The Surprising Sector Set to Surpass the 'Magnificent Seven'

For a long time now, the biggest companies in the S&P 500 Index have been largely responsible for gains...

That might change soon.

As you probably know, the stock market is historically concentrated into a handful of stocks. The "Magnificent Seven" – Microsoft, Apple, Amazon, Alphabet, Nvidia, Meta Platforms, and Tesla – account for roughly one-third of the S&P 500.

Earnings for these giants have ballooned in recent years. And expectations for future earnings growth mean that company valuations have expanded... A lot of this has been because of advances with integrating artificial intelligence ("AI") into the businesses.

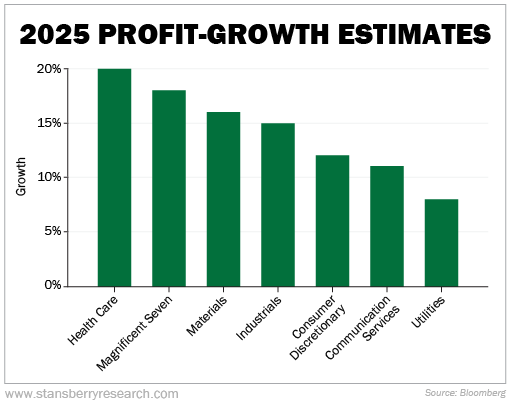

In its recent estimate of profit growth for sectors in the S&P 500, Bloomberg's leading group of stocks wasn't the Magnificent Seven.

While this group of dominant tech stocks is estimated to see profits expand by 18% next year, which may sound impressive, it's barely half this year's estimate of 34% growth.

Still, 18% growth in profits is pretty good. The problem is, Nvidia is doing most of the heavy lifting. The remaining six stocks are only projected to grow profits by an average of 3%.

The sector with the most upside potential isn't tech... It's health care.

Health care is leading Bloomberg's growth estimates for next year with 20%...

We can understand why estimates are so high... As we've talked about before, biotech has been stuck in a brutal bear market following the pandemic. The money flowing into the sector suddenly dried up once COVID-19 was no longer a mainstay in the news. Many smaller companies in the space also struggled to keep up with higher interest rates.

We've seen signs of life recently, though, with more money starting to move into health care companies. And, given the depressed state of the sector, there is plenty of room for earnings growth.

You see, health care has been one of the sectors left for dead. No one has cared about it over the past year or two.

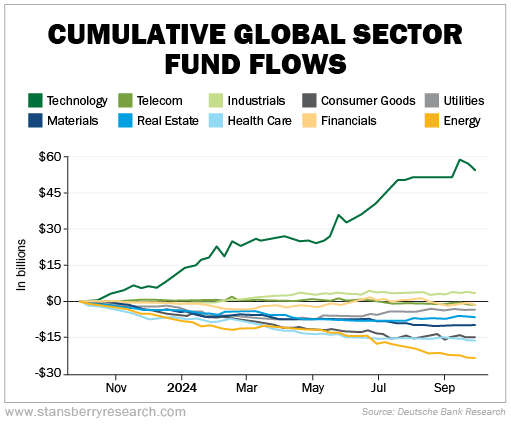

The chart below tracks investment dollars flowing in and out of specific sectors over the past year. Since many companies that use AI are in the tech space, investors are piling into them at a massive rate. Meanwhile, we've seen many billions of dollars move out of health care. Only the energy sector has seen more outflows than health care.

Take a look...

As a contrarian, you always want to buy when no one is paying attention. Today, no one is excited to buy health care stocks. How can they be when Nvidia and AI is all anyone can talk about?

But they'll start to care about health care next year if margins do expand like we expect. And we'll be ready to take advantage of health care stocks in 2025.

We aren't the only ones looking at which stocks should do well next year.

Yesterday, my colleague – and founder of our corporate affiliate Chaikin Analytics – Marc Chaikin went live with his comprehensive stock market road map for 2025. In it, he explained what the mainstream financial media is getting wrong about the markets, what you should expect from stocks over the next six months, and if we could see a repeat of the 2022 market crash.

If you missed it, catch up on all the details here.

What We're Reading...

- Something different: Walmart employees are now wearing body cameras in some stores.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

December 18, 2024