The Real Reason Oil Has Rallied

The real reason oil has rallied... The largest liquidation in history... The next leg of the junk-bond crisis could be starting now... Student-loan defaults are soaring... Steve Sjuggerud lets his hair down...

![]() Oil prices have staged one of the biggest rallies in history...

Oil prices have staged one of the biggest rallies in history...

As regular Digest readers know, crude oil soared more than 50% over the past seven weeks. But if you thought this rally was driven by bullish bets on higher prices, think again...

According to the latest data from the U.S. Commodities Futures Trading Commission ("CFTC"), it was actually short-sellers that were behind the big jump in prices.

Because short-sellers must buy back assets to close their short positions – in this case, oil futures or options – this buying can drive prices higher just as easily as when investors are buying long positions. In fact, because short-sellers are often motivated to close positions quickly – either to lock in profits or stop further losses – short-covering rallies are often some of the biggest, most violent rallies you'll see.

![]() CFTC data show short positions on West Texas Intermediate crude – the U.S. benchmark for oil prices – have plunged 67% since early February. This is the largest liquidation of oil short positions on record.

CFTC data show short positions on West Texas Intermediate crude – the U.S. benchmark for oil prices – have plunged 67% since early February. This is the largest liquidation of oil short positions on record.

Bloomberg News reports there have been two other similar short-covering "streaks" in the past 10 years, starting in September 2009 and December 2012. Both were much smaller than the recent moves, but each resulted in significant rallies to oil prices.

![]() More important, despite the plunge in bearish bets, the data show bullish bets on higher prices fell, too. As short-sellers were covering, long investors weren't buying... They were selling.

More important, despite the plunge in bearish bets, the data show bullish bets on higher prices fell, too. As short-sellers were covering, long investors weren't buying... They were selling.

This is not what you would expect to see if oil was beginning a true recovery. As John Kilduff of energy hedge fund Again Capital explained to Bloomberg...

The rally has come from shorts getting scared out of their positions, and you're not seeing a lot of money coming in on the long side. It really calls into question the fortitude and staying power of the rally.

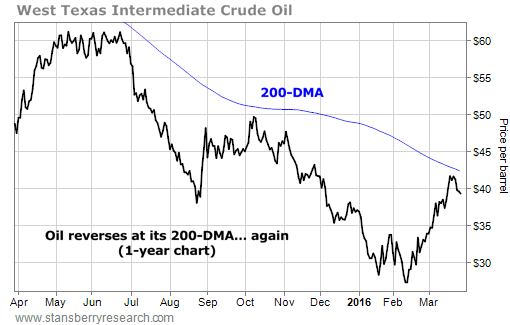

In short, this evidence – along with oil's recent reversal at its 200-day moving average ("DMA") – suggests the recent surge in oil is a classic bear market rally... and lower prices are likely...

![]() If that's the case, it could mean more bad news for the broad market, too.

If that's the case, it could mean more bad news for the broad market, too.

We've discussed the record-high correlation between oil and stocks. But it turns out oil prices aren't only leading stocks...

According to strategists at Deutsche Bank, oil prices have also become tightly linked to the high-yield (or "junk") bonds of non-energy companies...

Naturally, the bonds of energy companies are highly correlated to oil prices. But the debt of non-energy companies usually isn't.

However, in the past few months, the correlation between oil and non-energy junk bonds has soared to an all-time high of 85%. And this non-energy debt makes up nearly 90% of the high-yield market.

![]() This high correlation with oil prices means high-yield bonds have also soared over the past several weeks.

This high correlation with oil prices means high-yield bonds have also soared over the past several weeks.

According to Marty Fridson – the world's leading expert on credit cycles in corporate bonds – the rally has now pushed the entire high-yield bond market to overvalued levels.

In particular, Fridson singled out non-commodity junk bonds – again accounting for the majority of the junk bond market – as "extremely overvalued."

![]() Meanwhile, folks have been rushing to buy these junk bonds like there's no tomorrow...

Meanwhile, folks have been rushing to buy these junk bonds like there's no tomorrow...

Investors have poured $11.5 billion into high-yield bonds over the last month. This is the largest four-week inflow in history, according to Bank of America Merrill Lynch high-yield strategist Michael Contopoulos.

Contopoulos also pointed to the record correlation between oil and junk bonds as a reason for concern, and believes the rally is unlikely to last. As he wrote in a note last week...

Such a high correlation suggests to us that investors have taken their eye off the ball with respect to non-commodity balance sheet health – something that is likely to lead to a surprise increase in defaults and negative price action later this year.

Couple the deteriorating fundamentals for high yield issuers with downgrades outpacing upgrades by a ratio of 3.5:1 and a worsening of global growth potential, and we believe the recent rally, though boosted by strong inflows and cash generation, will ultimately fade.

![]() Our colleague Ben Morris is also concerned. As he pointed out to his DailyWealth Trader subscribers yesterday, despite near-record low yields, investors have been piling into junk bond funds...

Our colleague Ben Morris is also concerned. As he pointed out to his DailyWealth Trader subscribers yesterday, despite near-record low yields, investors have been piling into junk bond funds...

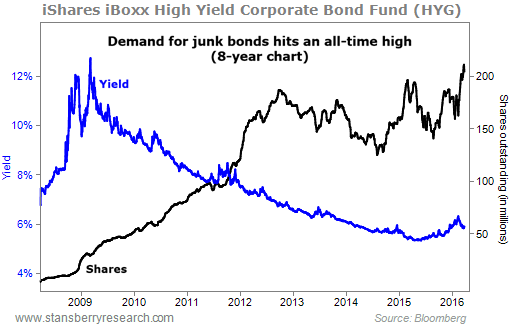

One of the easiest ways for investors to buy junk bonds is through the iShares iBoxx High Yield Corporate Bond Fund (HYG). HYG is an exchange-traded fund ("ETF"), which means it buys and sells assets, and creates and liquidates shares, along with demand. When investors are interested – and they're buying more than they're selling – the share count rises. When investors lose interest, the share count drops.

In the chart below, you can see that HYG's share count (the black line) has risen tremendously over the last eight years. Just last week, it hit an all-time high. But the fund's yield (the blue line) is not far off its all-time low. Over the last 12 months, HYG paid out just 5.9%.

![]() Much of the trouble in the junk-bond market last fall was centered on energy debt.

Much of the trouble in the junk-bond market last fall was centered on energy debt.

If oil prices turn down again, this record-high correlation with one of the market's most expensive sectors suggests the next round of trouble could be much bigger.

Sometimes we feel like a broken record... But we know from experience that many of you have heard our warnings, but still haven't taken action.

Maybe you've been busy. Maybe you've been putting it off. Maybe you're just hoping the worst has passed.

Maybe you're right... maybe the worst is behind us.

But we're seeing many of the same quiet warning signs that preceded last year's big market declines.

What will you do if you're wrong?

![]() If you still haven't taken a few simple steps to protect yourself, we urge you to learn more about our Bear Market Survival Program right here.

If you still haven't taken a few simple steps to protect yourself, we urge you to learn more about our Bear Market Survival Program right here.

And once you've mastered the basics, consider taking your education to the next level with our Bear Market Trading Program.

This series builds on the lessons learned in the Bear Market Survival Program to show you everything you need to know to make consistent, short-term profits no matter which way the market is headed.

Together, these services offer our best advice on not only protecting your savings, but actually making some of the best returns of your life during the coming bear market. As Porter explained in the March 4 Digest...

Wouldn't you love to be able to say with total confidence, and without a trace of arrogance, that you simply don't care anymore what the market does? That you know – come hell or high water – that your portfolio is going to make 15% to 30% this year (or maybe more, if you hit another flash bid)?

Get all the details on our Bear Market Trading Program right here.

![]() While the energy sector is where the recent trouble began, regular readers know Porter believes these credit problems will eventually spread to other "bubbles" like emerging-market debt, subprime auto lending, and student loans.

While the energy sector is where the recent trouble began, regular readers know Porter believes these credit problems will eventually spread to other "bubbles" like emerging-market debt, subprime auto lending, and student loans.

We've reported several signs of stress in emerging markets and auto lending. Today, we'll check in on student loans...

![]() According to new data from the U.S. Department of Education – which guarantees approximately $900 billion of the $1.3 trillion in outstanding student loans – just 54% of loans are currently in repayment. That means 46% of these loans are not being paid at all today.

According to new data from the U.S. Department of Education – which guarantees approximately $900 billion of the $1.3 trillion in outstanding student loans – just 54% of loans are currently in repayment. That means 46% of these loans are not being paid at all today.

Importantly, just 13% are in deferment... meaning payments have been postponed for various reasons. That means the remaining 33% are either delinquent, in default (more than 270 days delinquent), or in forbearance, where payments have been reduced or suspended due to economic hardship. Worse, so-called "extreme delinquencies" and defaults are soaring. Both are up more than 30% in the last year alone.

![]() These figures don't say a student-loan crisis is coming... They say it's already here.

These figures don't say a student-loan crisis is coming... They say it's already here.

So why aren't you hearing about it on the nightly news? It's because student loans are different than most other types of debt. As Porter and his team explained in the November issue of Stansberry's Investment Advisory...

The only safe way to lend to someone who is broke (and most Americans are flat broke) is to get the government to guarantee your loan.

So, it's understandable that two out of the three types of credit that have continued to expand in America since the 2008 mortgage bust are guaranteed by the government: U.S. Treasury debt (up from $9.2 trillion to $17.4 trillion) and student loans (up from $500 billion to $1.1 trillion).

These obligations can't be written off by bankruptcy (at least not in the conventional sense), and they're backed up by the power to tax.

![]() As they explained, unlike most other types of debt – like mortgages, auto loans, and credit-card debt – student loans can't easily be canceled through bankruptcy.

As they explained, unlike most other types of debt – like mortgages, auto loans, and credit-card debt – student loans can't easily be canceled through bankruptcy.

Even after a borrower declares bankruptcy and sheds other debts, the government can still garnish his wages and tax refunds to collect payment. And if the borrower still can't pay, the loans are backed by the federal government.

These extra protections mean student loans are generally considered less risky than other types of debt. But that could slowly be changing...

![]() Last week, a federal judge ruled for the first time that law-school graduates who file for bankruptcy protection can discharge a portion of their debts...

Last week, a federal judge ruled for the first time that law-school graduates who file for bankruptcy protection can discharge a portion of their debts...

According to a report in the Wall Street Journal, the case involves a 36-year-old law student who borrowed $15,000 while studying for her bar exam. Judge Carla Craig of the U.S. Bankruptcy Court in Brooklyn, N.Y., reversed precedent and said these debts can now be canceled.

Now, it's just a small step... The ruling applies only to additional loans taken out while studying for the bar exam, and not loans taken out for law school. (In this case, the former student in question will still be responsible for nearly $300,000 in student-loan debt.) But it could be important...

It's a sign that public opinion about these loans could be changing. Other courts will see this ruling, and some will surely agree. And it joins a growing chorus of folks – including the White House, several members of Congress, and a number of consumer advocacy groups – demanding student loans be treated like other forms of debt.

As more and more students struggle to make payments, you can expect these cries to grow louder.

Sooner or later, it's likely this bankruptcy "immunity" will be overturned... and these loans may suddenly become much riskier than most folks believe.

![]() Finally, we would like to share a note that has nothing to do with finance or the markets...

Finally, we would like to share a note that has nothing to do with finance or the markets...

On Easter night, the normally conservative Steve Sjuggerud let his hair down, singing and playing live with the outstanding father-son duo Tim and Myles Thompson.

If you aren't familiar, Tim and Myles are some of the world's best musicians... literally.

In September, Myles finished second place in the National Mandolin Championship... and he had only been playing the mandolin about four years. A few years earlier, his father Tim won the National Fingerstyle Guitar Championship. You can check them out right here.

Believe it or not, the Stansberry Research team is full of talented musicians... and we've asked Steve and some other staff members to play live at our Stansberry Alliance conference in Las Vegas this fall. We promise... you won't want to miss it.

![]() New 52-week highs (as of 3/28/16): Coca-Cola (KO), Nuveen Premium Income Municipal Fund 2 (NPM), PNC Financial Services – Series P (PNC-PP), Public Storage (PSA), short position in Santander Consumer USA (SC), Travelers (TRV), and Wells Fargo – Series W (WFC-PW).

New 52-week highs (as of 3/28/16): Coca-Cola (KO), Nuveen Premium Income Municipal Fund 2 (NPM), PNC Financial Services – Series P (PNC-PP), Public Storage (PSA), short position in Santander Consumer USA (SC), Travelers (TRV), and Wells Fargo – Series W (WFC-PW).

![]() Another slow day in the mailbag. What's on your mind? Let us know at feedback@stansberryresearch.com.

Another slow day in the mailbag. What's on your mind? Let us know at feedback@stansberryresearch.com.

Regards,

Justin Brill

Baltimore, Maryland

March 29, 2016

|