The Most Powerful Force Behind the Market's Rise

Back in 2021, everyone wanted in on stocks...

Sentiment among retail investors – i.e., nonprofessionals – skyrocketed thanks to the meme-stock mania. Names like GameStop (GME) and AMC Entertainment (AMC) were all anyone could talk about, and this hype fueled further reckless buying.

Things got so crazy that author Ben Mezrich wrote a book called The Antisocial Network, which detailed the market craze around GameStop (and which was subsequently turned into a movie called Dumb Money).

We'll probably see finance professors lecture about the insane level of market sentiment in 2021 for many generations to come.

That leads me (Jeff Havenstein) to today...

We're currently seeing even higher levels of excitement among mom-and-pop investors than in 2021. That's because folks are giddy about the market's biggest stocks that have any exposure to artificial intelligence ("AI").

During the last week of January, there were two days when inflows from retail investors surpassed $2 billion. We've only seen this happen nine times in the past three years. Then, on February 3, retail investors put $3 billion into stocks in a single day. And the following day, cash inflows exceeded $2 billion within the first hour and a half of trading – a record going back to 2015, per JPMorgan Chase.

Notably, about 70% of that cash went to the Magnificent Seven, with most of it flowing into AI darling Nvidia (NVDA).

Put all this together, and you probably won't be surprised to learn that individual-investor exposure to stocks is near its highest level since 1997, according to investment bank Barclays...

As I've talked about before in this newsletter, bull markets don't die with a whimper. They end when everyone goes "all in," falsely believing they can't lose when they invest in stocks. Bull markets end when folks are euphoric.

We saw this toward the end of 2021 as everyone poured into technology stocks despite their extreme valuations. Then when a bear market hit in 2022 and dragged the S&P 500 Index down roughly 25%, many investors were blindsided.

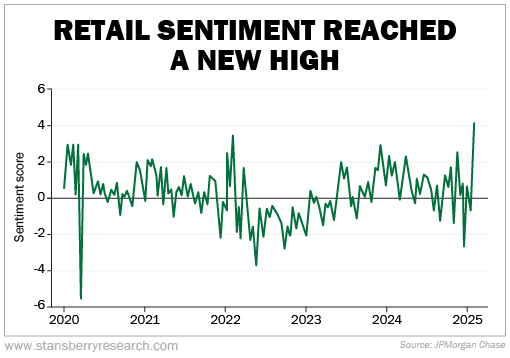

And we could see the same exact thing happen this time around. We're certainly getting close to peak levels of euphoria today. Just take a look at sentiment among everyday investors. It's through the roof...

I tend to look at a chart like this with a contrarian mindset. It tells me we're getting close to a peak.

But, as I've also said before, stocks can shoot much higher and for much longer than you'd expect during euphoric market runs like this. Higher stock prices lead to more money being moved into the market, which leads to even higher stock prices. This vicious cycle can happen quickly and last a while, so it can be difficult to tell when everything is about to crumble.

But eventually, the music will stop.

You'll want to look for the point where people in your life – your family, neighbors, and co-workers – talk either about taking profits... or about taking out big loans so they can buy even more stocks. This is how you'll know the party is over.

Long story short, the retail crowd is fully committed to the markets for now, so you should stay invested and reap profits. But be ready to scale back when we do see inflows from the retail crowd start to slow.

In the meantime, 50-year Wall Street veteran Marc Chaikin over at our corporate affiliate Chaikin Analytics is sharing his No. 1 favorite strategy for finding the best stocks out there right now...

The markets have been more volatile lately thanks to sticky inflation and President Donald Trump's antics, but Marc has discovered one group of stocks he's particularly bullish on. We can't give away too many details, but this is the biggest announcement of Marc's career. And just for tuning in, you'll receive one free stock recommendation.

What We're Reading...

- Coca-Cola takes on Olipop and Poppi with a new prebiotic soda brand, Simply Pop.

- Something different: Change your passwords.

Here's to our health, wealth, and a great retirement,

Jeff Havenstein

February 19, 2025