Thoughts on navigating a tough market; The Coming Inflation Shock of 2022; CarGurus presentation; Comparison with 2018; Meeting John Legend

1) Thanks to the worst inflation in 40 years, a busted supply chain, the war in Ukraine, rising interest rates due to a hawkish central bank, a drain-off in liquidity, and worrisome developments in such realms as consumer debt and housing, it's not surprising that markets are in turmoil.

This is actually good news for long-term investors who can keep their wits about them, as I discussed in Friday's e-mail: Thoughts on navigating a tough market.

To help my readers get through this, I'm hosting a special event I'm calling "The Coming Inflation Shock of 2022" on Tuesday, May 17, at 8 p.m. Eastern time. In it, I'll share my views on inflation and tips on how to avoid mistakes, mitigate risk, and keep the profits you've made. It's free to attend – just click here to save a spot.

2) I chatted with seven billionaires last night at the Robin Hood charity gala, most of whom are in the investment business. (A notable exception was former New York City mayor Michael Bloomberg... After thanking him for his incredible long-term support of charter schools, I said – with a smile – "It's a great time to own a wonderful business that produces lots of cash flows." He smiled and nodded in agreement!)

The investors I spoke with had different views on the markets, but a number agreed with me that the extreme sell-off among growth stocks recently smells like forced selling, which indicates that a number of high-profile funds are likely to shut down.

3) In yesterday's e-mail, I said that I "think it's time to start looking to buy high-quality growth businesses whose stocks have been oversold by panicky retail investors and hedge funds being forced to liquidate" and shared a presentation by Columbia Business School students on PayPal (PYPL).

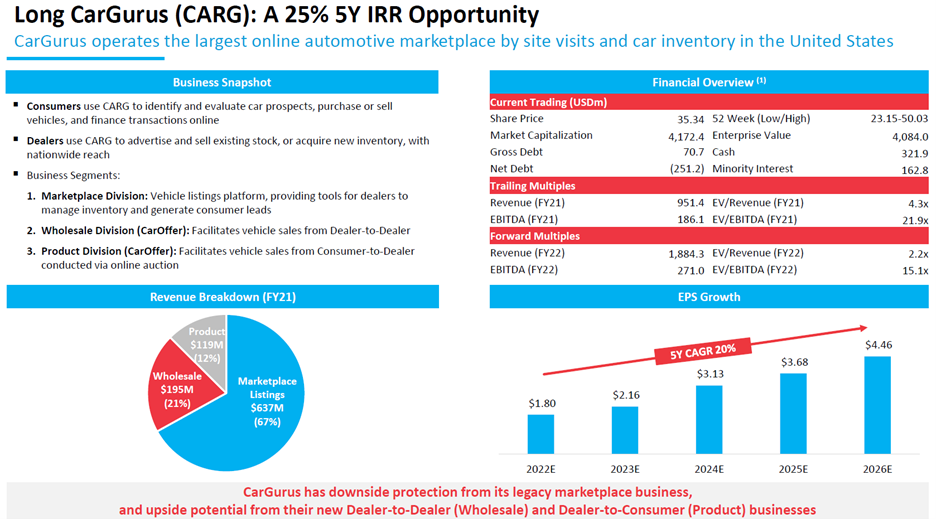

Today, I'd like to share the presentation by the team that won second prize (and $50,000!) in the Pershing Square Challenge, a pitch for online auto marketplace CarGurus (CARG).

The company reported first-quarter earnings this morning and, at first glance, the numbers appeared strong: revenue was $430.6 million, up 151% year over year and comfortably exceeding expectations of $403 million. Adjusted earnings per share ("EPS") were $0.36, a penny above expectations.

But the stock is selling off heavily today due to weak guidance for the second quarter. While revenue is expected to be $480 million to $510 million – well above expectations of $453 million – the company anticipates that adjusted EPS will only be $0.26 to $0.29... which is well below estimates of $0.39.

The stock has now been cut in half in less than two months!

I haven't done enough work on CarGurus to have an opinion on whether this steep sell-off represents a buying opportunity, but it's definitely worth a look, so I'll be reviewing the students' 55-slide presentation carefully (I've posted it here, with their permission).

Here are the first two slides with an overview of the company and their investment thesis:

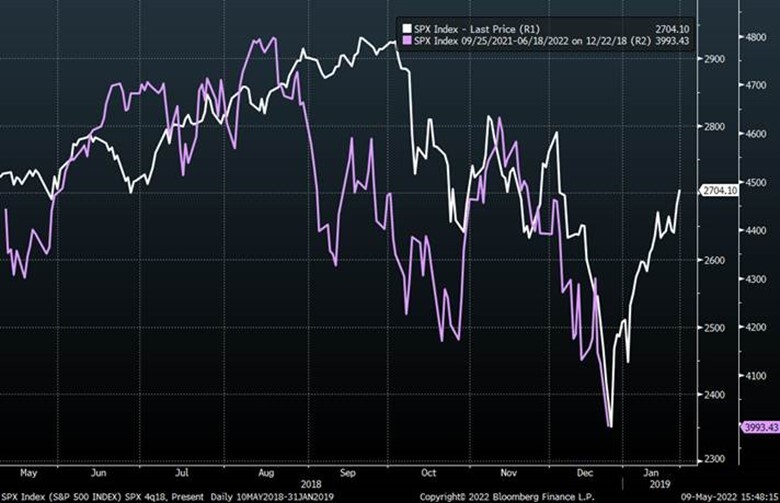

4) In yesterday's e-mail, I shared a chart comparing the rise and collapse of the Nasdaq Composite Index in the late 1990s and early 2000s with the similar story of Cathie Wood's ARK Innovation Fund (ARKK).

Today, I'd like to share another historical comparison chart (courtesy of Jon Simon, a trader at Sanford Bernstein):

The playbook is the same, popcorn is a bit stale. This is a near-perfect match of what happened in the fourth quarter of 2018 when the Fed was hiking and running down the balance sheet. And then they blinked in January 2019. Does that mean I am calling a bottom? Not at all, that would be irresponsible. Is there a higher likelihood of a face-ripping rally for a few days? Yup. One man's opinion...

SPX 5/10/2018 –> 01/31/2019 – white line

SPX 9/25/2021 –> Present – pink line

5) I also had the chance to chat briefly last night with John Legend, who is one of only 16 people (and the youngest) to win Emmy, Grammy, Oscar, and Tony awards. He performed last night after the gala:

I first met him in 2009, when we were on a panel (with James Carville) at the Teach for America 20th Anniversary Summit in Washington, D.C. (I was one of the founders – it was my first job after college in 1989... He joined the board a year later.) He wasn't as famous then as he is now so I had no idea who he was, but I figured he was special because so many young women in the audience were sneaking up to the front to take his picture (I leaned into as many as I could and commented to him, "I sure am popular today!").

We've kept in touch ever since, as we share a passion for both education and criminal justice reform. Here's a picture of my wife and me with him after his concert at Madison Square Garden in 2017:

Funny story: A dozen or so years ago, Susan and I were at a restaurant with our three daughters. One of his songs came on, and I mentioned that I knew him. Our girls laughed and started mocking me, "Yeah right, you know John Legend..."

So I whipped out my phone and sent him a quick e-mail: "Hi John, my girls don't believe I know you. Would you mind replying and setting them straight?"

Within one minute, he did, writing, "Hey girls, your dad is a cool guy."

When I showed it to them, they screamed, "No way!!!" and almost fell on the floor.

I will always be grateful to John for giving me one of my greatest moments as a father!

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.