These Stocks Haven't Crashed Yet, But They Will

A jaw-dropping new record in oil... The rally could be over... These stocks haven't crashed yet, but they will... A 'significant reversal' is starting...

Editor's note: The market will be closed tomorrow in observance of Good Friday, so we won't be publishing the Digest. Enjoy the holiday.

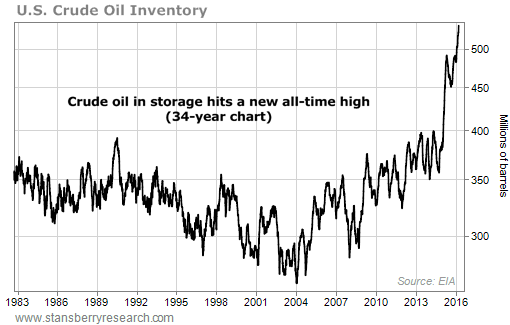

According to the U.S. Energy Information Administration ("EIA"), that's how many barrels of crude oil are now stockpiled across the U.S... a new all-time high...

In its latest report published yesterday, the EIA said inventory increased by 9.4 million barrels last week – more than three times the amount that analysts expected...

![]() West Texas Intermediate Crude – the U.S. benchmark for oil prices – plunged 4% on the news, trading back below $40.

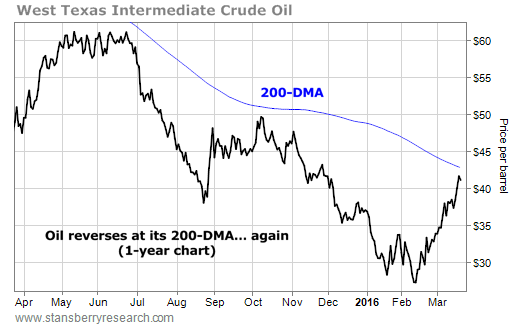

West Texas Intermediate Crude – the U.S. benchmark for oil prices – plunged 4% on the news, trading back below $40.

It was the sharpest drop since the rally in oil (and many other assets) began on February 11. And there are plenty of signs that prices could be headed even lower from here.

![]() As we noted on Monday, speculators have become bullish on crude again, which is a bearish signal for prices.

As we noted on Monday, speculators have become bullish on crude again, which is a bearish signal for prices.

Several technical measures have become extremely "overbought," which often leads to lower prices.

And yesterday's decline comes after oil "bumped up" against its 200-day moving average ("DMA") – which has kept a lid on prices since 2014 – and immediately turned lower...

![]() If these concerns aren't enough, a new report from Deutsche Bank analyst Michael Hsueh says that tens of millions of additional barrels of oil could be coming back to the market...

If these concerns aren't enough, a new report from Deutsche Bank analyst Michael Hsueh says that tens of millions of additional barrels of oil could be coming back to the market...

Why is that?

In short, approximately 160 million barrels of oil are in "floating storage" today. This is exactly what it sounds like – big oil tankers full of oil with nowhere to go.

![]() Normally, this would be insane. But since oil prices crashed, the current "spot" price of oil has been trading well below the price of oil in the futures markets. This is known as "contango," and it means it has actually made sense for traders to pay to keep oil in tankers at sea with the intention to sell it in the future.

Normally, this would be insane. But since oil prices crashed, the current "spot" price of oil has been trading well below the price of oil in the futures markets. This is known as "contango," and it means it has actually made sense for traders to pay to keep oil in tankers at sea with the intention to sell it in the future.

But after the recent rally in oil prices, many producers have been hedging their production again. This means they're agreeing to sell future production at an agreed-upon price down the road. It's a way for them to lock in higher prices if they expect prices to fall.

![]() Because so many folks have been hedging, the "spread" between current and future prices has collapsed. This alone is a bearish sign. It means many producers believe lower prices are likely.

Because so many folks have been hedging, the "spread" between current and future prices has collapsed. This alone is a bearish sign. It means many producers believe lower prices are likely.

But according to Hsueh, it also means it's no longer economical to keep oil in floating storage. He predicts nearly 20% of the 157 million barrels in storage are likely to come onshore over the next several months.

That's more than 31 million extra barrels of oil that could be added to an already massively oversupplied market, just as oil prices are heading lower again.

![]() The news isn't any better for energy stocks...

The news isn't any better for energy stocks...

According to financial data firm FactSet Research Systems, energy companies have quietly become some of the most expensive stocks in the market.

As of last Friday, energy companies in the S&P 500 trade at an incredible 38.8 times trailing earnings. That's nearly three times higher than their average price-to-earnings (P/E) ratio of just 13.1 over the past 10 years, and more than twice the broad market's current P/E of 18.

Even if oil prices don't plunge again, many of these companies' share prices easily could.

![]() If there has been one bright spot in the sector, it has been oil refiners.

If there has been one bright spot in the sector, it has been oil refiners.

While most oil-related stocks plunged last year, refiners like Valero Energy (VLO) kept moving higher. As Stansberry Resource Report editor Matt Badiali explained to Growth Stock Wire readers earlier this week, this is due to the spread between prices of oil here in the U.S. and prices overseas...

Hydraulic fracturing ("fracking") has allowed the U.S. to tap oil reserves in areas like Texas' Eagle Ford and North Dakota's Bakken shales. Because of this, annual U.S. crude oil production is up more than 70% since 2008.

The glut of oil pushed the price of U.S. crude oil (called West Texas Intermediate, or "WTI") down more than 80% from its 2008 peak to its recent low. As a result, WTI crude traded at a big discount to European crude (called Brent).

And because the oil "spread" – the difference between WTI and Brent crude prices – was so large, U.S. refiners could undercut their overseas competitors and still book huge profits. As you can see in the graphic below, during this period, refiners' earnings soared...

![]() Unfortunately, this could soon change. Because the U.S. government recently overturned the 40-year ban on oil exports, the spread between WTI and Brent (the international benchmark) has collapsed. And as Matt explained, the reasons refiners were so profitable is no longer valid...

Unfortunately, this could soon change. Because the U.S. government recently overturned the 40-year ban on oil exports, the spread between WTI and Brent (the international benchmark) has collapsed. And as Matt explained, the reasons refiners were so profitable is no longer valid...

Because the U.S. can now export crude oil, U.S. and European refiners are on an even playing field. Without the huge price advantage, U.S. refiners will see their profit margins start to shrink. And we're already starting to see that happen...

If you still own refiners, take profits soon... because things are about to get ugly.

![]() As we've discussed, oil's correlation with the stock market is at its highest level ever... meaning if oil heads lower, stocks are likely to move lower, too. But regular readers know that's just one of several warning signs we're seeing today...

As we've discussed, oil's correlation with the stock market is at its highest level ever... meaning if oil heads lower, stocks are likely to move lower, too. But regular readers know that's just one of several warning signs we're seeing today...

We've explained how the stock buyback "blackout" is starting... We've highlighted new stress in the credit markets... And we've shown you several indicators that are flashing "red" right now.

Today, we'll close with one more...

![]() UBS technical analysts Michael Riesner and Marc Müller have one of the most impressive track records on Wall Street this year.

UBS technical analysts Michael Riesner and Marc Müller have one of the most impressive track records on Wall Street this year.

Reisner and Müller not only called the recent rally in gold, they also correctly predicted each of the last two stock market corrections. They even called the recent February 11 bottom in stocks, nearly to the day.

So what are they saying today?

They, too, believe the recent rally was simply a bear-market rally, and not the start of a new bullish trend.

They say the market is set up almost exactly as it was in early February, except from the opposite extreme. In particular, they note that while the market was extremely oversold last month, it's now more overbought than it has been any time in the past six years.

They believe a "significant reversal" is likely to begin this week, followed by another leg lower in an ongoing bear market.

Again, the markets are closed tomorrow for Good Friday. If you still haven't prepared for the possibility of much lower stock and bond prices, we urge you to take a few minutes over the long weekend to do so.

![]() Finally, we won't be publishing the Digest tomorrow, but we will be publishing the next module in our ongoing Bear Market Trading Program.

Finally, we won't be publishing the Digest tomorrow, but we will be publishing the next module in our ongoing Bear Market Trading Program.

Module 3 will cover an unusual way to bet on a market crash without having to risk any of your own money upfront. If you believe the market could fall in coming weeks, this is a strategy you need to know. Click here to learn more.

![]() New 52-week highs (as of 3/23/16): Johnson & Johnson (JNJ), Reservoir Minerals (RMC.V), and Wells Fargo – Series W (WFC-PW).

New 52-week highs (as of 3/23/16): Johnson & Johnson (JNJ), Reservoir Minerals (RMC.V), and Wells Fargo – Series W (WFC-PW).

![]() In the mailbag, one subscriber has a question about troubled drug company Valeant Pharmaceuticals, and another shares his thoughts on Porter's OneBlade razor. Send your comments to feedback@stansberryresearch.com.

In the mailbag, one subscriber has a question about troubled drug company Valeant Pharmaceuticals, and another shares his thoughts on Porter's OneBlade razor. Send your comments to feedback@stansberryresearch.com.

![]() "Have you recommended a short on Valeant or is this a 'stay away from this stock no matter what'!!! If I missed it, please forgive... if you have recommended it, what's the latest deal? Thanks. Flex member and proud of it!!!" – Paid-up subscriber Terry W.

"Have you recommended a short on Valeant or is this a 'stay away from this stock no matter what'!!! If I missed it, please forgive... if you have recommended it, what's the latest deal? Thanks. Flex member and proud of it!!!" – Paid-up subscriber Terry W.

Brill comment: As always, we have to note that we aren't able to provide individual investment advice. What we can tell you is that while we believe there is a serious risk of bankruptcy – meaning shares could ultimately go to zero – Valeant is not an official short recommendation in any of our publications.

Instead, as Porter explained on Friday, Valeant and the other "deviants" are poster children for the biggest excesses and potential problems in the credit markets.

It's up to you to decide if you want to short Valeant. (If you do, we encourage you to use proper position sizing and a stop loss.) It could be a bumpy ride... After falling more than 60% last week, Valeant shares rallied nearly 20% over the first three trading days of this week. Expect more volatility (and plenty of news and rumors about the company) as its big hedge-fund and institutional investors try to save face and sell at better prices.

![]() "I have to thank you for putting together the information on shaving. I saw the information on your new razor and never got it. My shaves consisted of a hair trimmer just to knock down the big stuff. I've never really had a close shave. I'm 46 years old and I have to say, I've never learned how to shave. If I did try to shave, it never turned out well and was painful at best.

"I have to thank you for putting together the information on shaving. I saw the information on your new razor and never got it. My shaves consisted of a hair trimmer just to knock down the big stuff. I've never really had a close shave. I'm 46 years old and I have to say, I've never learned how to shave. If I did try to shave, it never turned out well and was painful at best.

"I finally watched your video on how to shave. Thank you! It seems so simple, but no one ever taught me how to shave. I just used a disposable razor, but shaved per the instructions in your video and I can say I actually shaved successfully for the first time. I'm going to start saving for a OneBlade. Thank you for the services you and your team provide." – Paid-up subscriber Quint R.

Regards,

Justin Brill

Baltimore, Maryland

March 24, 2016

|