Politics Is Preventing the Market Top

Stocks may have you nervous lately...

As you know, bull markets end when everyone mistakenly believes that they can't lose with their investments, going "all in."

Stock investors are getting close to this point. (Crypto investors might be there already... but that's a story for another day.)

Everyone wants in on the action with U.S. stocks right now, especially since Donald Trump won the presidential election. Many folks are bullish because of Trump's support for tax cuts and less business regulation.

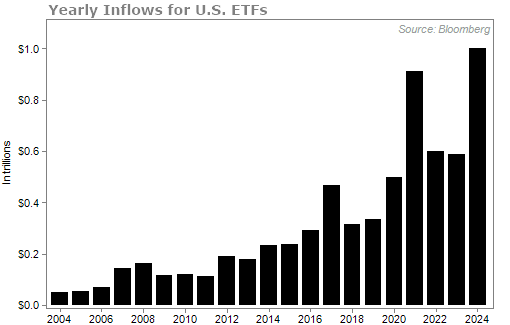

Money poured into U.S. exchange-traded funds ("ETFs") in November at a record rate... roughly $155 billion over the course of the month, or a historic $7.3 billion a day.

This is especially impressive considering November only had 20 trading days, less than an average month.

Net inflows have crossed the $1 trillion mark so far this year – and there are still more than two weeks' worth of trading days to go. The 2024 tally has even surpassed the previous record of $911 billion in 2021. Take a look...

Now, it's important to point out that investors from all over the globe are choosing U.S. equities over equities from other countries.

The next chart shows the inflows of U.S. equity ETFs compared with the rest of the world. When the line moves higher, that means there's more money rolling into U.S. stocks. The rolling three-month difference between the U.S. and non-U.S. equity ETFs just reached a staggering $188 billion.

And as you can see, today we're at the highest level in more than a decade...

With the S&P 500 Index trading at 27.1 times earnings and 3.1 times sales, it's easy to see we're on our way to the top.

But I (Jeff Havenstein) don't think we're there yet. This could go on for a while longer.

As I've written about before, we're not seeing signs of euphoria.

Yes, the money is flowing in at record rates. But I'm not hearing from relatives or friends who want to talk stocks all day. (They do want to talk bitcoin, though.)

It's clear that there are still some bears in the market. And that means there are still some potential buyers to push stocks even higher.

To gauge sentiment, I often check out the American Association of Individual Investors' ("AAII") Investor Sentiment Survey. Since 1987, AAII members have been answering the same simple question each week: "Do you feel the direction of the stock market over the next six months will be up (bullish), no change (neutral), or down (bearish)?"

Historically, 31% of investors answer that they are bearish. Today, the survey is showing that exact result. That's a far cry from what you typically see at a market top...

When markets were up in early 2022, for example, the survey showed bearish readings around 20%. And as you know, stocks went on to plummet 25% over the next 10 months.

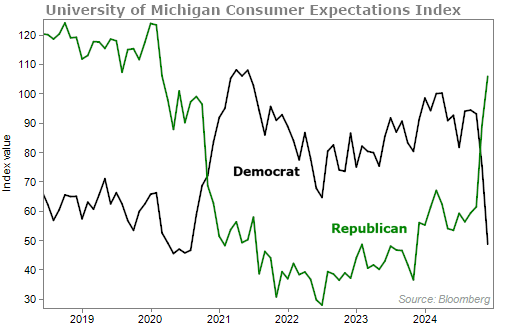

Politics has a lot to do with today's sentiment. Many Republicans are over-the-moon excited for what's to come with the economy and the stock market in 2025. But many Democrats believe the world will end and do not want to pour more money into stocks.

The chart below shows the University of Michigan Consumer Expectations Index for both Democrats and Republicans. You can see the typical partisan flip after the recent election...

Politics is a strong driver of emotions. But that can only go so far.

The market will likely continue to march higher in the months to come. At that point, greed will kick in... The skeptics of today will be pressured into buying stocks because, well, who doesn't want to make money on something that can't lose?

When you see that happen, then it'll be time to change your investing strategy.

You'll want to pare back some of your holdings to only the highest-quality businesses. Given the chart I showed you earlier, international stocks look like they'll be a safe play.

You'll also want to hold plenty of cash. And you'll want to own some of what Doc Eifrig calls "chaos hedges," like gold.

My advice today is to keep betting on U.S. stocks to run higher. But keep your ears open for that moment of euphoria... If your spouse has never shown an interest in the market before and one day brings up opening a brokerage account, it's that moment.

Trust me, you'll know when it's here.

In the meantime, I urge you to check out tonight's issue of Retirement Millionaire. In it, Doc and I recommend buying one of the best businesses in the world.

This is a company that the algorithms we developed at Stansberry Research have pinpointed as the No. 1 stock out of nearly 5,000 that we analyze.

And best of all... it's a recession-resistant company trading near its lowest valuation in the past decade. It's exactly the type of stock you want to own to prepare for whatever the market does in 2025 and beyond.

Our issue will be published later tonight. If you're not already a Retirement Millionaire subscriber, you can click here to see our latest offer.

What We're Reading...

- Something different: Mondelez made a takeover approach for Hershey.

Here's to our health, wealth, and a great retirement,

Jeff Havenstein

December 11, 2024