A Rally That's Too Good to Be True

A rally that's too good to be true... Checking in on the 'lions'... And introducing the 'deviants'... Why our portfolio performs well in both bull and bear markets...

Over the past 24 days, the price of crude oil is up 53%. The only comparable rallies in the history of the oil markets were after Iraq invaded Kuwait and immediately after the financial crisis in March 2009. But... is this rally really about the dynamics of the oil market? Days of supply (economic supply) just set a new multidecade high on March 4. Supply in the U.S. remains at these record levels (33 days of consumption).

![]() And it's not just oil that's moving higher...

And it's not just oil that's moving higher...

Just about every commodity you can name is up over the past month. Commodity stocks are soaring as a result. U.S. Steel (X) is up 85% over the past month. Leading copper and gold producer Freeport-McMoRan (FCX) is up 35%. Vale (VALE), a major iron-ore producer, is up 23%. The Market Vectors Junior Gold Miners Fund (GDXJ) – which holds a basket of small-cap gold stocks – is up 15%. Foreign currencies are up, too, with even the lowly Japanese yen (and its negative interest rates) strengthening against the dollar.

![]() These rallies have seen the Dow Jones Industrial Average erase its losses for the year. So what is the market telling us? Is it saying that our troubles are behind us? Is the "water" safe again for swimmers?

These rallies have seen the Dow Jones Industrial Average erase its losses for the year. So what is the market telling us? Is it saying that our troubles are behind us? Is the "water" safe again for swimmers?

Here's the most interesting market dynamic of all: Over the past five weeks, the Volatility Index (which measures the prices of put options and reflects the amount of fear in the equity market) has fallen 45%. That's the largest five-week decline in history.

![]() In short, never before have more investors suddenly believed that there's nothing to worry about. What are the chances the herd is right? What are the chances that I (Porter) have been far too pessimistic in my outlook for 2016-2019? Maybe a bear market won't develop after all. Maybe this isn't the start of a new and dangerous credit-default cycle. Let's take a closer look...

In short, never before have more investors suddenly believed that there's nothing to worry about. What are the chances the herd is right? What are the chances that I (Porter) have been far too pessimistic in my outlook for 2016-2019? Maybe a bear market won't develop after all. Maybe this isn't the start of a new and dangerous credit-default cycle. Let's take a closer look...

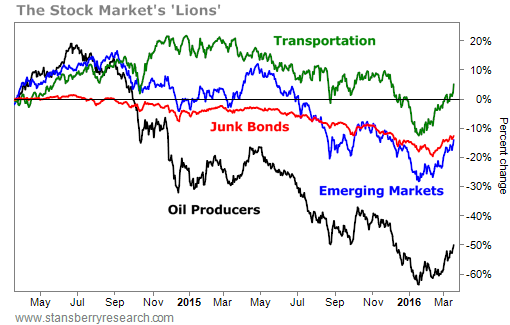

Recall that for almost the last year, I've been warning you about the "lions" stalking the bull market. I believed that we were on the verge of a big default cycle in the bond market, brought on mainly by unprecedented amounts of new, low-quality corporate debt and excesses in subprime auto and student lending.

I know... as the default rates on these dodgy debts continue to rise, bond prices – reflected by the iShares iBoxx High-Yield Corporate Bond Fund (HYG) – will fall. Debt-dependent emerging-market economies – the kind whose stocks are held in the iShares MSCI Emerging Markets Fund (EEM) – would slow.

And the main catalyst of this coming debt-default cycle is the oil glut. A debt-financed boom between 2010 and 2014 led to a doubling of U.S. production since 2005. So we also tracked the Market Vectors Unconventional Oil & Gas Fund (FRAK), which holds the stocks of companies involved in the shale-drilling boom.

As the oil boom faded, I believed the U.S. economy would slow, as all of the net growth in private employment since 2010 is directly related the oil boom – a trend reflected in the Dow Jones Transportation Average (^DJT).

By watching these sectors of the market (high-yield bonds, emerging-market stocks, domestic oil companies, and the Dow Jones Transportation Average), you can get a good idea of what's going to happen in the future to the market as a whole.

So... what do the "lions" tell us about the recent rally? Let's take a look...

![]() Looking at the chart, I don't see anything yet that makes me change my thesis. Oil stocks, emerging-market stocks, and U.S. transportation stocks all bottomed on the same day – January 19.

Looking at the chart, I don't see anything yet that makes me change my thesis. Oil stocks, emerging-market stocks, and U.S. transportation stocks all bottomed on the same day – January 19.

This precise correlation and the record decline in the VIX tells me that the rally we've seen is probably caused by short covering as opposed to any change in the fundamental outlook.

Of course, I could be wrong. If, for example, there's a confirming change in the economic supply of oil, I would be far more willing to change my mind. But so far, that hasn't happened. And none of the "lions" have rallied enough yet to even break through any of their previous lower highs.

In short... these sectors of the market have suffered so much carnage that this rally hasn't established a new trend. Thus... so far... this rally actually confirms my view. These kinds of sharp rallies that fail to establish a new, higher trend are exactly how bear markets work. Let me explain...

![]() Following the markets on a daily basis for 20 years has taught me one over-riding lesson: In the short term, the markets are designed to take away the most amount of money from the largest amount of people possible. Extreme changes in sentiment will drive all market action in the short term, regardless of fundamentals. And market sentiment has never in history swung faster than it did over the past few weeks. This is exactly the kind of short-term move that's necessary to fool people to get back into the markets.

Following the markets on a daily basis for 20 years has taught me one over-riding lesson: In the short term, the markets are designed to take away the most amount of money from the largest amount of people possible. Extreme changes in sentiment will drive all market action in the short term, regardless of fundamentals. And market sentiment has never in history swung faster than it did over the past few weeks. This is exactly the kind of short-term move that's necessary to fool people to get back into the markets.

A bear market can't develop unless most investors don't believe it's going to happen. The same is true of bull markets. Bull markets climb "a wall of worry" – they're designed to make skeptical and cautious investors look stupid.

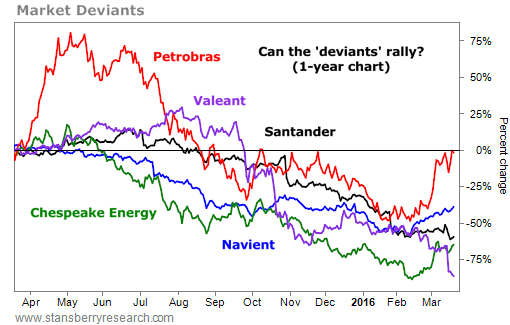

On the flip side, bear markets slide down a rising tide of hope. Right now, investors hope oil inventories recede. They hope notorious drug-royalty company Valeant (VRX) won't file bankruptcy. They hope the world's central banks have found a way to stop the big U.S. dollar rally. There's a lot of hope in the market...

![]() Meanwhile, credit-ratings agency Fitch predicts that $60 billion worth of energy-related bonds will default this year, up from $17.5 billion last year. If Valeant defaults (and I believe it will), that would add another $30 billion in bad debt. You should know that Valeant has been the leading issuer of high-yield debt in the U.S. since the last financial crisis. It makes up a substantial portion of almost every collateralized loan security that Wall Street has packaged and the credit-ratings agency has rated "triple-A."

Meanwhile, credit-ratings agency Fitch predicts that $60 billion worth of energy-related bonds will default this year, up from $17.5 billion last year. If Valeant defaults (and I believe it will), that would add another $30 billion in bad debt. You should know that Valeant has been the leading issuer of high-yield debt in the U.S. since the last financial crisis. It makes up a substantial portion of almost every collateralized loan security that Wall Street has packaged and the credit-ratings agency has rated "triple-A."

![]() So... the facts we see in the credit markets don't match the hope expressed in the equity markets. Which side will win? We can't know, of course... but we have an idea. And to help focus your mind on what we see in the markets, we want to share another group of charts with you.

So... the facts we see in the credit markets don't match the hope expressed in the equity markets. Which side will win? We can't know, of course... but we have an idea. And to help focus your mind on what we see in the markets, we want to share another group of charts with you.

I introduced the lions to you last year. Today... I bring you the "deviants." These are the companies who best express the fears I have about the excesses of the credit markets and the default cycle I believe we've entered. The deviants are: subprime auto lender and "dark angel of debt" Santander Consumer Finance (SC), student-loan firm Navient (NAVI), debt-fueled fracking giant Chesapeake Energy (CHK), emerging-market debt issuer Petrobras (PBR), and leading issuer of high-yield debt Valeant (VRX)...

![]() In my view, the underlying problems in all of these companies will not be solved without either a major restructuring (Petrobras) or bankruptcy. In either case, the existing equity holders will be wiped out and the debt holders will take a major haircut.

In my view, the underlying problems in all of these companies will not be solved without either a major restructuring (Petrobras) or bankruptcy. In either case, the existing equity holders will be wiped out and the debt holders will take a major haircut.

I don't think this bad news is priced in to these stocks yet... and I don't think these issues will be contained to only these bad apples. At least another $1 trillion in bad debt will be written off over the next three years. We are still in the early innings of what I believe is coming.

![]() Assuming for a moment that I'm right... how can you manage your portfolio? I've done my best to show you in our Bear Market Survival Program. We gave you step-by-step guidance on how to raise cash, buy gold, short stocks, take advantage of distressed opportunities in stocks and bonds, and more.

Assuming for a moment that I'm right... how can you manage your portfolio? I've done my best to show you in our Bear Market Survival Program. We gave you step-by-step guidance on how to raise cash, buy gold, short stocks, take advantage of distressed opportunities in stocks and bonds, and more.

We're also teaching subscribers how to trade bear markets for both stable income and big, short-term profits in our Bear Market Trading Program. The second module of this series – explaining our "dividend kicker" strategy – hits inboxes today. This lesson will show you a simple, proven way to make quick, double-digit gains. It's as simple as buying a stock.

In coming weeks, we'll be showing readers the low-risk way to bet on a stock market crash without risking your capital upfront... how to set up "market-neutral" trades that profit no matter the market direction... how to "sell" volatility... and much more. You can learn more about our Bear Market Trading Program right here.

I urge you to read both. These reports will help you optimize your results. You might discover that bear markets are actually investors' best opportunities to build wealth. Or, as I call them, giant legal transfers of wealth.

But... even if all you're doing is following the portfolio in my newsletter, you're doing fine. I asked our former professional auditor (Mike DiBiase) to study how our Investment Advisory portfolio had weathered the incredibly volatile last six months in the market. He reports that, across all of our positions, the average return for the last six months is 7.7% annualized... compared with the 4.9% return the S&P 500 would have produced over the same period (based on all of our buys and sells). But there's a big catch when you look at these numbers...

We held 32 "long" positions (where we recommended buying a stock) and we held nine short positions (where we recommended selling a stock short). Thus, our portfolio was 28% short the market during the correction we experienced. That gave us a tremendous buffer against the falling value of our long positions.

We made big gains (59%) shorting "deviant" stock Santander. We also did well shorting financial-services stock Capital One (COF) and a collection of Texas banks. No, not all of our short recommendations made money – we lost money shorting GM, for example. But overall, the returns were great. While other investors were getting killed... a big part of our portfolio went up in value.

![]() That's not the only way our portfolio was hedged. We also hold a gold stock that has soared 45% over the past six months and several high-quality, capital-efficient stocks that tend to do best when the market as a whole struggles: fast-food icon McDonald's (MCD) is up 27%, software giant Microsoft (MSFT) is up 25%, and pharmaceutical firm Johnson & Johnson (JNJ) is up 14%.

That's not the only way our portfolio was hedged. We also hold a gold stock that has soared 45% over the past six months and several high-quality, capital-efficient stocks that tend to do best when the market as a whole struggles: fast-food icon McDonald's (MCD) is up 27%, software giant Microsoft (MSFT) is up 25%, and pharmaceutical firm Johnson & Johnson (JNJ) is up 14%.

![]() The combined result of these choices – to hedge our portfolio with super-safe stocks and short recommendations – means that our portfolio was dramatically less volatile than the market as a whole. The maximum drawdown over the past six months in the S&P 500 was 8.1%. But in our portfolio, the maximum drawdown was only 1.7%.

The combined result of these choices – to hedge our portfolio with super-safe stocks and short recommendations – means that our portfolio was dramatically less volatile than the market as a whole. The maximum drawdown over the past six months in the S&P 500 was 8.1%. But in our portfolio, the maximum drawdown was only 1.7%.

If you're into the Greek terms of finance, the "beta" of our model portfolio was only 0.32 during one of the most volatile six months in market history. In other words, for every 1% the market moved up or down... our portfolio moved just 0.32%. That should give you tremendous confidence to continue to follow our advice. It's one thing to do well in stocks... but it's a whole lot different to do well safely.

That, I believe, is by far the most valuable thing we have to offer investors. Whether we're right or wrong about our macro outlook, our portfolio is positioned to prosper, safely. I hope your portfolio is, too.

![]() New 52-week highs (as of 3/17/16): Kaminak Gold (KAM.V), Coca-Cola (KO), Public Storage (PSA), Sturm, Ruger (RGR), Sysco (SYY), and AT&T (T).

New 52-week highs (as of 3/17/16): Kaminak Gold (KAM.V), Coca-Cola (KO), Public Storage (PSA), Sturm, Ruger (RGR), Sysco (SYY), and AT&T (T).

![]() Have you followed the advice in Stansberry's Investment Advisory? Please let us know what your experience has been over the past six months. We can't respond to individual e-mails, but we read them all. We'd love to hear from you... Send us a note at feedback@stansberryresearch.com.

Have you followed the advice in Stansberry's Investment Advisory? Please let us know what your experience has been over the past six months. We can't respond to individual e-mails, but we read them all. We'd love to hear from you... Send us a note at feedback@stansberryresearch.com.

Regards,

Porter Stansberry

Baltimore, Maryland

March 18, 2016

P.S. You might have noticed that for the last few days, I've been urging you to try my new OneBlade razor. It's a free trial, so you have nothing to lose. And I've gotten some really incredible feedback, including a note from a client who reports that he has come to love our razor so much, he has trouble sleeping now because he's so excited about his morning shave routine.

Also, I've heard from folks who are interested in OneBlade... but have never learned how to shave. Not to worry... we have a free how-to video on our website. Whether you switch to our razor or not, I hope you'll at least give it a try. Our free trial offer ends in 10 days. Click here to learn more.

|