How the Power Gauge Saw This Bankruptcy Coming

Editor's note: Sometimes, fundamentals drive stock prices – but often, it's pure hype. That's why it's critical to check your emotions against reality. And right now, Vic Lederman from our corporate affiliate Chaikin Analytics is sharing an easy way for investors to do just that.

Today, we're taking a break from our usual fare to share a recent issue of the free Chaikin PowerFeed e-letter. In it, Vic reveals how you could've spotted one bankruptcy story long before the market did...

"Corporate disaster" doesn't even begin to describe it.

Through August 2023, one company's stock had plunged roughly 97% from its June 2020 peak... which had been just days after the company went public.

Then, the company's CEO stepped down...

He said it was for a "family health matter."

Sure, that could've been the main reason. But notably, he'd only been CEO for about seven months. And his replacement was the fourth to hold the position in three years.

At the time, in a desperate attempt to raise cash, the company planned to issue new shares. However, it also suspended production of the technology that had made it famous.

The company cut costs wherever else it could. It eliminated 270 jobs in June 2023. And it liquidated an acquisition related to its abandoned technology.

Things didn't get any better in 2024. The company laid off about 15% of its remaining workforce that October. Then, two months later, it held another round of layoffs.

None of it helped.

Fast-forward to this February... The company filed for bankruptcy protection. Then its stock was delisted from the Nasdaq Composite Index. (It now trades "over the counter" for just pennies per share.)

Folks, this situation is about as bad as it gets. But as crazy as it might seem... investors kept clinging to the dream this company sold until it was far too late.

But if they'd known where to look, they could've spotted the signs before losing their money...

Market Hype Propped Up This EV Maker's Slow Decline

You see, this company operates in one of the market's most passionately debated segments – electric vehicles ("EVs").

With this company, far too many people couldn't see beyond the EV hype. The promise of the technology blinded them to every misstep this corporate disaster made.

But the Power Gauge wasn't fooled...

This is a tool we use at Chaikin Analytics to gather a wide array of investment fundamentals, technicals, and more into a simple, actionable rating such as "bullish," "neutral," or "bearish."

Through all the twists and turns, our one-of-a-kind system never assigned this company a "bullish" rating. And if you'd followed its lead, you would've stayed far away.

Let's take a closer look...

If you haven't guessed yet, we're talking about electric-truck maker Nikola.

Nikola initially had grand plans to bring heavy-duty electric trucks to the market. And investors loved the idea...

The company soared after it went public – for a few days, at least.

If the Power Gauge was a momentum-only system, Nikola likely would've earned a "bullish" rating at that point. But that's not how our system works. Instead, it gives us the full picture...

The Power Gauge looks at 20 factors across four different categories – Financials, Earnings, Technicals, and Experts. Because of that, emotional appeal doesn't play into it.

More specifically, the Power Gauge knew something was wrong right away.

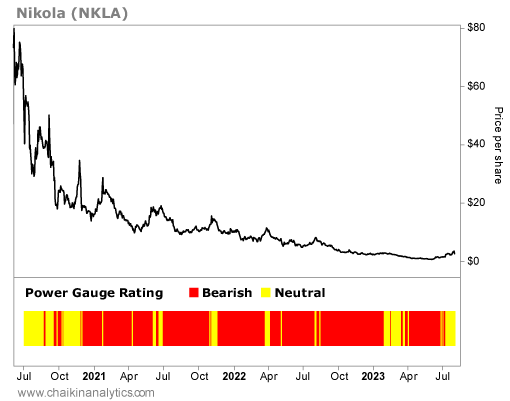

You can see what I mean in the following chart. Along with the stock's steep decline, it shows the Power Gauge's ratings for Nikola from its public listing through August 2023...

As you can see, Nikola only mustered a "neutral" rating when the Power Gauge first graded it in July 2020. And before long, the Power Gauge turned "bearish" on the company.

That doesn't surprise me. After all, the U.S. Securities and Exchange Commission and the Department of Justice came knocking at Nikola's door a few months after it went public...

Their investigations into the company started in September 2020. By July 2021, they had indicted the first CEO, Trevor Milton, for lying about "nearly all aspects of Nikola's business."

It might seem obvious that Nikola didn't deserve a "bullish" grade from the Power Gauge.

But look back at the above chart. Each day that Nikola's share price stayed above zero was another day that an unsuspecting investor believed an opportunity still existed.

Heck, even as the company struggled to survive, its stock briefly spiked about 70% in March 2024. After everything, some folks still held out hope that Nikola would rebound.

The Power Gauge knew better... right from the outset.

As I said, Nikola went bankrupt in February. And its shares are essentially worthless.

Investors who went all in – and stayed in – went broke. Don't fall into that trap.

Good investing,

Vic Lederman

Editor's note: The market has reached new all-time highs in recent weeks... Yet, the specter of another tech-fueled dot-com-style crash looms large in folks' minds. Chaikin Analytics founder Marc Chaikin is no stranger to wild markets like we're seeing now. That's why, on Tuesday, August 26, he's stepping forward to answer your most pressing questions... and to reveal an urgent update to his 2025 market forecast.