Musk buying Twitter; Bad news for DWAC; Doug Kass: 'Why I Have Turned More Bullish'; The deadliest road in America

1) Exactly as I predicted in more than a dozen e-mails in recent months (see archive here), Elon Musk has finally seen the writing on the wall and has ended his increasingly absurd, bad-faith attempts to weasel his way out of the ironclad agreement he signed to acquire Twitter (TWTR) at $54.20 per share.

Every investor should celebrate this tremendous victory for the rule of law!

Here is the key sentence in the two-sentence letter from Musk's lawyers:

On behalf of X Holdings I, Inc., X Holdings II, Inc. and Elon R. Musk (the "Musk Parties"), we write to notify you that the Musk Parties intend to proceed to closing of the transaction contemplated by the April 25, 2022 Merger Agreement, on the terms and subject to the conditions set forth therein and pending receipt of the proceeds of the debt financing contemplated thereby, provided that the Delaware Chancery Court enter an immediate stay of the action, Twitter vs. Musk, et al. (C.A. No. 202-0613-KSJM) (the "Action") and adjourn the trial and all other proceedings related thereto pending such closing or further order of the Court.

Musk's hand was forced because, as I wrote in my September 7 e-mail, "Chancellor Kathaleen McCormick is going to give Musk a legal beatdown that he won't soon forget and force him to honor the contract he signed."

The only mild surprise to me is that he wasn't able to get even a tiny discount. This is what I wrote on May 19, when the stock closed at $37.29:

In the August 2020 issue of Empire Stock Investor, we recommended readers buy shares of Twitter, with a reference price of $37.38. (You can subscribe for a full year for only $49 – and find out how to get access to the entire portfolio – right here.)

After the company accepted Tesla (TSLA) CEO Elon Musk's bid of $54.20, we told our subscribers on May 4 to sell at $50.59, locking in a 35% gain, writing:

We think it's best to exit here because we think there is a real possibility that the deal could fall apart.

Sure enough, with comparable stocks down a ton since his offer, Musk is engaging in all sorts of shenanigans to try to get a lower price...

It costs Musk nothing to engage in a bunch of saber-rattling that he's going to walk away from the deal, but as this Wall Street Journal article points out, Is Elon Musk Actually Going to Buy Twitter? Can He Just Walk Away?, it's not so simple...

I think the deal will go through because: a) Musk really wants to own Twitter... and b) his lawyers will make him aware that he'll likely have to pay many billions in damages if he reneges on the agreement he signed. But I do think there will be a negotiated agreement on a modestly (maybe 10%) lower price.

With TWTR shares closing yesterday at $52, up more than 22% on the day, investors who followed my advice made 39% in four and a half months, during which time the S&P 500 fell 3%.

I don't get them all right (to say the least), but I nailed this one twice – first for Empire Stock Investor subscribers and then for readers of my daily e-mail.

If you own the stock, congratulations! But I wouldn't stick around for the last $2.20. There's a lot of downside and, as this New York Times DealBook article this morning notes, there's still financing risk (though I think it's very small):

- Is he still hoping bank financing gives him an out? In his letter to Twitter, Musk says he will do the deal "pending receipt of the proceeds of the debt financing." (Per the terms of the deal, if the bank financing falls apart, he needs to pay only a $1 billion breakup fee.) The banks have already committed to their $12.5 billion – as long as a deal happens by April 2023. Is Musk hoping they try to back out?

- Could Twitter stop Musk from using the banks as an out? One route would be to ask the judge to have the banks say in writing that they remain committed to funding the bid. The company could also ask Musk for a letter saying that he is unaware of any conditions that could impede the deal closing.

- Do the banks wish they had an out? The leveraged loan market, which Musk is partly relying upon, has weakened in recent months. If the Citrix deal is any indication, the banks lending to Musk, led by Morgan Stanley, could be sitting on big lending losses. Note: They cannot change the terms of their lending agreement.

2) I've also nailed Digital World Acquisition (DWAC), which has collapsed since I first warned my readers about it (and dozens of times since then – archive here) on October 22 last year, when the stock closed at $94.20.

On a day when garbage stocks were up 5% to 10%, it fell 5.3% yesterday because Musk buying Twitter is bad news for the company DWAC is trying to buy, Twitter-clone Truth Social: Trump's Potential Return to Twitter Under Musk Hits Digital World. Excerpt:

Digital World Acquisition, the blank check company attempting to merge with former President Donald Trump's struggling media group Truth Social, is facing another hurdle in its attempts to complete the deal.

With Elon Musk now reversing course again and moving to complete his acquisition of Twitter for $44 billion, Trump may regain access to the social media site.

Trump was banned from Twitter and other social media sites after his failed attempt to subvert the peaceful transfer of power in the fatal Jan. 6, 2021 attack on the Capitol.

Musk has indicated he would allow Trump to return to Twitter if he completes his acquisition of the micro-blogging platform. That in turn could reduce Trump's interest in seeing the Digital World acquisition go through.

I think there's less than a 10% chance this deal goes through, notwithstanding the absurd, desperate campaign to pressure the SEC: 'Defund the SEC.' Becomes a Rallying Cry on Trump's Social Media Site. Excerpt:

The Securities and Exchange Commission is corrupt. The SEC is politically motivated. Defund the SEC.

Some shareholders of Digital World Acquisition Corp. have had it with the commission, the nation's top securities cop, and they are airing their views loudly. Last October, the blank check company agreed to merge with Trump Media and Technology Group, the parent company of Truth Social, the Twitter-like social media platform backed by former President Donald J. Trump. Within weeks, the SEC announced an investigation. One year later, the deal still hasn't closed.

People claiming to be angsty shareholders have taken to posting the social media equivalent of hate mail on Truth Social, attacking the SEC and calling its investigation a political move. The hashtag #DWACtheSEC, a reference to Digital World's stock symbol and a play for some on the word "whack," is trending. There are calls to "defund the SEC" Shareholders are preparing to petition the commission to end the "garbage" inquiry and approve the deal. There is even a call to pray for Digital World on a weekly video show on Rumble, a right-wing streaming media site that is a business partner of Trump Media.

It's shareholder activism – with a Make America Great Again spin.

This isn't political, as the last two paragraphs of the article note:

Adam C. Pritchard, a securities law professor at University of Michigan Law School, said with everything going on with the deal, Mr. Trump may be "creating the narrative for why things have fallen apart" by targeting securities regulators.

Mr. Pritchard said he did not see politics at work but a desire by the SEC to rein in the SPACs. "The agenda is not to get Trump, it's to get SPACs," he said.

When this deal finally dies a well-deserved death, DWAC's stock will trade down to its cash value around $10 – far below yesterday's close of $17.10.

And to those who think the stock is down so much that it can't possibly fall any further, here's a Wall Street adage:

Question: What's the definition of a stock down 90%?

Answer: One that's down 80%... and then gets cut in half!

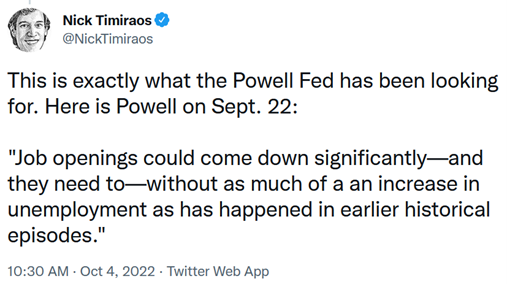

3) The market ripped on the first two days of the fourth quarter on renewed optimism that the Fed might start easing after the Bank of England did so to avert a crisis and in the wake of this report, U.S. Job Openings Fell in August, Layoffs Up Slightly, which led one person to tweet:

So, it's possible that I was too cautious in not calling the bottom in Monday's e-mail. With so much negativity last week and the major indexes falling below their prior lows for the year in mid-June, I knew we were close, which is why I urged my readers to hold on and not panic, but perhaps I should have been pounding the table. Time will tell...

For a good summary of the bull case for stocks, here's an excerpt from the monthly investors' letter of my friend Doug Kass of Seabreeze Partners (you can read the full letter right here):

Why I Have Turned More Bullish

October 4, 2022

- I continue to (Aaron) Judge the future by looking at the past, as history is an instructive teacher.

- At times history is a vast warning system, and at other times (perhaps like today) it is a good forecasting tool for better times.

- History teaches us that investment opportunities emerge out of instability, bad news, excessively bearish investor sentiment, and defensively positioned investors. (Fear, panic, and lower stock prices are the allies of the rational and opportunistic investor.)

- While we fully recognize the policy mistakes that have been made and the economic and market challenges that lie ahead, we see economic buffers (moderating inflation, a strong jobs market, excess savings, a cushion of unrealized equity/home gains, and high, inflation-aided nominal economic growth), a strong banking system and the absence of levered and debt-heavy sectors (e.g., in mortgage and finance) that were present in previous economic downturns.

- It is our central view that much has or is in the process of being discounted in sharply lower stock prices, so as students of history there are a number of reasons for optimism about the markets.

- All roads lead to bond yields.

- We are of the view that while inflation may remain "sticky," inflation has peaked as most inflationary forces are improving at the margin.

- Bond yields have also likely peaked for the cycle. (The yield on the 10-year Treasury is down by 44 basis points in less than a week.)

- Through the end of September 2022, the S&P has had the fourth worst start in history. Only during The Great Depression (1931), the bust of the Nifty Fifty (1974) and during the implosion of the dot-com era did stocks fall as much. Importantly, equities in the final quarter of the 15 worst nine months (save The Great Depression and The Financial Crisis) managed gains over the last quarter of the year.

- Equities now represent an attractive upside reward vs. downside risk proposition.

- We have been raising our net long exposure in the last several weeks as, for the first time in almost two years, we now perceive an opportunity to buy great companies for good prices.

Doug concludes:

In our view, we are now getting the chance to buy great companies at good prices.

Stock prices are not yet low enough for us to say that we are getting the ability of buying great companies at great prices.

We fully recognize that stock prices could continue their skein lower over the short term, particularly given rising interest rates, economic and profit concerns and the risks associated with market structure. (Stock market bottoms are often "events" while stock market tops are often "processes.")

As a consequence, our net long exposure has remained low and our cash position remains high.

But, given the above, we have recently increased our long net exposure.

I tend to write in practical terms about the markets, forsaking the hyperbola we often view in the business media. But, at current prices, I really like what I own. I would even go out on the limb and say that some of our industry and specific, individual equity holdings now have the potential to more than double in the coming years with relatively limited risk.

I have been patiently waiting for an opportunity to expand my net long exposure.

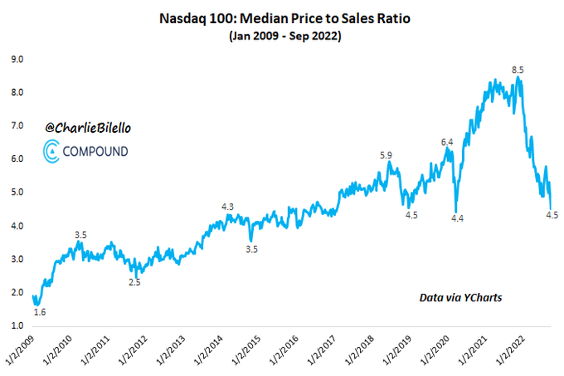

After having almost zero long exposure in technology throughout most of 2022 I have recently built up a relatively small position (of slightly less than 5%) in Microsoft (MSFT), Amazon (AMZN), and Alphabet (GOOGL). As noted below, the median price-to-sales ratio of the Nasdaq 100 has almost halved (from 8.5x to less than 4.5x), its lowest level since the COVID lows in 2020:

My still relatively large cash position puts us well-positioned for the resurfacing of value.

Thank you, Doug!

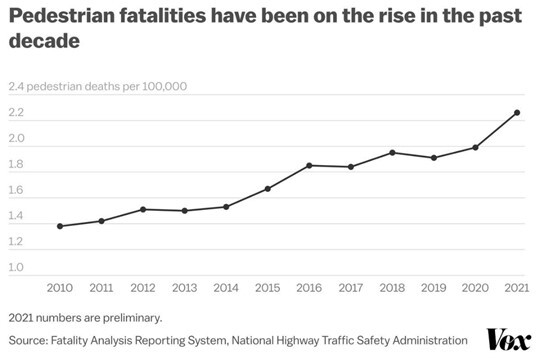

4) I've written a lot about car and bike safety, but until reading this article I had never given much thought to pedestrian safety: The deadliest road in America. Excerpt:

But the evidence mounting over the past few years indicates that something much larger is going on: America is experiencing a pedestrian fatality crisis.

It's not just Florida. In 2020, more than 6,700 pedestrians were killed while walking and using wheelchairs, despite a dramatic decrease in the number of cars on the road and the number of miles traveled. Data from the Governors Highway Safety Association that year projected that the pedestrian fatality rate soared 21%, amounting to "the largest ever annual increase in the rate at which drivers struck and killed people on foot." That same year, nearly 39,000 people were killed in car crashes, the largest number of deaths since 2007. When the National Highway Traffic Safety Administration released its preliminary findings, the NHTSA's deputy administrator told Reuters: "We've never seen trends like this, and we feel an urgency... to take action and turn this around as quickly as possible."

Be careful when crossing the street!

For more on this, one of my colleagues wrote:

On the topic of pedestrian/bike safety, this is a great YouTube channel, Not Just Bikes, from a Canadian transplant to Amsterdam. He does lots of videos on city design and the benefits of making urban areas more bike- and pedestrian-centric rather than car-centric.

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.