This Pattern Separates Good Growth Stocks From Great Ones

Editor's note: Growth and value investing may look different on the surface, but they share a common trait. In this issue, Joe Austin of our corporate affiliate Chaikin Analytics explains how the most successful companies turn smart decisions into momentum. And this self-reinforcing cycle helps create the kind of businesses that reward investors over time...

On Wall Street, the growth versus value debate never ends...

I've worked both sides of the trade.

When I pitched value investing, it was always a "tortoise and the hare" kind of story. It's the concept of "slow and steady wins the race." And if the market fell, we'd lose less money than anyone else.

That's how value investors compound capital over time.

When pitching growth stocks, we painted ourselves as "porpoises in the sea." Sometimes we would swim above the water... and sometimes below.

And volatility was great since we were always swimming with the tide. That's how growth investors compounded capital.

The simple truth is that while both strategies have done fine over the long run... growth has been the real winner.

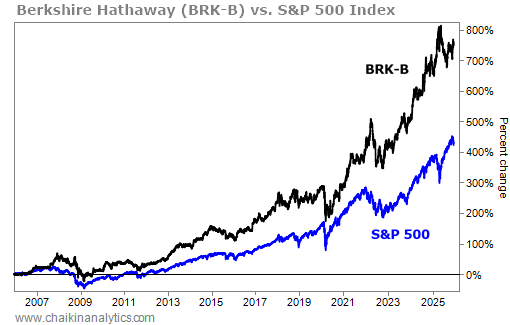

For value investing, you needn't look much further than the legendary Warren Buffett and Berkshire Hathaway (BRK-B). Just take a look at Berkshire's outperformance versus the S&P 500 Index over the past two decades...

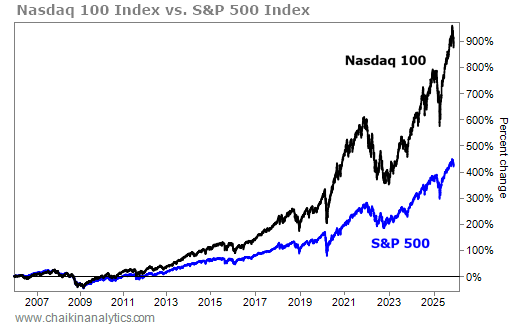

And for growth investing, consider the tech-heavy Nasdaq 100 Index. Here's how it looks compared with the S&P 500 over the past 20 years...

As you can see, the Nasdaq 100's outperformance versus the S&P 500 is even stronger than Berkshire's.

So if growth investing is where the real money gets made, how do you find the best growth companies?

Great investors know the secret: Whether you're buying growth or value, capital allocation matters the most.

When he's looking for value stocks, Buffett focuses on capital allocation. He believes it has a critical impact on a company's value over time.

Capital allocation is critical in growth companies, too.

That's because in the best growth companies, smart capital allocation does more than just compound returns... It creates a cycle that feeds itself.

When management reinvests profits in the right places, each dollar generates bigger returns. Those bigger returns mean more money to reinvest. And the cycle keeps accelerating.

In business, it's called the "flywheel effect"...

The Power of the Flywheel

In mechanical engineering, a flywheel is a heavy, rotating wheel in machinery that stores energy and maintains momentum. Once it's spinning, the flywheel takes relatively little effort to keep going.

And in business, the flywheel metaphor describes how successful companies create self-reinforcing cycles where each success makes the next one easier.

A great example of this is Google parent Alphabet (GOOGL)...

Google's search engine is free. But the company's true value lies in the data that it collects and analyzes. This data shows exactly what people want, how they behave, and what makes them engage with the content they see.

The more people use Google's services, the more data they generate. In turn, that makes Google's products better... which attracts more users.

This is why Google can offer most services for free while building a trillion-dollar business.

We can also see a flywheel effect with Tesla (TSLA)...

Tesla sells electric cars. But it also collects valuable data while those cars are in use.

Tesla currently has nearly 8.5 million cars on the road. Its latest Model Y has eight exterior cameras and one interior camera that collect data for every mile driven – tracking things like speed, acceleration, braking, and battery life.

Tesla can then use that data to train its Autopilot and Full Self-Driving systems faster and better than competitors. Those self-driving features make Teslas more attractive to buyers, putting more cars on the road.

Meanwhile, a great example of the flywheel effect outside of tech is big-box retailer Costco Wholesale (COST)...

The company's flywheel is its memberships. Fees for these memberships only make up about 2% of Costco's annual revenue. But they tend to account for around 70% of the company's annual net income.

The number of cardholders at Costco has gone from less than 106 million in the company's 2020 fiscal year to more than 145 million in its most recent fiscal year. And because of all those members, Costco has pricing power over its suppliers.

The company set a rule that no branded item can be sold for more than a 14% markup. And its Kirkland brand products can't be sold for more than a 15% markup.

According to a study by New York University, the average gross margin for a retailer is around 31%. For grocery stores, it's about 26%.

At Costco, the flywheel works because lower prices bring more members. More members mean higher sales volumes. Higher volumes mean pricing power with suppliers, leading to even lower prices.

This is the flywheel effect in action. And it has allowed Costco to flourish in a notably difficult business like retail.

One way to find great growth companies like this is to use the Discovery Engine within the Chaikin Analytics platform. It's a powerful idea-generation tool that helps you find new stock or exchange-traded fund ("ETF") candidates similar to those you already like.

Whether you're building a watch list or looking for fresh opportunities aligned with your strategy, the Discovery Engine helps bring ideas to the surface based on similar stocks you've selected.

In the best growth companies, capital allocation doesn't just compound... it accelerates business momentum.

And the flywheel effect separates companies with steady growth from those with exponential growth.

When you find a company where one success leads to another, you've found something special. And that's where the real money gets made.

Good investing,

Joe Austin

Editor's note: Wall Street legend and Chaikin Analytics founder Marc Chaikin has just completed his 2026 market battle plan. He's eyeing a rare January "trigger" that could determine whether 2026 is a wealth-building year or a setback. Since 1950, this signal has predicted the year ahead with 100% accuracy. And on Thursday, he'll go on camera to explain the details – plus two key stock ideas and his Top 10 list for 2026.

Further Reading

Wall Street is slow to spot trends. Just by watching how people act and what they use, you can get ahead of the big-money investors. By noticing real-world signals, you can act on the next wave of great businesses ahead of the market.

The mergers and acquisitions market is finally starting to thaw. Market conditions are better for dealmaking. And as smart acquirers cut inefficiencies and boost growth, they could spark the biggest market moves of the year.