We're approaching another moment of panic...

We're approaching another moment of panic... What most people got wrong in 2008... How to be a victor instead of a victim... A powder keg that's waiting to blow...

Editor's note: Today's Digest is the second essay in Porter's five-part series about investing in distressed equities (stocks). If you haven't yet, please read Part I here.

It was November 20, 2008. This was roughly two months after the failure of Lehman Brothers. It was roughly eight months after the collapse of Bear Stearns. It was about a year and a half after the collapse of the subprime mortgage market. By this point, the market for high-yield debt of all types had been "no bid" for months. This was a genuine panic: The VIX, a measure of fear in the markets, hit 80.9 – an all-time high. The market was roughly two times more volatile than I (Porter) had ever seen it before in my career.

It was a moment of epic distress and panic in the equity markets.

![]() Although I couldn't have known for certain at the time, I felt sure that November 20 would prove to be the point of "maximum pessimism." I was so certain that I not only committed a large portion of my liquid capital to the markets that day, I also wrote a strident memo to all of my closest friends and family, telling them that for the first time ever in my career, I was pushing most of my chips into the pot at one time.

Although I couldn't have known for certain at the time, I felt sure that November 20 would prove to be the point of "maximum pessimism." I was so certain that I not only committed a large portion of my liquid capital to the markets that day, I also wrote a strident memo to all of my closest friends and family, telling them that for the first time ever in my career, I was pushing most of my chips into the pot at one time.

I sent that private memo at 3:23 p.m. on the worst day in the markets I had ever seen. Just after that, I bought a portfolio of the 10 highest-quality businesses I knew well: Amazon, Bank of America, Berkshire Hathaway, Campbell Soup, eBay, Google, Harley-Davidson, Intel, Coca-Cola, and ExxonMobil.

I had never written anything like this before to my friends or family... and I've never written anything like it since.

I bring it up now because I'm more and more certain we are approaching another moment in time like I saw back then. I don't expect to have the fortitude or the luck to buy on the exact worst day... but I plan to get close. In my business I have a huge advantage in regards to judging market sentiment. You, dear subscribers, tell me when you're bullish and when you're bearish by the newsletters you buy... and the newsletters you cancel. Back then, I knew that fear was at a huge peak from watching our subscribers.

As I told my friends and family in my note from that terrible afternoon:

The last two months have been grueling for me. It is very difficult to watch stock prices fall. I know many of my subscribers will lose interest in the stock market. I know the next few years are likely to be very tough on my business. I'm worried about the financial security of my family and my friends. I can't recall a more difficult time – financially – in my entire life.

Ironically and paradoxically, these emotions that I'm feeling now – the anxiety, the sadness – are how I know it is time to make long-term investments. Without these emotional difficulties and the huge amount of uncertainty in the markets, these stocks would not be available to me at any reasonable price.

![]() The profits I made from those investments were massive. The Dow was up more than 40% over the next year – one of its biggest one-year moves ever. These gains would propel me financially into a new level of wealth. Less than a year later, I would contract for my first trophy property in Miami Beach (a lease with an option to buy). I would purchase my first boat: a new, beautiful 36-foot Everglades Center Console, purchased from a bankrupt dealer for less than its construction cost.

The profits I made from those investments were massive. The Dow was up more than 40% over the next year – one of its biggest one-year moves ever. These gains would propel me financially into a new level of wealth. Less than a year later, I would contract for my first trophy property in Miami Beach (a lease with an option to buy). I would purchase my first boat: a new, beautiful 36-foot Everglades Center Console, purchased from a bankrupt dealer for less than its construction cost.

But I didn't only generate big profits for myself. It was around this time that I also launched a new advisory, the Put Strategy Report, which was specifically designed to help subscribers capture profits from the distressed equity markets of 2008-2009.

These recommendations were almost absurdly profitable… like 156% in Patterson-UTI Energy (PTEN), 147% in MGM Resorts (MGM), 125% in Take-Two Interactive (TTWO), 124% in Annaly Capital Management (NLY), and 112% in Rowan Companies (RDC). As I explained in the 2010 annual Report Card...

We sold 23 puts between the launch of the service and the end of 2009. We only lost money on two trades, for a win rate in excess of 90%. The average gain (based on 20% margin) was 54%. And we held these trades on average for less than 100 days, meaning we were making more than 150% annually on these trades.

But... even these huge numbers don't tell the whole story. On dozens of trades, we made close to 100% by selling puts with strike prices below the liquidation value of the common stock. We were making a killing by selling options that had zero intrinsic risk. We literally couldn't lose.

That month – November 2008 – the title of my Investment Advisory was, "This Is It." As I urged subscribers in that issue, "This is the moment I've been waiting for my entire career. The investments you make right now will become the best investments of your entire life."

![]() And so, I have a simple question to ask you...

And so, I have a simple question to ask you...

On November 20, 2008, did you see the financial markets as providing you with the greatest opportunity of your life? On that afternoon, were you so eager to buy stocks that you looked at the list of companies you had always wanted to own? Did you buy them all? Do you recall staring at your trading terminal feeling like this was the greatest Christmas morning of your entire life?

![]() My bet is that you didn't. Don't feel bad. More than one of my employees asked me if they should start looking for a new job. There was fear and panic in our office, just like there was in the homes of our subscribers. The only real question is: Can you learn from these mistakes?

My bet is that you didn't. Don't feel bad. More than one of my employees asked me if they should start looking for a new job. There was fear and panic in our office, just like there was in the homes of our subscribers. The only real question is: Can you learn from these mistakes?

![]() Here's what most people got wrong during the last big crisis.

Here's what most people got wrong during the last big crisis.

First, most investors never understood the "dominoes" of the financial crisis. They didn't understand that banks, insurance companies, and leveraged financial companies of all kinds had piled into mortgage securities that were filled with subprime mortgages. They didn't understand how so many AAA-rated securities were nothing more than large piles of garbage.

Or, as Warren Buffett's business partner Charlie Munger famously explained, "When you mix raisins with turds, they are still turds."

And so, unlike what we did with my Investment Advisory model portfolio, most investors hadn't been shorting Fannie Mae, Freddie Mac, General Motors, and Capital One. They weren't hedged. They weren't liquid. For these investors, the only choice left was to throw in the towel. A whole bunch of them finally did on November 20, 2008.

Millions and millions of people panicked and sold. They intended to be "buy-and-hold" investors. But in the crucible of a genuine panic, they became "buy-and-fold" investors. And they gave people like me their wealth.

![]() That's what I'm talking about when I describe a legal transfer of wealth. I didn't make anyone sell me stocks at ridiculously low prices. They essentially begged me to buy from them. And I obliged.

That's what I'm talking about when I describe a legal transfer of wealth. I didn't make anyone sell me stocks at ridiculously low prices. They essentially begged me to buy from them. And I obliged.

![]() Before we go any further through this discussion of distressed-equity investing, you have to get one thing straight with yourself: Unless you know for certain that you will be able to act in the middle of that kind of panic, just forget it. If it's a "maybe," ignore this Digest series. Unless you have genuine emotional discipline, you will never be able to act at the right time. And unless you're taking steps now to prepare for this coming opportunity, you won't be ready.

Before we go any further through this discussion of distressed-equity investing, you have to get one thing straight with yourself: Unless you know for certain that you will be able to act in the middle of that kind of panic, just forget it. If it's a "maybe," ignore this Digest series. Unless you have genuine emotional discipline, you will never be able to act at the right time. And unless you're taking steps now to prepare for this coming opportunity, you won't be ready.

This is my promise to you today: If you will do the things I'm going to teach you right here (for free)... if you take the time to prepare yourself and your brokerage account... if you educate yourself enough so that your reason can win the battle against your fears... then I promise you will get to be the winner next time. You can be the guy who is making all of the money instead of the guy who is panicking and getting killed. All you have to do is decide – and you need to decide right now, because time is growing short.

So what's it going to be? Do you want to be a victim? Or a victor? It's up to you.

![]() I've described – in immense detail – all of the troubles that are just now starting to come to light in our credit markets. Last Friday was the first time since the last crisis that hundreds of corporate bonds went "no bid" – meaning the market was frozen. But there is a lot more of this crisis left to build. Nobody realizes yet that the current debt crisis will be just as bad (if not worse) than the mortgage crisis.

I've described – in immense detail – all of the troubles that are just now starting to come to light in our credit markets. Last Friday was the first time since the last crisis that hundreds of corporate bonds went "no bid" – meaning the market was frozen. But there is a lot more of this crisis left to build. Nobody realizes yet that the current debt crisis will be just as bad (if not worse) than the mortgage crisis.

Student loans total $1.3 trillion. More than 50% of these debts aren't currently being serviced. Hundreds of billions of these loans were made to unqualified students who attended online college and who hold degrees that are essentially worthless.

![]() More than $1 trillion has been lent against automobiles on terms (high interest rates, 84-month durations) that make it impossible for the "owners" of these vehicles to generate actual equity. That's tantamount to mortgage underwriting with zero down payment. Sooner or later, these borrowers are going to default because their car-loan totals will greatly exceed the value of their used cars. It will happen... More than 40% of all auto loans this year were made to subprime borrowers.

More than $1 trillion has been lent against automobiles on terms (high interest rates, 84-month durations) that make it impossible for the "owners" of these vehicles to generate actual equity. That's tantamount to mortgage underwriting with zero down payment. Sooner or later, these borrowers are going to default because their car-loan totals will greatly exceed the value of their used cars. It will happen... More than 40% of all auto loans this year were made to subprime borrowers.

Distress from these coming credit disasters (in student loans and autos) is already evident. Shares of student-loan firm Navient (NAVI) are down nearly 40% this year. Shares of subprime auto-loan firm Santander Consumer USA (SC) are down 25% since we shorted the stock in September.

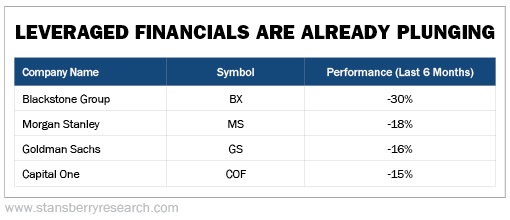

![]() These acute problems, however, are merely the "candles" that are lighting a much larger fire. Losses from these bad debts will spread through the entire financial sector, as these loans have been packaged and sold to banks, insurance companies, and investment banks. Look at the recent performance of a wide range of leveraged financial institutions and you will see the first signs of what's coming...

These acute problems, however, are merely the "candles" that are lighting a much larger fire. Losses from these bad debts will spread through the entire financial sector, as these loans have been packaged and sold to banks, insurance companies, and investment banks. Look at the recent performance of a wide range of leveraged financial institutions and you will see the first signs of what's coming...

![]() The powder keg waiting to blow is the junk-bond market and the lowest-caliber group of investment-grade corporate debts. More corporate bonds are outstanding (as a percentage of GDP) than ever before. Worse, the mix of obligations has never been more skewed toward low-quality loans.

The powder keg waiting to blow is the junk-bond market and the lowest-caliber group of investment-grade corporate debts. More corporate bonds are outstanding (as a percentage of GDP) than ever before. Worse, the mix of obligations has never been more skewed toward low-quality loans.

Over the past five years, record amounts of junk bonds were underwritten. We've seen three straight years of more than double the former peak issuance. Vast quantities of these bonds will default over the next three years – probably around 40% of the total outstanding.

Likewise, we've seen record issuance of the lowest caliber of investment-grade debt ("BBB"). More than $500 billion of these bonds have been issued in the last year, warping the entire pool of investment-grade debt. These bonds are merely one downgrade from junk status.

Four of the world's most important financial institutions – Citigroup, Bank of America, Morgan Stanley, and Goldman Sachs – have all seen their credit ratings downgraded to this level. These firms will fail immediately if they are downgraded to junk status, because their funding costs will rise at the same time that most investors will be selling their bonds. (Most institutions are not allowed to own junk-rated debt.)

That outcome would be 10 times worse than the Lehman collapse. It's impossible to imagine our global financial system functioning at all.

![]() These risks, which I've been warning you about since May 2013, are now becoming obvious to more and more investors.

These risks, which I've been warning you about since May 2013, are now becoming obvious to more and more investors.

As I mentioned, on Friday, large swaths of the high-yield bond market went "no bid" – meaning there were no buyers for hundreds of different issues that normally trade in the millions every day. This followed news on Thursday that Third Avenue Management had trapped investors in its Focused Credit Fund while it tries to liquidate its holdings.

I told subscribers months ago this would happen! More and more owners of bonds are going to panic – they're going to try to sell, and they're going to end up trapped in mutual funds that can't get rid of their bond portfolios.

The giant high-yield exchange-traded fund that I've been warning you would continue to fall – the iShares iBoxx High-Yield Corporate-Bond Fund (HYG) – saw both record volume and a record daily decline (-3%)...

.png)

![]() Incredibly, two more funds have already failed since then...

Incredibly, two more funds have already failed since then...

On Friday, hedge fund Stone Lion Capital Partners – coincidentally founded by two former employees of Bear Stearns – suspended redemptions in its credit funds after "many" investors asked for their money back.

And just this morning, $900 million high-yield credit fund Lucidus Capital Partners announced it has liquidated its entire portfolio and plans to return money to investors next month.

![]() Trust me... these problems are going to get a lot worse. How do I know? Because this is exactly how the credit cycle works. Credit builds as more and more credit is extended. As long as lenders remain willing to "roll" debts forward, few borrowers default. Then, suddenly, creditors start to worry. They slowly withdraw their support of the market. Suddenly, default rates spike (they've doubled since last year). This causes more fear... which causes tighter credit conditions... which leads to more defaults, and so on.

Trust me... these problems are going to get a lot worse. How do I know? Because this is exactly how the credit cycle works. Credit builds as more and more credit is extended. As long as lenders remain willing to "roll" debts forward, few borrowers default. Then, suddenly, creditors start to worry. They slowly withdraw their support of the market. Suddenly, default rates spike (they've doubled since last year). This causes more fear... which causes tighter credit conditions... which leads to more defaults, and so on.

This default cycle is going to be massive – far larger than usual – because during the last default cycle (in 2009), the federales stepped in and guaranteed trillions in debt, allowing it to be refinanced. Well, those debts are now coming due. But how many of them can be repaid? Experts in the corporate-bond market predict more than $1.5 trillion in defaults will occur before 2019.

![]() If you've taken any of my advice, you're already far better off than regular investors, who probably haven't even noticed yet that there's a big problem, once again, with our financial markets. I've helped you get on the right side of these problems. You're already way, way ahead of the game. But I can do a lot more for you...

If you've taken any of my advice, you're already far better off than regular investors, who probably haven't even noticed yet that there's a big problem, once again, with our financial markets. I've helped you get on the right side of these problems. You're already way, way ahead of the game. But I can do a lot more for you...

I want you to join me in that "Christmas morning" feeling I know I'll get to have again soon. It won't take long. Maybe 12 months. Maybe 24 months. I doubt it will take longer than that. Eventually, the credit and stock markets are going to absolutely panic. There's already around $2 trillion worth of equity outstanding from corporations whose bonds are trading for less than $0.80 on the dollar. If these bonds aren't "money good," all of that equity is going to zero.

Trust me – there's going to be a huge panic. The only question is... what will you do when that time comes?

![]() The whole key to our strategy for dealing in distressed equity markets revolves around selling put options. That's what we did with fantastic results in our Put Strategy Report, and that's what we're going to do again.

The whole key to our strategy for dealing in distressed equity markets revolves around selling put options. That's what we did with fantastic results in our Put Strategy Report, and that's what we're going to do again.

If you've never sold a put before, I'm sure you're thinking, "Oh gosh, I can't do that... I don't know the first thing about it." That's fine. You can learn. And I'm going to show you everything you need to know. But if you're worried, start small. Sell one contract (one put option contract is an agreement to buy 100 shares of stock).

![]() Selling puts is the key to our strategy because it allows you to generate huge amounts of immediate income before you buy anything. It allows you to use other people's money to speculate in stocks. And best of all, the amount of income you will receive is tied directly to the VIX. The more volatile the market becomes, the more income you'll make selling puts.

Selling puts is the key to our strategy because it allows you to generate huge amounts of immediate income before you buy anything. It allows you to use other people's money to speculate in stocks. And best of all, the amount of income you will receive is tied directly to the VIX. The more volatile the market becomes, the more income you'll make selling puts.

That's why selling puts is analogous to buying distressed debt. Both strategies allow you to turn other investors' fear into large amounts of income. And it's this income that safeguards you from losses. Plus, because puts cost more than calls (especially during market panics), you can also finance the purchase of call options to make sure that when the market bounces back, you'll profit. That's the second leg of our "Alpha" trading strategy, and I'll explain how it works later.

Today, I just want you to understand how to sell a put.

Selling a put isn't complicated. All you're doing is promising to buy 100 shares of stock, at a fixed price, for a fixed period of time.

It's exactly like selling insurance. And just like insurance is one of our favorite businesses, selling puts is one of our favorite market strategies because it allows you to use other people's money – but keep all of the profits. It seems completely unreal that someone else will pay you a lot of money just for promising to do something (buy stocks) that you are willing to do anyway. But that's exactly what happens... and the premiums you can earn from promising to buy stocks that are in distress can be huge.

![]() Just for an example, let's say you've been following EOG Resources (EOG) – one of America's leading shale-drilling oil companies.

Just for an example, let's say you've been following EOG Resources (EOG) – one of America's leading shale-drilling oil companies.

You're convinced that sooner or later, oil prices will rebound as Congress changes the rules to allow U.S. exports of crude oil. As demand eventually grows, thanks to oil's lower price, you think EOG, as one of the top and most efficient producers, will survive the downturn. You want to profit on the volatility in the stock. The key to this strategy is to never sell a put on a stock you don't actually want to own. As long as you're happy to buy it at the strike price of the put you've sold, you're not risking anything extra by selling a put.

Today, EOG is trading around $75. That's down about 35% from its most recent high of around $117. You figure that given its best-of-breed status and growing production, it isn't likely to fall. You're willing to buy it around $60. You check the options market and right now you can get $3 per share for a $60 put option on EOG that expires next July.

That means you would get paid $300 for every contract you sold. And for each contract you sold, you'd be on the hook to buy 100 shares of EOG at $60. That's $300 in cash, upfront, to assume the obligation to buy $6,000 worth of EOG. That's a 5% yield, which isn't all that great. But consider how safe this trade is... For you to lose money, EOG would have trade all the way down to $57 a share. That's another 24% decline in the stock.

And there's an easy to way to "sweeten the pot." Rather than putting up the entire $6,000 in capital you might have to spend (if the stock goes down and you have to buy it), your brokerage firm will probably just require you to set aside 20% of that amount in margin. That means you would really only have to put up $1,200 in cash to make this trade. Earning a safe $300 against only $1,200 is 25%. That's a great return on your margin – far more than you're going to make doing just about anything else.

![]() Now, listen... that's just an example. Just as with corporate bonds, investors who "yield shop" – who go around selling puts on every company whose options trade at heavy premiums – are going to get hurt. You have to make sure you only sell puts on companies you're sure are going to survive and whose shares you're willing to hold for the long term.

Now, listen... that's just an example. Just as with corporate bonds, investors who "yield shop" – who go around selling puts on every company whose options trade at heavy premiums – are going to get hurt. You have to make sure you only sell puts on companies you're sure are going to survive and whose shares you're willing to hold for the long term.

![]() You also want to make sure you wait to do these kinds of trades when options premiums are expensive. The VIX index tells you exactly when it's time to sell options. You want to wait until the VIX is above 20. Above 25 is better. And above 30 is best. This much fear and volatility doesn't happen often.

You also want to make sure you wait to do these kinds of trades when options premiums are expensive. The VIX index tells you exactly when it's time to sell options. You want to wait until the VIX is above 20. Above 25 is better. And above 30 is best. This much fear and volatility doesn't happen often.

But when the market enters a period of credit distress (like it's doing now), it's going to happen frequently. This sets us up for a one- to three-year period where we will see lots of great opportunities to sell puts safely on high-quality companies and earn cash on cash returns in the high double digits and returns on margin in excess of 50% annually.

![]() Put-selling is the single best way to trade a distressed equity market for two obvious reasons. First, it allows you to immediately generate lots of income, which helps to reduce your risk in the trade. And second, it allows you to pick the price you're willing to pay. If a stock drops that far, you'll be happy to own it.

Put-selling is the single best way to trade a distressed equity market for two obvious reasons. First, it allows you to immediately generate lots of income, which helps to reduce your risk in the trade. And second, it allows you to pick the price you're willing to pay. If a stock drops that far, you'll be happy to own it.

![]() But... what about the upside you're missing if the stock soars? When you sell a put, you get to keep all of the premium if the stock doesn't trade below the strike price. You don't get the gains, though, as the stock trades back up. Don't worry. That's the second leg of our Alpha strategy, which I'll explain tomorrow.

But... what about the upside you're missing if the stock soars? When you sell a put, you get to keep all of the premium if the stock doesn't trade below the strike price. You don't get the gains, though, as the stock trades back up. Don't worry. That's the second leg of our Alpha strategy, which I'll explain tomorrow.

In the meantime, send your questions to feedback@stansberryresearch.com... and be sure to register for Thursday night's free, live webinar by clicking here.

![]() New 52-week highs (as of 12/11/15): short position in iShares MSCI Canada Index Fund (EWC), NovaGold Resources (NG), and short position in Santander Consumer USA (SC).

New 52-week highs (as of 12/11/15): short position in iShares MSCI Canada Index Fund (EWC), NovaGold Resources (NG), and short position in Santander Consumer USA (SC).

![]() A disgruntled subscriber has some choice words for Porter in today's mailbag. Send your e-mails – vitriol and all – to feedback@stansberryresearch.com.

A disgruntled subscriber has some choice words for Porter in today's mailbag. Send your e-mails – vitriol and all – to feedback@stansberryresearch.com.

![]() "You didn't waste any time shutting down Art C. His question is legitimate as were the comments related to the pitfalls of paying accrued interest when you purchase a very distressed bond. I'm certain you did not discuss either of these issues and they are significant gaps in your articles.

"You didn't waste any time shutting down Art C. His question is legitimate as were the comments related to the pitfalls of paying accrued interest when you purchase a very distressed bond. I'm certain you did not discuss either of these issues and they are significant gaps in your articles.

"Also, the day after you said the junk bond and credit collapse has begun, you start talking about how we will be able to make money with distressed equities. In your ad-nauseam and often repetitive narrative on gaining wealth with distressed bonds, you said we may never need to buy equities again.

"It is a pretty safe bet to accuse your subscribers of being stupid. Only an idiot would continue listening to you after today's Digest. Porter, you are either lazy or a fraud or both." – A soon-to-be ex-subscriber Fred Rittelmeyer

Porter comment: Interesting points.

Investing in something new, like bonds, requires careful study. That's something I always stress: Don't do something you don't understand. Likewise, I emphasize again and again that there's no such thing as teaching, there's only learning.

Several thousand people read our work on bonds. Some bought our research.

Out of these people, two have written to complain that our teaching wasn't adequate.

The first admitted that not only did he not follow our advice, he deliberately did two things we specifically warned never to do: First, he bought a bond he expects will default, and second, he bought only the riskiest (highest-yielding) bond he could find. I'm certain he will experience massive losses based on these poor choices – which we had nothing to do with.

I regard this customer as the type who opens the back of his new TV, ignoring all the warnings about not opening the cabinet. He then proceeds to electrocute himself because he didn't think to unplug the unit first. I have no idea how to help people like this... And I firmly believe that these people shouldn't be managing their own money (or anyone else's). If you're going to deliberately violate our most important investing prohibitions, it's probably not a good idea to write in to complain about your results. We won't be sympathetic. We will only think you're a fool.

Art C. offered a tale of woe as he was concerned about minor price fluctuations on a bond we haven't recommended. He seemed to believe that my comments about the binary outcomes of bonds meant that their prices shouldn't or wouldn't ever change. I have no idea how any rational person would have reached that conclusion, especially given that the majority of our essays dealt, in great detail, with the idea that declines in bond prices are what position us to buy high-yielding bonds that offer capital gains, too.

It was clear to me that this customer simply isn't capable of reading and learning on his own, as he hadn't grasped the first concept we were trying to teach. Whether that's because he has a very poor mental capacity, he hadn't read what we wrote, or English is his second language, I don't know – and I don't care. It's clear that he hasn't benefited from our work and so, it's probably better for both of us that he get his money back and allow us to part as friends.

I wonder what you think I should have done instead.

Finally... There's something in your feedback that seems unkind. You've chosen to endorse our critics and color their complaints as legitimate – despite the serious problems with their comments – while at the same time taking my words completely out of context.

Readers who grasp the power of buying distressed debt may reasonably choose not to buy equities again. That does not mean that they wouldn't be interested in learning about how to make similar gains from distressed equities.

My eagerness to help investors learn new strategies is one of the things that I believe makes our business stand out amongst our competition. We have a genuine desire to see our readers become better investors. That you would attempt to color these efforts as hypocritical is bizarre.

Regardless, only a small fraction of our subscribers are interested in buying bonds. I've done my best to draw their attention to these opportunities, but the overwhelming majority of our subscribers remain only interested in buying stocks. I'm going to continue to serve these subscribers, too.

And I'm even willing to serve a mean-spirited critic like you. You serve a valuable role – you'll tell me things about our work that my friends wouldn't.

Regards,

Porter Stansberry

Miami, Florida

December 14, 2015

|