My recent interview; The Bond King; Nate Anderson on Mullen Automotive and SOS Limited; Cool video

1) I did another interview with alternative investing platform Prometheus last week (I wrote about my first one here).

In it, I shared why I think there could be a ceasefire in Ukraine in the not-too-distant future, which could trigger a rally in beaten-down growth stocks... expressed skepticism that a viable alternative to the U.S. dollar's reserve currency status exists... and outlined why I think Twitter (TWTR) could be a 10-bagger in the next decade (this was before the news of Elon Musk's investment – I now think Twitter will be acquired at well above today's price around $50 per share).

You can listen to the podcast right here.

2) I just finished listening to this new book about legendary bond investor Bill Gross: The Bond King: How One Man Made a Market, Built an Empire, and Lost It All.

While I've never invested in bonds, in the early days of my investing career starting 25 years ago I enjoyed and learned a lot from Gross' monthly Investment Outlooks (archive here).

So it really saddened me to see the picture this book paints of Gross: as a petty, erratic, untrustworthy tyrant who became unbearable to nearly everyone around him as he gained fame, wealth, and power.

One of the stories that jumped out at me was in the aftermath of his divorce in 2018 from his wife of 33 years, when she got the house. Before he left it, he squirted "fart spray" all over, cut the cables on the exercise bike, and stole all of the TV remotes.

Or consider his dispute with his neighbor over some petty issue, in which he played loud music to harass them and then attacked the judge who ruled against him: Bill Gross slams judge who sentenced him, mocks community service.

I don't doubt that he has autism spectrum disorder (commonly known as Asperger's syndrome) (see: Bill Gross says he diagnosed his own Asperger's while reading The Big Short), but still...

As I observe Gross' crazy, narcissistic behavior, I have two thoughts...

- Please don't let this happen to me, even to a tiny degree. My goal as I grow older is to become wiser, kinder, more loving, forgiving, and generous.

- I have even more respect for Warren Buffett and Charlie Munger, who haven't let their fame and fortune go to their heads. I've studied them closely and they're the same down-to-earth people they've always been. (Yes, Munger can be quite blunt and provocative, but he's always been that way!)

For more on the book, here's an interview with the author by the New York Times DealBook. Excerpt:

For decades, one of the financial world's best-known investors and market commentators could be found not on Wall Street but in sun-drenched Newport Beach, Calif. Bill Gross, who helped found and lead the investment firm PIMCO, earned the nickname "The Bond King" for helping to revolutionize the once-sleepy world of bond investing – and earning a fortune along the way.

But behind the aw-shucks, folksy demeanor that Gross, an Ohio native, presented in public was a hard-nosed trader who fought to squeeze every dollar out of his trades and ruled Pimco with awe and fear. Gross frequently clashed with his own colleagues, notably Mohamed El-Erian, the urbane economist he helped hire to be PIMCO's CEO and co-chief of investment. El-Erian quit in 2014, and Gross was pushed out months afterward, resurfacing at a smaller rival, Janus.

Gross retired in 2019, unable to repeat the success he found at PIMCO. But he remained in the headlines, thanks to a dispute with a neighbor over his $1 million Dale Chihuly glass sculpture. During the feud, Gross blared the theme to "Gilligan's Island" on repeat, which eventually earned him a suspended sentence for harassment last year.

All of this is vividly chronicled in The Bond King: How One Man Made a Market, Built an Empire, and Lost It All, by the NPR Planet Money host Mary Childs, a book seven years in the making and out next week. Childs spent hours talking with Gross – who self-published a memoir last week (I'm Still Standing: Bond King Bill Gross and the PIMCO Express) – and numerous current and former PIMCO colleagues. (El-Erian participated only via lengthy notes from his lawyer.)

DealBook spoke with Childs about tracing the arc of the pioneering investor, whose career helped shape a crucial part of finance but whose personality alienated colleagues and neighbors alike.

3) More kudos to Nate Anderson of Hindenburg Research, who keeps exposing frauds and/or promotions...

Yesterday, he nailed another one – publishing an in-depth, damning report on electric vehicle ("EV") developer Mullen Automotive (MULN): Mullen Automotive: Yet Another Fast Talking EV Hustle. You really can't make this stuff up:

- Mullen is an aspiring EV manufacturer that came public in late 2021 via reverse merger. It has yet to produce a sellable vehicle.

- The company's stock has spiked ~316% in the past couple of months driven by retail investor euphoria over bold claims of ground-breaking technology, near term production of its EV vans, and a major as-yet-unnamed Fortune 500 customer.

- Despite only spending ~$3 million in R&D in 2021, Mullen claims its solid-state battery technology is on track for commercialization in 18 to 24 months, putting it head of every major technology and automaker in the industry who have collectively invested billions on solving the problem.

- Mullen recently press released an update on its battery testing, sending its stock soaring 145% in a day. In reality, the "news" appears to be a rehash of testing the company had already announced in 2020.

- Mullen apparently misrepresented the test results, according to the CEO of the company that performed the tests. Its CEO told us of Mullen's press release: "We never would have said that. We never did say it and certainly wouldn't have said it based on the results of testing that battery"...

In an industry where most successful EV companies are run by top engineers, Mullen is led by an unlikely leader. Its Chairman, CEO & Founder David Michery lists no educational experience in his biography and came from a career in entertainment. Michery formed the company after combining several distressed automotive assets.

As we detail later, Michery's bio leaves out his CEO roles at nearly half a dozen failed penny stock companies, several of which had their securities registrations terminated or revoked by the SEC.

His experience also includes signing a deal with an individual that would later be criminally convicted of securities fraud and sentenced to 30 years in prison. In the indictment in that case, prosecutors outlined evidence of fraud that included the dealings involving Michery's company.

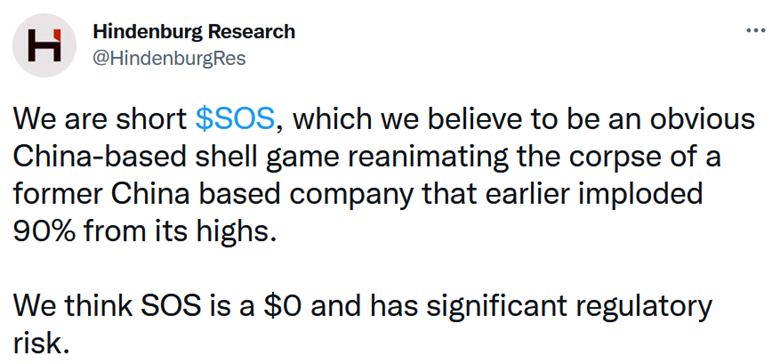

Anderson also recently tweeted this about crypto miner SOS Limited (SOS), which has imploded and is trading near its all-time low under $0.50 per share:

Here's his original post about it on February 26, 2021, when the stock closed at $4.77 per share:

4) This one-minute video of a gymnast/acrobat blows my mind – such strength, balance, and grace!

Best regards,

Whitney

P.S. I welcome your feedback at WTDfeedback@empirefinancialresearch.com.