PG&E 'is a f**king no brainer'; The latest issue of Empire SPAC Investor; Twitter Is Stuck With Itself, Too; Two more comments on Uber and Lyft; I persuaded a friend to get his teenage kids vaccinated!

1) I continue to enjoy Hard Money's Million Dollar Podcast, hosted by my colleagues Enrique Abeyta and Gabe Marshank. They've turned $10,000 into $57,015 since they launched on February 2.

In their latest episode (starting at 35:32), they discuss California utility PG&E (PCG), which Enrique says "is a f**king no brainer."

I think they're right...

2) In the latest issue of Empire SPAC Investor – publishing later today after the market close – Enrique is at it again...

He has identified an opportunity to buy into a hugely established player in a great industry, with the chance to bet alongside a legendary investor with a phenomenal track record. And yet, it's a "boring" business – meaning its triple-digit upside potential is being overlooked.

If you aren't already a subscriber, click here to find out how to get the latest issue of Empire SPAC Investor risk-free.

3) Speaking of great ideas, we recommended shares of Twitter (TWTR) a year ago in Empire Stock Investor. They're up 76% since then, more than double the 33% return of the S&P 500 Index.

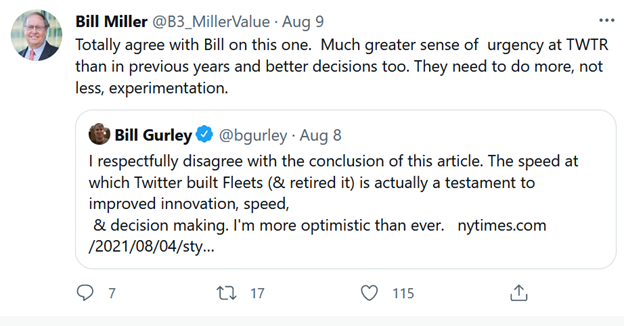

We continue to like the stock and agree with legendary investors Bill Miller and Bill Gurley, who both recently posted on Twitter:

Here's the New York Times article they were commenting on: Twitter Is Stuck With Itself, Too. Excerpt:

In July, Twitter announced that the feature, which rolled out publicly in November 2020, would disappear on Aug. 3. "We built Fleets to address some of the anxieties that hold people back from Tweeting," the company said. Though that isn't usually understood to be Twitter's main problem, the company decided that, after seeing little increase in people "joining the conversation," it would shelve the feature.

Aside from the implication that Fleets were something other than an attempt to incorporate a competitor's feature in the hopes of increasing engagement, the announcement was unusually frank. We tried! Users didn't use. Lessons learned. Better luck next time, to us.

But as anyone who uses Twitter knows, recalcitrance reigns.

Twitter is influential. It's also relatively small. Its user base is just a fraction of Facebook's, YouTube's, TikTok's, or Instagram's. The company reports substantially fewer users than Snapchat and slightly fewer than Reddit. It's the least-used social network that everyone knows about, seemingly talked about more than it's talked on.

Twitter's situation would seem more bizarre if hadn't been this way for so long. Its stagnant-to-slow growth, its incremental approach to adding new features and its adherence to formal limitation would be deemed intolerable or absurd in other corporate contexts. In 2005, nobody could have guessed what Facebook would become. Show 2021 Twitter to a time-traveling 2007 Twitter user, though, and they wouldn't likely have many questions – at least not about the platform itself.

When Twitter has committed to major change, it has done so in a gradual, piecemeal fashion, experimenting with capabilities outside its main app before integrating them (see: Periscope, Vine). It took more than a decade to get from 140 to 280 characters. When new big-deal features stick around – live video, for example – they remain subordinate to the core experience.

This slow process can leave users feeling unheard, or a bit stuck.

4) In response to yesterday's e-mail, in which my readers agreed with my bearish views on ride-sharing companies Uber (UBER) and Lyft (LYFT), a friend, Isaac S., wrote:

I don't agree with such negative assessment of ridesharing.

Whether drivers are temporarily scarce, or Uber/Lyft raise prices to control supply/profitability – I don't see how any of this fundamentally calls into question the business model of using technology to safely/efficiently pair drivers (or self-driving cars/vans) with riders. Taxis might work for an airport-to-city route, but rideshare technology is much broader than this. It enables people to slowly bring down the cost of car ownership through maximizing the usage of the car. Rideshare's original insight that the average car spends 96% of its life sitting dormant is very much still relevant.

An average suburban family will always have at least one car. But the idea that 20 years ago a family had 1.3 cars per adult and over time this will be more like 0.8 or 0.7 seems to create a large market for rideshare.

Disclosure: I am long Uber.

And here's an e-mail from Bill C., who moonlights as an Uber driver:

I "Uber" for fun every once in a while. I need to go out this week and spend an hour or two driving, because Uber is offering me a $120 bonus for completing a total of THREE rides. This is the second time in the past few months that I've received this offer. I also received a $100 bonus for ONE ride. I don't think the company is making any profits from my driving...

5) I only know three people who haven't been vaccinated against COVID-19 (one friend and another friend's two teenage kids), and I've made it a personal mission to change their minds.

I'm delighted to report that one friend, who lives in Florida, is getting his kids vaccinated this week, writing: "Obviously your badgering helped push me over the edge. Delta changed the game."

Click here to read the e-mails I sent him that helped change his mind.

(I sent the full e-mail yesterday to my coronavirus e-mail list, which you can sign up for by sending a blank email to: cv-subscribe@mailer.kasecapital.com.)

Best regards,

Whitney