosters

- Rapid tests

- What to do if you test positive

- CDC Shortens COVID Isolation Period

- Upgrade your mask

- Kudos to Trump

- Reader comments

And Sunday:

- I sent my friend some love... by calling him an idiot

- Cost of the unvaxxed

- Prior infection doesn't protect versus omicron

- Trump shout-out

- If I'm wrong

- Great news from South Africa, Denmark, and London

- U.S. dashboard

- Likely huge underreporting

- Why omicron is mild

And yesterday:

- My reply to being called an "abusive toxic ass"

- A positive note

- Prior infection may protect against omicron

- Which is better: triple vax or prior infection?

- Coronavirus Can Persist for Months After Traversing Body

- Pan-Coronavirus "super" vax

- Pregnant women come last

- Candace Owens on Trump

6) My family and I are having a great time on Lamu Island in Kenya, where I'm kiteboarding every day that conditions permit:

I've posted more pictures on Facebook here and here.

And here's what I posted a year ago:

On Friday, my last day, it all came together and I finally felt like a real kiter! I was able to launch from the beach, go back and forth from the same spot, nail roughly 80% of my turns (called "transitions"), and spend more than 90% of my time on the water. It felt AWESOME!!!

I only made one mistake – but it was a serious one: I nearly decapitated my instructor Denis' girlfriend, Eka. I was going one way, intensely focused on my kite, and failed to see her coming the other way, so, as part of a "power stroke," I dove my kite right into her. Fortunately, she's an experienced kiter and was paying attention, saw my kite coming right at her, and – as you can see in the first 14 seconds of the video below – dove off her board into the water in the nick of time!

I was so apologetic – what a rookie move! – but she was gracious and told me she's had to take similar dives many times because she usually kites in Crimea (she and Denis are Russian), where 50 to 100 people are kiting in the same size area we kite in on Lamu.

Denis followed me with a GoPro on Friday (see pictures of us below) and got some epic footage. I've compiled 12 of the best clips into one four-minute video, which I've posted here.

The video starts with the crazy/funny stuff: Eka diving for her life, Denis' and my kites getting tangled and crashing into the water, both of us going for a swim, me doing a faceplant, and me falling backwards on my butt (I showed my girls these first five clips and they were horrified, saying, "You suck!" – LOL!)... But the rest of the clips are the good stuff: me cruising along at high speed, giving a thumbs-up, and making perfect transitions. (The girls were too impatient to watch this, however!)

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.