Singapore joins 'Currency Wars'...

Singapore joins 'Currency Wars'... Apple's blowout earnings... The highest quarterly earnings in corporate history... Why Dan Ferris says Apple is worth $1 trillion... What Apple must do to get there... Don't worry about Microsoft's drop... Why it's good when stocks languish... The biggest opportunity Dan sees today...

Our theme in the Digest this week has been fear. On Monday, we discussed the destruction of most of the world's currencies thanks to reckless money printing.

Yesterday, we shared why it's good to be scared... and why Porter said he is "as bearish as I have ever been in my entire life." In short, he thinks stock valuations are absurd, the world is swimming in debt, and the main purchaser of stocks – companies buying back their own shares – will dry up. Porter recommends buying gold and playing defense.

Today marks the second time this year the central bank of a safe-haven currency shocked the markets. We've covered in detail how the Swiss National Bank (SNB) unpegged the franc from the euro, causing its currency to soar.

Today marks the second time this year the central bank of a safe-haven currency shocked the markets. We've covered in detail how the Swiss National Bank (SNB) unpegged the franc from the euro, causing its currency to soar.

SNB said it would lower its target range for three-month Libor (London Interbank Offer Rate) from the previous range of -0.75% to 0.25% to the revised range of -1.25% to -0.25%. (The Libor is the rate at which banks lend each other short-term money... It's a key interest rate for banks.)

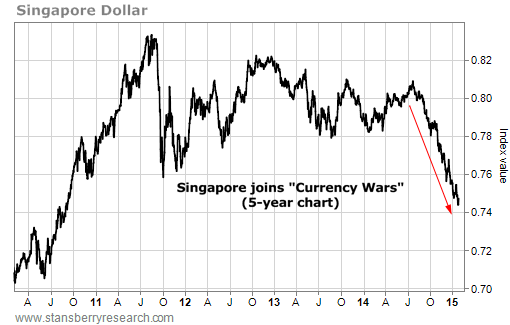

Now, the wealthy Asian city-state of Singapore is joining the easing party.

In a surprise announcement, Singapore's central bank – the Monetary Authority of Singapore – announced it would slow the appreciation of the Singapore dollar.

As we explained on Monday, a country's currency is a de facto way to "invest" in that country... If things are going well, a nation's currency typically rises... and vice versa. The business-friendly Singapore is thriving... It recorded a 2013 budget surplus equal to 1.1% of GDP. The U.S., for comparison, has a deficit equal to 2.8% of its GDP.

The Singapore dollar trades in an undisclosed, managed range against a basket of major foreign currencies. So we don't know exactly what steps Singapore will take... but it wants a cheaper dollar.

The country's central bank also forecasted that inflation in 2015 will now be between -0.5% and 0.5%. That's down from the forecast of 0.5% to -1.5% made in October.

We hope that's the end of the currency surprises. We know most of you probably find currencies boring. But it's important to remember the main point: Central banks are actively destroying their currencies... And it won't end well.

We hope that's the end of the currency surprises. We know most of you probably find currencies boring. But it's important to remember the main point: Central banks are actively destroying their currencies... And it won't end well.

Meanwhile, things are looking up for one of the most popular companies in the world today...

The company reported $74.6 billion in revenue. And it earned $18 billion in the fourth quarter. That's an increase of 30% and 37%, respectively, over the same period a year ago.

Apple's fourth-quarter earnings were not only a record for the company... They were the largest quarterly earnings in corporate history. No other company in any industry has ever earned more money in a single quarter than Apple. Not ExxonMobil, not Wal-Mart, not Berkshire Hathaway...

The company also generated $33 billion in cash in the quarter. Apple is now sitting on an incredible $178 billion in cash – up 15% from just the previous quarter.

Apple sold a record 74.5 million iPhones in the quarter. Said Apple CEO Tim Cook...

|

Apple also sold more than 21 million iPads and 5.5 million Macs, producing record revenue. (It's also important to note Apple's revenues rose 70% in China.)

One final point on Apple before we turn to Extreme Value editor Dan Ferris, who recommended shares back in June 2013...

One final point on Apple before we turn to Extreme Value editor Dan Ferris, who recommended shares back in June 2013...

The company returned more than $8 billion to shareholders in the quarter (buying back $5 billion in shares and paying $3 billion in dividends). Apple has returned a total of $103 billion to shareholders since announcing its capital return program in August 2012. And it returned $57 billion of that in just the last 12 months alone.

|

There's no question about it: Apple has no use for $178 billion in cash (and growing). The company simply can't get a return on that capital. It's shareholder capital being held hostage for a "tax benefit."

There's no question about it: Apple has no use for $178 billion in cash (and growing). The company simply can't get a return on that capital. It's shareholder capital being held hostage for a "tax benefit."

As Dan explained, Apple shouldn't take on debt to avoid bringing that money home. It should bring the money home, pay taxes, and buy back shares...

|

Great brands get acquired for 30 times free cash flow. Apple is too big to be acquired, so some of its valuation could be discounted because of that. But it's also discounted because it's holding a huge amount of idle capital.

Great brands get acquired for 30 times free cash flow. Apple is too big to be acquired, so some of its valuation could be discounted because of that. But it's also discounted because it's holding a huge amount of idle capital.

As Dan explained, "Apple should be double today's price, easy. It deserves a $1 trillion-plus market cap... or it would deserve it if it handled that excess cash more efficiently." To do that, Apple needs to take some steps to help it get there...

In total, Dan has published three Extreme Value issues about Apple... in June 2013, July 2013, and his letter to CEO Tim Cook in November 2013.

In total, Dan has published three Extreme Value issues about Apple... in June 2013, July 2013, and his letter to CEO Tim Cook in November 2013.

He also appeared on the Fox Business show "Money with Melissa Francis" that October to scoff at the idea that Apple had lost its mojo and needed to buy Tesla (which some analysts said at the time). You can watch Dan's segment right here.

In short, few analysts have been as bullish about Apple as Dan has. Apple jumped more than 6% higher after reporting the earnings. And Extreme Value subscribers are up more than 90% on the recommendation as of midday trading – the safest 90%-plus returns anybody has ever made, according to Dan.

As of yesterday's close, Dan's Extreme Value portfolio was up an average of 73%, including 12 stocks up 80%-plus. That's the beauty of Extreme Value and buying high-quality companies when they go on sale.

Software giant Microsoft reported estimate-beating earnings yesterday... But the company lowered its revenue forecast. Shares fell nearly 10% on the news.

But Dan isn't concerned about the company's future. He quelled his Extreme Value subscribers' concerns in yesterday's weekly update...

|

Dan noted that the company's commercial cloud-services division just posted its sixth consecutive quarter of 100%-plus growth. In just three years, this division's sales have nearly doubled, and the gross margin has quintupled...

Dan noted that the company's commercial cloud-services division just posted its sixth consecutive quarter of 100%-plus growth. In just three years, this division's sales have nearly doubled, and the gross margin has quintupled...

|

He also pointed out that more than 60% of the company's revenue earns a gross margin of 90%-plus... and it intends to reward patient shareholders...

He also pointed out that more than 60% of the company's revenue earns a gross margin of 90%-plus... and it intends to reward patient shareholders...

|

Shares were down nearly 3.5% today. But remember, a falling share price of a company you want to own for the long term is a great thing. As investing legend Warren Buffett said in his 2012 letter to shareholders, you want stocks to languish.

Shares were down nearly 3.5% today. But remember, a falling share price of a company you want to own for the long term is a great thing. As investing legend Warren Buffett said in his 2012 letter to shareholders, you want stocks to languish.

We'll share an excerpt from that letter below – which coincidentally discusses another World Dominator that is languishing (IBM). (You can also read the entire Digest we wrote about Buffett's 2012 letter right here.) From Buffett...

|

So don't worry if shares of a high-quality company like Microsoft or IBM falls in price. If anything, you should be cheering.

So don't worry if shares of a high-quality company like Microsoft or IBM falls in price. If anything, you should be cheering.

No sector has languished more over the past several years than commodities.

While gold is down 4% since July, gold stocks are down around 60%. Copper is down 25% in the same time frame. Coal prices are down nearly 30% since May. And iron ore prices are down more than 50% since February 2013.

Naturally, stocks in the sector have gotten crushed.

But as we've written recently, our analysts are turning bullish. Porter, Steve Sjuggerud, Matt Badiali, and Jeff Clark are all super-bullish on gold. And in today's Growth Stock Wire, Matt explained why he thinks we'll see a breakout in silver soon.

Dan is also bullish on resource stocks. He says buying certain high-quality resource stocks today is one of the best opportunities he has seen in his entire investing career.

Dan is also bullish on resource stocks. He says buying certain high-quality resource stocks today is one of the best opportunities he has seen in his entire investing career.

Dan studied the cyclical pattern of resource stocks going back 30 years...

As Digest readers know, resource stocks boom and bust like crazy. Dan believes we're on the verge of a boom today... and a certain handful of resource stocks could return 300%.

He doesn't think we'll get another opportunity like this in at least a decade.

But Dan is only recommending a few specific stocks. Most resource firms are much better at destroying value than creating it... so you must be selective. But when you own the right resource stocks in a bull market, the returns can get ridiculous.

But Dan is only recommending a few specific stocks. Most resource firms are much better at destroying value than creating it... so you must be selective. But when you own the right resource stocks in a bull market, the returns can get ridiculous.

And Dan isn't just recommending mining companies or small, speculative gold stocks.

These companies will profit from a rebound in all the blown-out resource sectors – gold, silver, uranium, agriculture, energy, etc.

At least one of these companies is a "deal maker" in the resource markets... and is loaded up with cash and looking to buy distressed assets today. These are deals you would never personally get the chance to invest in... And when the market inevitably heads higher, the value of these newly purchased assets should soar.

To learn more about why Dan is so bullish on resources today – and why he hand-picked these companies – click here.

New 52-week highs (as of 1/27/15): Axis Capital (AXS), Blackstone Group (BX), Invesco Value Municipal Income Trust (IIM), and Nuveen Municipal Value Fund (NUV).

New 52-week highs (as of 1/27/15): Axis Capital (AXS), Blackstone Group (BX), Invesco Value Municipal Income Trust (IIM), and Nuveen Municipal Value Fund (NUV).

In today's mailbag, a common question we receive: How can we recommend selling a stock in one advisory and recommend buying it in another? Send your thoughts to feedback@stansberryresearch.com.

In today's mailbag, a common question we receive: How can we recommend selling a stock in one advisory and recommend buying it in another? Send your thoughts to feedback@stansberryresearch.com.

"Gents, how can you stop out of BP in Retirement Millionaire and still have BP on your recommended buy for Income Intelligence (twice) up to $50. How can BP be a value in one newsletter and not the other? Both are written by Doc. What's up?

"Gents, how can you stop out of BP in Retirement Millionaire and still have BP on your recommended buy for Income Intelligence (twice) up to $50. How can BP be a value in one newsletter and not the other? Both are written by Doc. What's up?

"I recall the original piece on the BP recommendation showing us how BP's reserves were valued by the market at a fraction of RDS and today Retirement Millionaire is stopping out of BP to buy RDS... I understand about the need for stop losses to limit your downside risk, but there's something to be said about using position sizing and also about quality blue-chip companies.

"Is there ever a time to say, BP has gone down with the plunge in oil prices, however it remains the same quality company we recommended and perhaps it makes sense to buy more at these values. Porter has stated that the value of a business doesn't change each day with the fluctuations in market prices for its stock, a great business remains a great business. One could make the case for BP as Doc has done in recent podcasts. Thanks for listening to my rant." – Paid-up subscriber Tony

Goldsmith comment: The portfolios do have different goals. Depending on your goals, any given stock could be a buy or a sell at any time. Also, if you see an investment in two different newsletters, it doesn't mean you should double your position. You have to look at your portfolio as a whole.

However, one of the most important lessons you can learn as an investor is discipline. Sell stops aren't just there to limit your risk. They are there to remove emotion from your sell decision. Doc's team uses a prescribed sell stop on every position. It's there to make sure that you admit when you're wrong and get out. The stops are at different levels because the two newsletters recommended BP at different times. If BP shares hit their stop loss, Doc will recommend closing the position in Income Intelligence as well.

Cutting losers and staying disciplined is one of the most important lessons you can learn as an investor. If we didn't stick to our rules, what kind of example would that set?

Regards,

Sean Goldsmith

Baltimore, Maryland

January 28, 2015