The bull case for Planet Fitness; How high mortgage rates are affecting the housing market; Michael Lewis Is Still Defending Sam Bankman-Fried; How to build grip strength

1) One of my smartest friends, a former hedge-fund manager who now tweets anonymously, is bullish on gym franchisor Planet Fitness (PLNT). Here's a thread he recently posted:

As a value guy, the stock's valuation – at 7.4x trailing revenue, 14.7x EBITDA, and 39.8x earnings per share – appears awfully rich.

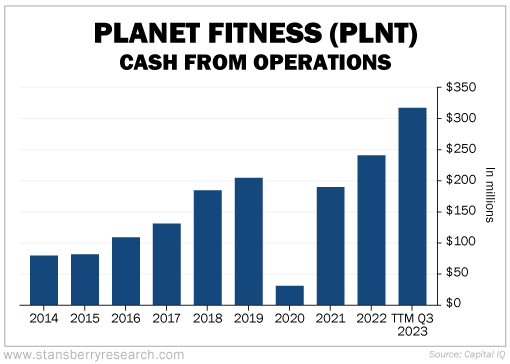

But I'll take a look, as franchising is a great business... Check out the company's operating cash flow over the past decade:

As always, if I decide it's a buy, Stansberry Research subscribers will be the first to know!

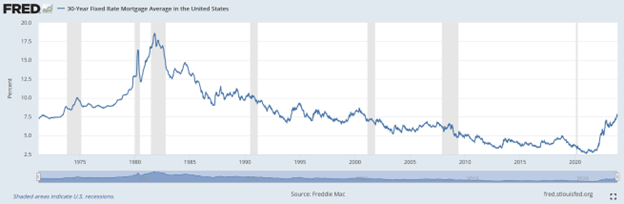

2) The interest rate on a standard 30-year fixed rate mortgage has skyrocketed from less than 3% as recently as two years ago to 7.5% today, a 13-year high (source):

As I discussed in my August 22 e-mail, this has reduced housing affordability to its lowest level ever and has tilted the market toward new homes.

The market for existing homes is frozen because sellers don't want to give up their low-rate mortgages and buyers can't afford the higher rates. As you can see in this chart, more than a third of conventional mortgages are fixed at 3% or lower, and nearly three-quarters are below 4%:

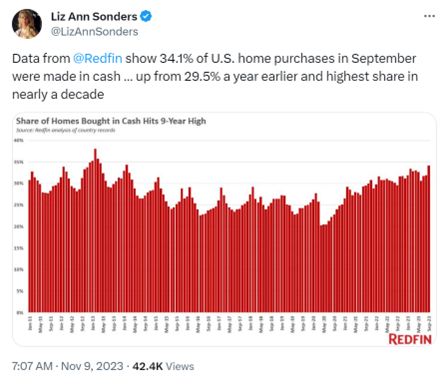

High mortgage rates also mean that more and more buyers are those who don't need a mortgage, as this chart shows:

3) I'm a big fan of Michael Lewis, having read all of his books since his first in 1989, Liar's Poker. I especially enjoyed The Big Short: Inside the Doomsday Machine.

But I must say, I'm not sure I'm going to spend the time to finish listening to his latest book about FTX founder Sam Bankman-Fried, Going Infinite: The Rise and Fall of a New Tycoon, after reading this article about him by my friend Michelle Celarier of Institutional Investor: Michael Lewis Is Still Defending Sam Bankman-Fried. Excerpt:

But despite a mountain of evidence against Bankman-Fried that was presented in court, through written documents and the oral testimony of three former FTX executives who pled guilty, Lewis was still enamored with his protagonist. On his podcast, he said that Bankman-Fried had a "superpower" in avoiding questions and was a "wonderful explainer" who was "very smart, very persuasive."

Lewis argued on the podcast that the onetime multibillionaire was not really a thief, as the prosecution alleged, but merely a gambler who simply borrowed customers' money and then lost it in a lapse of risk management.

"Their insistent line is that he stole the money," Lewis said, who argued that instead Bankman-Fried borrowed it and put it at risk without asking anybody's permission." He suggested that a juror would likely have more sympathy for a gambler than a crook.

How can I trust a book written by someone who so clearly has lost all objectivity? It was obvious just days after FTX collapsed that SBF was a massive fraudster. We now know this with certainty, thanks to the mountain of evidence that the government and all of SBF's top lieutenants presented, and the jury's quick conviction on all counts.

So how Lewis can keep defending him is beyond me...

4) Following up on my June 14 e-mail about how grip strength is an excellent indicator of current health and future problems, especially for the elderly, if you want to improve it, here are some ideas:

a) Join a climbing/bouldering gym. On the upper east side of New York, an excellent one is Vital on Lexington Avenue between 97th Street and 98th Street.

b) When you're working out in the gym, do exercises that use your grip, like lat pulldowns and farmer's carries.

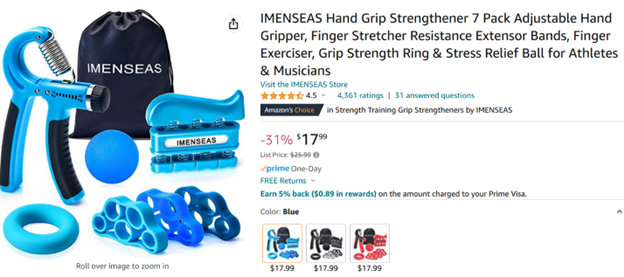

c) Buy this set for $17.99 and squeeze the various devices while you're watching TV, etc.:

Best regards,

Whitney

P.S. I welcome your feedback – send me an e-mail by clicking here.