In This Episode

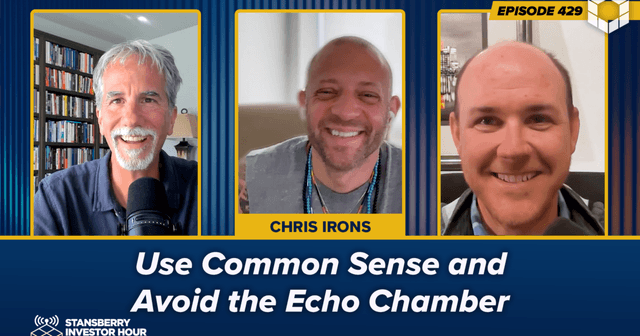

On this week's Stansberry Investor Hour, Dan and Corey welcome Chris Irons to the show. Chris started writing about finance back in 2013 under the moniker Quoth the Raven and was a speaker at the 2019 Stansberry Conference.

Chris kicks things off by addressing tariffs and shares how nominal prices will continue to rise regardless of what we do. He says the cycle of crashes and money-printing has continued to accelerate and create bigger distortions and drops. And he discusses passive bids that pile into the S&P 500 Index and cause valuations to become stretched. He warns against overexposure to the fund due to potential drawdowns in any of the "Magnificent Seven" that could take the index down with them...

Every once in a while... things happen, something unexpected happens, a key person at the top dies, or a company commits fraud, or there's some type of major product liability or something... [It] could be the impetus for exactly what sets off a cascade lower just by virtue of its weighting in funds like these. And so we're really in a situation where we're putting so many of our eggs all in seven baskets. And that's frightening.

Next, Chris states that the market has gone "all in" on options instead of equities, creating a state of leveraged gambling. And he predicts that things have changed so much that despite the beliefs that there will continue to be government bailouts or other solutions, this cannot continue. Something will break eventually. However, it's not all doom and gloom. Chris says you just have to find where there's good value...

I'm not a pessimist, I'm just trying to put together a clear picture of exactly where we stand based on common sense and not from this echo chamber that you see... [They're] just making excuses on why people should be buying now, which is a ridiculous thing to do because these people are... backfitting [their] thesis as to why we should buy to the ridiculous price, instead of looking at the price and making up their mind.

Finally, Chris shares advice on how to hedge any large market crashes based on his own strategies. He also cautions against buying into assets in blind hope of reaching a bottom. If a company is burning money without generating any cash, there won't be a bottom to bounce off of...

What people don't realize, and a lot of dip buyers don't realize, is that when you're buying something that is burning cash, or you're buying something pre-revenue, or you're buying something that's unprofitable, or you're buying something that doesn't have any, you know, that's an insolvent on its balance sheet, essentially, there is no bottom... And with insolvent companies and companies that don't generate cash, they will die when the market pulls back. And that's just how it goes.

Click on the image below to watch the video interview with Chris right now. For the full audio, including Dan and Corey's post-interview thoughts, click "Listen" above.

(Additional past episodes are located here.)

This Week's Guest

Chris Irons started writing about finance and "pulling the curtain" back on the B.S. of the industry under his moniker Quoth the Raven in 2013. Since then, he has been quoted in the Wall Street Journal, Financial Times, and Barron's, has made SeekingAlpha's list of Top Bloggers, Forbes' 100 Twitter Accounts in the Financial World to Follow, and has shared the stage as a speaker with acclaimed investors David Einhorn, Andrew Left, Ben Axler, Jon Najarian, and many others.

Dan Ferris: Hello and welcome to the Stanberry Investor Hour. I'm Dan Ferris. I'm the editor of Extreme Value and The Ferris Report, both published by Stansberry Research.

Corey McLaughlin: And I'm Corey McLaughlin, editor of the Stansberry Daily Digest. Today we talk with Chris Irons, also known as "Quoth the Raven" on Substack.

Dan Ferris: Chris is a very smart guy and he's a salty old dog, so get ready for that. But get out your pens and pencils. He's got a lot of great ideas about what is happening in the world right now that I want you to hear. You need to hear them in my opinion, and you need to hear them in a different way. And this is that way, so let's do it. Let's talk with Chris Irons. Let's do it right now.

All right, Chris Irons. Welcome to the show, apparently for the first time ever. I thought you've been on before but I guess not.

Chris Irons: Happy to be here. And as I said before, I thought my half-life with ever being invited back to anything Stansberry after my 2019 onstage performance in Las Vegas was much longer than six years. I thought it was going to be at least 20 years but it's great to be back six years later. I'm not surprised it took so long.

Dan Ferris: Well, you know how people are. They hear a little salty language and they get all flustered.

Chris Irons: Yeah, well, I appreciated the invite. And happy to be here.

Dan Ferris: Yes. And –

Corey McLaughlin: You're putting too much stock in our planning as well if you think that that was an issue for us.

Dan Ferris: That's right. Yeah.

Chris Irons: Hey, I enjoyed myself. I get invited to these conferences and things, which I don't really do too many anymore. I do still get invites. And my thought processes is if I go, I go. If I don't, I don't. I'm not – I'm just going to go and say what I want to say and that's going to be it. And if I don't get invited back, that's OK. I remember the guy at your stage show because everybody – it was very professionally done. Professional sound, professional everything, great crowd. It was like "Oh, do you want to wear a jacket?" I remember he asked me, "Do you want to wear a suit coat?" because I had a tank top on, because about 30 minutes before the presentation started I was out at the pool. It was at the Wynn, right, I think?

Dan Ferris: I think so.

Chris Irons: Yeah, I was out at the pool drinking beers and having a good time and I looked down. I was like "Oh sh*t, I've got to be on stage in 30 minutes." So, I ran inside and I – the guy's like, "Do you want my suit coat?" I was like, "No, it's 90 degrees outside." Anyways, I have graduated since from a tank top now to a sleeveless shirt. And so, maybe in six years when you invite me on again, I'll be wearing a button down shirt.

Dan Ferris: He's getting closer to sleeves, folks. It's a process. It's an evolution.

Corey McLaughlin: It gets longer.

Dan Ferris: Yeah. Well, I enjoy your commentary. I enjoy your presentations. So, apparently I have some amount of sway over who gets on this show, so here you are. And I'm happy to have you. I'm happy to have most folks who are self-professed libertarian, Austrian economics-oriented, as are you. So, yeah. Happy to have you here. And of course, you're an investor, too, so there's potentially lots of stuff to talk about. We might start there in fact. I'd like to start there if you don't mind.

Chris Irons: Sure.

Dan Ferris: What does an Austrian-minded fellow yourself think of things like tariffs? Is there any good outcome potential from this? From the highest tariffs since the 1930s? OK.

Chris Irons: Yeah, I think a lot of the criticism of tariffs and the fact that it does eventually work its way back into prices does make sense. There's some people who argue against that, like Jim Rickards did a pretty good job of making a case as to why tariffs don't affect prices. But one way or the other between tariffs and between monetary policy, I mean, nominal prices are going to continue to go up regardless of what we do. And that's part of my broader kind of macroeconomic thesis, which is the Fed will do anything at all costs to try to save face at any point. And so, I think not to carry the Austrian school/libertarian/Peter Schiff disciple line, but I do think at some point we're going to have an extremely sharp deleveraging. I think it's going to be worse than anything that we've seen thus far. I'm not saying that to try to elicit any type of response, just out of common sense with the way that this cycle goes, which is we crash, we print more, we crash, we print even more, we crash, we print even more than that. And so, the [modern monetary theory ("MMT")] kind of abusing the corpse of the dollar cycle that we're on right now, it just accelerates and gets faster and faster as time progresses. And so, naturally with that come bigger and bigger distortions and bigger and bigger drops in the market.

As far as the idea of tariffs as a political strategy, I don't hate it because I think that there is a – look, the only thing this country exports right now is dollars. We don't manufacture anything here. And so, the case that I made was, look, back during COVID when we needed important items when the supply chains were really gummed up, we really found out during COVID just exactly how many items come from overseas. And it was maybe a year or so that we were walking into stores and it was natural for half of the shelves to be empty because they weren't – the items from overseas weren't getting here anymore or they were trickling in. And so, what you'd see is this small selection of items that were manufactured in the United States or had finally made their way over.

But more importantly are the things that Trump is talking about, the ingredients that are used to make pharmaceuticals, the pharmaceuticals themselves, the rare earth minerals, the things that really in the balance hang significant portions of our quality of life. And so, I don't think that it's a bad idea. As misguided as I think some of the tariff rates were that Trump came up with and the calculation that he used was, I don't think it's a bad idea to make this hard stop and say, "Listen, we have to do something." Because when you drive through the Pennsylvania countryside in Northeast PA and really even in places near where I grew up in New Jersey, I think of one factory, for example, that used to be a Kimberly-Clark factory. That just shut down. They were making tissues and toilet paper and things that. You see it in Detroit. You see it in places like Bethlehem. If you go to Bethlehem, Pennsylvania you see the whole steel industry has essentially shut down. And those are just microcosms of what's happened across the entire United States.

So, we used to be a country that manufactured its own goods, that had sound money, that was – had a budget surplus, was in a much better financial position if you gauge financial positions through an Econ 101/common sense/Austrian school point of view. And so, I don't think that the idea of wanting to rejigger our trade deficit is necessarily a terrible idea. I think that there are a lot of moving parts, not the least of which are the cost of items that we get from overseas versus the cost of manufacturing here. But net net, I think that it's a good idea because it brings up – it puts into the zeitgeist the idea that the country doesn't manufacture anymore, which has been a problem for a long time.

So, if you're like me and you believe that we're overspending and we are overconsuming and that we have essentially entered a period of decadence or just we have the global reserve currency, we use it, we weaponize it. And now I find myself going to Europe and I find myself going to cities in Europe and thinking "Man, why doesn't the United States look this nice?" And so, in some ways, it almost feels we're over the – we've reached the zenith of our flourishing as an empire. And in order to try to correct any of that, first off, it's going to be near impossible to correct. It's like turning around the f*cking Titanic. It just doesn't happen quickly. But in order to do it, there are certain giant fundamental changes we'd have to make, not the least of which is onshoring some manufacturing again, and then of course trying to cut spending and trying to balance the budget, which we're not doing a fantastic job of either. So, I see the good and the bad.

Dan Ferris: Yeah, creating real wealth is – speaks for itself, right? And if you do less of that in the process or sending your net worth overseas and – what net worth you have, you're shipping it overseas, and then you're also not creating as much of it, it could be a problem.

Chris Irons: I think what's even more frightening from the "Liberation Day" debacle, what happened, I think if you want a takeaway from that outside of arguing over tariffs, it would be the market's reaction to what happened and how quickly and swiftly it reacted. And then how coincidentally after several days of down 2%, down 3%, and the 10-year and 30-year yields moving higher, how coincidentally, oh, all of a sudden there was a 60-day pause or a 90-day pause. And people on CNBC were acting it was the goddamn end of the world. I thought Steve Liesman was gonna f*cking cry. It was just...

And that speaks to a broader theme which is sometimes when you want to make big changes you have to deal with some discomfort. But nothing had even happened at that point. The pricing –

Dan Ferris: Right. It was all announcements, yeah.

Chris Irons: Yeah, it hadn't hit. And nothing was missing from shelves. It was just pure panic. And the idea that, OK, the market went down 10% or 15% and so now we need to just scrap this entire plan shows you how truly trapped we are because if we get to a major sharp deleveraging event – and it will happen at some point in the future where the Fed's not going to be able to stop it and the president's not going to be able to stop it. And then it's like bar the door because we have no idea what's coming next. But that will happen.

But it just shows you just how beholden we are to the little number on the screen that has the S&P in it, because as I've written about, there's a million reasons we can talk about them, but something like the passive bid, when that starts to dry up and people start to redeem instead of contribute you're going to see a nightmare.

Dan Ferris: Chris, I just – I didn't get to it, I just saw the piece of yours about – it was – I forget the title, something about how passive unwinds. And I didn't get to it. So, let's do talk about that.

Corey McLaughlin: Yeah, that was one of the things I was going to ask you about, too, because we recently had our – one of our colleagues, Bryan Beach, on here, who's been talking about – and Dan, too – talking about the passive bid.

Dan Ferris: We've had Mike Green on. Yeah.

Corey McLaughlin: And Mike Green, yeah. But –

Chris Irons: Yeah, well, Mike Green was the impetus for that piece. And really, basically the piece that I wrote is – a lot of it is summarizing his thoughts because he's the person that I really sharpened my vision on this from. In fact, in that piece it passes along a great interview that Michael Green did with Palisades Gold Radio, which the first half of that interview I thought was the best explanation for exactly how out of whack things could get due to the passive bid that I've heard thus far. What I knew going into that interview was that the – this passive bid which is essentially routine forced buying through individuals who purchase [exchange-traded funds ("ETFs")] that are weighted to the S&P or people who contribute regularly via their retirement funds, their 401(k)s to these types of ETFs, what happens is –

Dan Ferris: With no reference to fundamentals whatsoever.

Chris Irons: Right. What happens is those funds buy a list of names, usually the top weighted names in the S&P 500, proportional to the amount that you invest in the ETF. And what they don't do is they don't look for value. They don't look at price-to-earnings (P/E) ratio. They don't look at price-to-sales ratio. They don't look at where the market is. It is a consistent purchasing program that doesn't let up regardless of valuation. And in the case of nowadays, you see market breadth, meaning the amount of companies that are driving the index higher is getting smaller and smaller. So, it's not uncommon to see a case where you have 60% of the S&P red on a day or 65% of the entire index red but the index itself green because the higher-weighted names in the index – your Amazon, Tesla, Microsoft, whatever, the Mag Seven and others – are green on the day.

So, they have been the equities that are driving the market rally higher. And their valuations have gotten pretty stretched. You're talking 40, 45 times the earnings of some of these names. A name like Tesla. I mean, you're in the hundreds P/E right now.

Dan Ferris: The hundreds.

Chris Irons: Right. And so, the point that Mike Green was trying to make that was something that I did not know, because I knew how the buying worked, but what I didn't know was that when people go to redeem from these major $20 trillion ETFs and funds, meaning when you take those emergency draws out of your 401(k), which happens when there's periods of financial distress or when you lose your job, when you do that a lot of these funds don't have cash liquid to absorb those redemptions. And what Michael Green was saying in this interview is that the funds have instead done things like taking on leverage specifically so they don't have to sell.

And that's a great solution until you get to a point. It's only a great solution if the market continues to move higher. But basically, it could eventually become a margin call on these multitrillion dollar passive funds, which when you add that to a major margin call in something like crypto, which is levered 100-to-1, and individual personal accounts that retail invaders – investors trade in, you could have an absolute nightmare, that it doesn't matter what the Fed does because you can't come in with a – you can't come in with a $20 trillion dollar bid if you're the Fed. You can and they would figure out some f*cking stupid way to do it and some dumb name for it. But then you're talking about 10%, 15% inflation or something the next year. And so, there's going to be a blowoff valve. And just to listen to Michael Green's perspective on this – and I recommend everybody listen to that interview. As I tell my subscribers on my Substack, I don't know why you subscribe to me because all I'm doing is just passing along what I learn from other people. But it really seems like something devastating could be waiting in the wings there if we do move low enough fast enough.

And that's the key. Can we move – will the market move low enough fast enough that it will trigger these calls before we have time to react like we did with the Liberation Day? When Trump and Bessent come in and say, "All right, there's an issue, we're going to do a 60-day pause" and the market breathed again, then people get a little bit of a – a little bit more time. But there will be an issue where people are just going to have to pay up. It's going to hit that time threshold where the market is low enough for long enough that people are going to start to see real collateral calls, real margin calls, real inability to service whatever needs to be paid on a monthly basis. And so, that'll be – it'll be unprecedented when it happens from where we're at now.

Dan Ferris: Right. And if you think about it – I like the way you put it. And I also – I feel like we all took the cue from Mike Green on this. And the algorithm is receive a dollar of capital, buy a dollar of equity with no other inputs. And then you're talking about the reverse of that, right? Redeem a dollar and sell a dollar of equity. But when you're borrowing, too, on top of that, it really makes – and you're talking about $20 trillion in funds, just everything that's – that has the S&P 500. The top the, three biggest funds – VOO, SPY, IVV – are almost $2 trillion. Just those three funds are almost $2 trillion of nothing but S&P 500, right?

Chris Irons: Yeah.

Dan Ferris: So –

Chris Irons: Yeah. Which is to say nothing of all the other –

Dan Ferris: Close to 40% of that money is in 10 stocks.

Chris Irons: Right. Which means if something happened tomorrow – and I'm not saying this is going to happen, but let's say something happened tomorrow, where one of these major Mag Seven companies was found to have committed accounting fraud. I'm not saying this is going to happen, but every once in a while, sh*t pops up, things happen, something unexpected happens. A key person at the top dies, or a company commits fraud, or there's some type of major product liability or something. That – something that innocuous could be – or even more innocuous than that could be the impetus for exactly what sets off a cascade lower just by virtue of its weighting in funds like these. And so, we're really in a situation where we're putting so many of our eggs all in seven baskets. And that's frightening.

Dan Ferris: Yeah, we've seen just in the past, I don't know, several years or something enormous one-day drawdowns. I know in Meta – you can look up on something Investopedia "biggest one-day market cap losses." You know what I'm talking about?

Chris Irons: Yeah.

Dan Ferris: And you'll see minus 19%, 20% in a day on a massive, massive market-cap company. And how much of that would it take, right? I hear what you're saying. You don't know what it's going to be. You don't even know what the catalyst could be.

Chris Irons: Specifically, if I had to pick two names I was the most concerned about – and none of this is investment advice and I'm just speculating and giving you a hypothetical, but you have a name like Tesla, where their legacy business essentially is in collapse and the valuation is extraordinarily stretched based on the fundamentals. And so, it's a call option on their future of robotics and AI and full self-driving. So, OK, what happens if that doesn't come to fruition?

Then also you have a company like Nvidia, which has all these very interesting circuitous transactions and relationships with other names, specifically CoreWeave and Supermicro that – and even Microsoft. I think they have a huge customer concentration issue with Microsoft. And so, you do have a lot of eggs in one basket again, where it just – I don't know. Look, I was a professional short seller for 10 years. I worked with some of the best short sellers in the world. When you do that, you start to just get a sense for when things might be askew. You see enough related party transactions and enough forensic accounting weirdness and even just enough sometimes behavior from a specific CEO or – you just kind of have a finger on the pulse a little bit more than someone who has not been in that world for a while.

And again, I'm not saying that this is an issue with any of these companies. I'm just saying for me something like Nvidia coming in and backstopping CoreWeave's IPO when it couldn't catch a bid at $40 per share, and they have this business relationship with them at the same time where they're reliant on one another, and then all of a sudden CoreWeave, what, goes to $150 a share when there was no bid for it during its IPO. I don't know. That stuff doesn't make sense to me. And I understand option gamma could be driving a higher speculation but it's definitely – it's a convenient move for CoreWeave insiders and it's a convenient move for Nvidia and anybody else that bought the IPO. But when you look back at that day, there didn't seem to be an appetite for the AI story. There didn't seem to be an appetite for their stock at $40 per share.

So, I'm watching carefully. Even things like data centers, too, and some of the valuations on some of these legacy data centers. I'm just watching –

Dan Ferris: I've noticed you watching, Chris. I've noticed you watching. I've noticed you watching Meta and Microsoft. You were writing about how they're doing great, but the market kind of puked it back.

Chris Irons: Yeah. Well, on Friday I just wrote a small note about that, the fact that – there will come – that's the action you would expect to see when valuations are peaking. What would you expect to see? You'd expect to see a great fundamental quarter because Microsoft, for example, beat analyst estimates, Meta beat analyst estimates, raised guidance. So, you've got a beat, beat, beat from both of these huge names. And the next day the market just sold it right off. And so, the market bounced yesterday, and now today it's selling off a little bit more. But those are the types of things that would suggest to me that the market says, "Look, despite this great quarter, how big can we make this delta between the fundamentals and the multiple that we're paying?"

Corey McLaughlin: Yeah, I wanted to ask you about something else. You mentioned the options gamma just a couple minutes ago. And I've seen you write about – and we know about the meme-stock traders and then the short squeeze and all of that. But you write about the weaponized options when – this idea that it if it goes the other way, if people start going – doing puts instead of calls and this underlying feature of the market. I think it's there, people know it exists – or a bug, if you want to call it a feature or a bug – all of this exists. And it's something that's been on my mind for a long time with all the zero day trading activity and everything. Can you just get into that a little bit and maybe enlighten people on what you're concerned about there?

Chris Irons: This and the passive bid, I've argued, are basically the two tails that are wagging the market dog. The market used to rise and fall because individual people would come in and buy Apple stock and then that would drive the ETF a little bit higher because it's highly weighted in there. And now the opposite is happening. People are buying the ETF and that's driving Apple higher. And that's why you get these f*cking insane out-of-whack valuations.

Another incredible feature of the market is when dealers sell options, when they sell calls or they sell puts, there's a certain percentage of the exposure that they get from that that they have to hedge against. And so, if I sell you a call option at a certain price, I've essentially got to go out and buy that stock in a smaller amount to make sure that I'm reducing my exposure, my counterparty exposure to that transaction. When that happens over and over and over again and you get a million people piling into the same stock at a strike price that's far outside of wherever the notional price or far outside of whatever the spot price is at the moment, what you get is essentially forced buying from dealers that are trying to hedge against the sale of all of those call options. And when that happens en masse, then option become the flywheel that spins up the market's equities instead of being a kind of side derivative feature of the market that lets you speculate in addition to owning the equity.

So, between the passive bid and the options market, I'm not sure we've had a fair price on equities in forever. And this is what happened with GameStop. People say, "Oh, was it just that people were coming in and buying shares of GameStop all the way up to $350 a share?" Probably not just that. It was – probably had a lot to do with people buying the furthest dated strike, and anytime the options market makers would list new strikes, they'd go out and buy the furthest dated strike. And that would have forced the dealers to buy the stock at whatever price. Plus you had some retail buying as well. When you think about the dollar amount that you would need to move the stock that high that quickly just buying the equity, the dollar amount to move it by buying options is significantly smaller. And nowadays, if you go on WallStreetBets, you just go look at it today and people are posting their wins and their losses, everybody's trading options. Nobody even buys equity anymore. The entire market has become options. And the entire market has become leveraged gambling. Top to bottom, there's no other way to put it. You have a cohort of less sophisticated investors who are making up a larger part of the market than they've ever made before, and their only means of investing is speculating on options, which become, again, a tail that wags the market dog.

So, when you look back to COVID, for example, and we had that huge dip, and then the Nasdaq basically f*cking tripled off the bottom, despite the fact that the economic turnaround didn't appear to be substantial at all, and then you see an article like – I believe it was in FT – where you're sitting around dumbfounded wondering "OK, why is Tesla up 10X in in six months? What could – how could that possibly make sense?" And you see these articles that say SoftBank and Goldman Sachs, I think were the two names that were in there, buying index calls off the bottom. So, they were making these enormous levered bets that on an index ETF, which forces buying of the index ETF, which forces that cash to be distributed per its weighting to the individual equities.

And so, that works in two ways. So, the same way that we blasted off the bottom and you do see these insane moves like we saw in Tesla in December of 2019 to mid-2020, where it did, I think, 10X, which is bizarre, those same moves can happen on the way down, which means when market psychology breaks, whenever that happens, we get to a moment where the Fed and the president can't help and people understand that and there's no turning back and there's no six-month delay on tariffs at the last minute, when that happens again, you're going to see options weaponized in the other direction, which I think could be extremely dangerous.

So, between that and the passive bid we have these two giant f*cking trap doors underneath the market that to me perfectly explain why valuations are as batsh*t insane as they are now. You get all these great investors like Mark Spiegel, my friend, writing about the market cap to GDP and the historical P/E averages. And it's just like "How could we be here?" Well, this market functions very differently than a market 20 years ago. We didn't have ETFs like we did 20 years ago. We didn't have options liquidity like we did 20 years ago. Totally different market. Totally unprecedented situation that we've been in, even going to monetary policy again. And so, we're going to have totally unprecedented outcome.

The worst part is over the last 20 years everyone has been conditioned to think that they should always buy the dip and there's always going to be a bailout or a solution from the Fed or from the government. And at some point, something is just going to break. And I'm not trying to be a fearmonger but it's just simple math. We're just moving higher faster than we ever have. There's more speculation and more leveraged margin debts at an all-time high right now. Real rates are positive. The economy is starting to grind to a halt. So, job losses will come next. Discretionary spending will start to be reduced. That will hit earnings. And then all of a sudden you're going to be starting a flywheel in the wrong direction. And then it's like hold the f*ck on.

Dan Ferris: Yeah, unemployment could certainly hit passive flows, too, right? The earnings.

Chris Irons: That would be what you'd want to watch. That would be the number to watch for passive flows.

Dan Ferris: Right. Well, gosh, let me just put a gun to my head real quick here. No, I'm just kidding.

Chris Irons: Hey, listen, man, I'm an optimistic dude. I'm not trying to be Mr. Doom and Gloom. I think it's ridiculous how people that just speak with any type of common sense and suggest anything other than like Tom Lee f*cking beating off to Ethereum on CNBC, and people that suggest anything other than that, they're all of a sudden like "Oh, they're anti-American. They're against the market. They're this. They're that." Look, man, numbers are finite. Math is math. Econ 101 is Econ 101. No matter how much modern monetary bullsh*t we want to f*cking build on top of the basic rules of debits and credits and supply and demand, they're still there. And like Ron Paul says, eventually the free market and those natural laws of economics are going to have their way. It's just when and how and who's going to be the scapegoat that takes the blame. Is it going to be Russia? Is it going to be short sellers? Who the f*ck knows? But really, it will be a mess of our own making when it happens.

Dan Ferris: It will.

Corey McLaughlin: Right. And you don't want to be the person caught up in that, I think, is the idea. That's why – yeah.

Chris Irons: And Stansberry people know this too because I remember in 2019 – there's a really good cross section of Stansberry's audience with kind of libertarian and Austrian school thinkers. At least, that's what I can remember from drinking whiskey in a bar with some of them. But it could be a little hazy memory on that one.

Dan Ferris: No, you're right. You're right. And it's even – I would even say there's sort of a firmwide bent in that direction. And certainly, look, I made a joke about putting a gun in my head, but I've been in this mode of questioning speculative excess since May of 2017 off and on. I was hugely bullish March, April of 2020 for several months. And then we just – it all just came right back to where we were. So, I hear you. I've had to write – I write once a week and I've had to write now and then "Look, I'm – I really am an optimist about humanity. I really am. I promise you." And I hear you sort of telling me the same thing.

Chris Irons: When we crashed during COVID, for example, I was writing and talking on podcasts that I'm buying financials. I was buying JPMorgan. I was buying Goldman Sachs. I was buying these companies that were trading at point 8 times book, 0.75 times book, under one times book because it wasn't a financial crisis. Nominally, the financial system is always going to be there because the Fed is the lender of last resort always. And so, I knew it was very different from 2008.

So, it's not that I don't think that there are things that aren't opportunistic because I do. I was saying that. And those names are all up 3X or 4X since then in just a couple of years. And even on my Substack at the beginning of every year I put out a list of names that I'm watching for the year, and only one of them was a short this year and 24 other ones were longs. You've just got to find where there is still some value. I'm just not like – I'm not out there long the Mag Seven. I'm long things like gold miners, silver miners, things like psychedelic names, all these little niche pockets of the market that – kind of undernoticed. I was long nuclear coming into this year, which has been – has had a great tailwind.

So, I'm not a pessimist. I'm just trying to put together a clear picture of exactly where we stand based on common sense and not from this echo chamber that you see. I don't really watch CNBC anymore, but I had it on yesterday and it was top to bottom – beginning to end to the day, nobody was skeptical. Jeffrey Gundlach was on for a little bit and he was like, OK, somewhat cautious. But every guest they brought on was just making excuses on why people should be buying now, which is a ridiculous thing to do because these people are – they're backfitting pieces as to why we should buy to the ridiculous price. Instead of looking at the price and making up their mind, which is what I'm doing, they're making up their mind and then backfitting it to what the price is now, which is why you get all these asinine f*cking price targets from people like ARK and all these sell-side analysts that they don't have a sell feature. They don't put out sell reports. It just doesn't happen. So, the question then becomes what bullsh*t do you have to make up – what do you have to factor in your f*cking Tesla model to justify a $1,000 price target when the legacy business is in collapse? I don't know. That's not my job. I would feel an asshole trying to make something up to justify that.

Dan Ferris: Yep. I'm glad you mentioned ARK because I recently they sent out these e-mails about their blog posts and things and the one e-mail that caught my eye was they were bragging about their year-to-date performance. And I thought, well, huge sentiment indicator when ARK is bragging about their year-to-date performance in August or July or whatever it was, you know something is up. And now they're saying they're under –

Chris Irons: Yeah. And this woman –

Dan Ferris: Go ahead.

Chris Irons: – she promised 40% compounded returns some years back. Do you remember that?

Dan Ferris: Yeah.

Chris Irons: Do you know how far off the mark she is from that? So, that's exactly what I'm talking about. I even wrote about that on my blog. I don't know – if I can't pull it up real quick, I'm not going to. But – here it is. She keeps moving the goalposts. This was back in 2022. And this was how she was listing things on her on her website. But she said, yeah, "According to our current estimates, our more concentrated flagship strategy today could deliver a 40% compound annual rate of return during the next five years." OK, so she said that in 2022. And has she compounded 40% since then? Actually, which would be some – I don't even know how ridiculous of a price that would be. Let's just go back and check just for f*cking sh*ts and giggles here because we're having a nice time today. She was at probably about $70 a share then and she's at about $70 a share now. So, she has – an approximation – over the course of five years produced zero percent returns. So, the difference between promising 40% compounded and zero is a huge deal. Forty percent compounded from the original would have been, let's see, $70 plus $28, so that would have been $98 at the end of the first year, which would have been, like, $140 at the close of the second year. It would have been $196 at the close of the third year. It would have been $270-ish at the end of the fourth year. And it would have been – three, four, 32 – it would have been somewhere between $350 and $400 a share now. And she's at $72.

Dan Ferris: Yep.

Corey McLaughlin: Just a little bit off.

Dan Ferris: A little bit off.

Chris Irons: Yeah.

Corey McLaughlin: Just a touch off. Yeah. And if we have the –

Chris Irons: And as of three months ago she was at $40. She's just now up at $72.

Dan Ferris: Right. And the idea that you're going to have a compounding – some kind of predictable compounding effect on stocks that are – the fund still contained a lot of, and still does have a lot of kind of cash-burning speculations in them, is a little silly. There's no compounding with that. It's a pure speculation. And she keeps talking about investing in disruptive innovation. Well, you're speculating on kind of garbage-y businesses and trying to replace them occasionally with Google or whatever. But even that is –

Chris Irons: And there is a whole tide of crap that needs to be taken out to pasture and shot, like all this speculation and crypto, outside of, let's say, bitcoin and Ethereum. There's hundreds of billions of dollars in speculation and leveraging. You still have a ton of [special-purpose acquisition companies ("SPACs")] that trade, a ton of pre-revenue companies. I mean, all of that needs to get carried out. All of it. And it will eventually. It's just a question of when.

Dan Ferris: Right. Well, a lot of the SPACs are effectively destroyed – I mean, down 80%, 90%-plus. Cannabis has had its head handed to it. All the stuff that was a bubble in March or April of 2021 – cannabis, SPACs, clean energy, a bunch of stuff. Yeah. And there's still – I agree, though, there's still a bid for it. She – that ARK fund, her main fund was up 90% off of that April 8 bottom recently. So...

Chris Irons: Let me just tell you, if that miraculous move in Tesla doesn't happen in December of 2019 to, let's say, June of 2020 where it was up 10X, if that move doesn't happen no one ever hears about Cathie Wood and no one ever hears about Ross Gerber. And that's it. Those are the two pieces of success that those two managers had that they've clung to. Ross is now getting wise to Tesla. Wood, I think, even if she doesn't like it at some point, I don't think she can – "I just can't quit you." She's got so many supporters that are Tesla supporters and everything. And so, they've clung to that. If that doesn't happen, that crazy December 2019 to June 2020 move in Tesla, which happened somehow right after Elon Musk got his pay package, but if that doesn't happen, no one ever hears of this woman – ever – because she has one after the other after the other invested in sh*t that's gone bankrupt, invested in stuff that's down 90% pre-revenue. This, that – there's just not a – I remember Ross Gerber buying Arcimoto, which went bankrupt, I think. There just – there hasn't been a piece of pre-order pre-revenue dog sh*t that these people haven't fallen in love with. And so, I think at some point that strategy is not going to work anymore. Who knows when that is?

Corey McLaughlin: All right. So, clearly we're not buying the ARK funds.

Dan Ferris: Yeah. We're not buying any ARK –

Chris Irons: I'm not – look, I'm not giving financial advice. I'm just telling you how I feel about these things. You guys can buy whatever you want.

Corey McLaughlin: No, no, I know. But what I wanted to say was how – if we – if somebody wants to hedge this the passive bid, the speculative mania of the market, the fact that the Fed comes to the – the belief that the Fed and the government will come to the rescue at all times, what do you look at? What – where do you go? And is it – and maybe it's something that's overlooked, that there's an area that you might be interested in like that for people to consider?

Chris Irons: Well, for me, it's like a combination. And so, I have some short exposure on the indices, which is always a place you can start if you want to hedge against the market going down. But then also, too, just like – I try to state diversified outside of the United States. I have a lot of emerging markets. If you look at even something simple like the EEM ETF, it's a good way to just get some emerging market. And then, there's the EMD, I think, which is emerging market dividends. You can look them up. But for me personally, what I like is I like owning gold. I like owning silver gold miners, silver miners, even real estate, which I actually do think will also crash at some point. But just trying to stay diversified outside of what's driving the market now, to put it simply. Right now it's speculation, and so I would be more weighted towards value.

I look at a name like UPS right now, which trades at 12 times earnings, pays a dividend. It's a company that I am certain is going to be around in 20 years, as shipping is not going away. It's a business that's going to be here forever. UPS and FedEx basically have a duopoly right now. So, I would much prefer to look at a name like that than to speculate at 50 times sales on Nvidia or whatever. So, you can obviously just get vanilla, short the indices. But for me also, too, it's having exposure to emerging markets, having exposure to gold, silver, miners. I even own some bitcoin. I own a little bit of Ethereum. Anything I can do to kind of get out of the system as it exists today. But also, I own long dated puts on some of the indices. Just as a hedge. Most of my portfolio is long, but it's just long in stuff that's not Mag Seven sh*t.

Corey McLaughlin: Got you.

Dan Ferris: Right. Yeah, there's plenty to do, I would even say. There's been plenty to do. We've made long pick after long pick in our Extreme Value newsletter. And that's a weird thing to be calling a newsletter at all these days. People are like "Value? Does that –?" And I like how you unabashedly make constant reference to value and valuation. A lot of people now, they're like, "Well, it doesn't matter anymore because market structure has changed everything." And you even refer to cyclically adjusted price-to-earnings ratio, which is something I do. I didn't think anybody else on the face of the earth cared about that. Everybody thinks it's stupid. It doesn't work, doesn't tell you anything. I would say it's a great way to identify an extreme peak in the S&P 500. You can see it. This chart screams at you, in other words. And it just –

Chris Irons: It does. Yeah. And we're near almost where we were at all-time highs, which was leading into the tech bubble of 2000. But this started 10, 15 years ago, kind of with the death of active investing. You used to be able – great managers who are – were great long/short managers like Einhorn, Chanos, these types of guys, they understood to short bubbles and to buy value. And that's really what investing should be. But active investing has just started to crap out two decades ago because of monetary policy and because of the fact that we've just decided to print at all costs and we can't take more than a 3% drawdown in the S&P.

So, the game has changed but I still think it's temporary. I feel like these things always have a way of making their way back to historical norms, historical averages. And it's just a question of when that happens. And until then you'll have to listen to everybody's bullsh*t stories as they try to tell you why this time it's different. Until then you'll have to listen to people make the argument that 30 times earnings is the new 12 times earnings. And really, that's – to me it just comes off as arrogant. It comes off as hubris. And so, I'm much more inclined to continue to focus on value because, look, if the market's trading at a 30 multiple and I can buy UPS for 13 times earnings and I feel it's going to be a business there for a while, then what's the difference? And how hard is that going to get sold off? If the market collapses 50%, Microsoft's going to go down 50%. Nvidia is going to go down 60%. UPS will probably go down another 10% or 15%.

And so, there's – you eventually find a bottom on names that are value names that generate cash consistently that have these remarkable decadeslong, cash-generative businesses. But what people don't realize and a lot of dip buyers don't realize is that when you're buying something that is burning cash or you're buying something pre-revenue or you're buying something that's unprofitable, or you're buying something that doesn't have any – that's insolvent on its balance sheet essentially, there is no bottom. When you talk about something like Fartcoin, there is no bottom. It's not one one-millionth of a cent. It's not one one-trillionth of a cent. It's zero. And with insolvent companies and companies that don't generate cash, they will die when the market pulls back. And that's just how it goes. It's Silicon Valley Bank. Sometimes you just can't meet your redemptions anymore and there's just no more bid. And psychologically when we start to make that change and people start to realize that, that effect will cascade further and further. And then our discussion today about buying UPS at 13 times earnings versus buying Nvidia at, whatever, 100 times sales isn't going to look as f*cking stupid as people think that it's going to look now when they see it because "This time it's different, Dan and me and you are the only people that don't get it."

Dan Ferris: Right. And I recently noticed that – well, actually, let me just say first I'm glad you mentioned David Einhorn because he was very smart. He was not getting great results and then he said, "Well –" it was almost like he thought about where do investment returns really come from, is what I took from his comments at the time some years ago. And they don't come from the market constantly pushing the valuation high forever because that doesn't happen. They come from cash. And so – and how that cash is deployed. And if the cash is deployed in a manner that basically sends the returns straight to the shareholder, whether it's dividends or share repurchases or something else, then you've found something, in my opinion. You've found something – if you've got a business or a company – I even actually recommended a publicly traded master limited partnership, which I don't do a lot of, but I thought – the more I looked at it, the more I thought, "Well, this thing's gushing cash. It's going to keep gushing cash. The debt's – the balance sheet is a fortress and the cash is going to make its way into the shareholder's pocket." So, it's going to be a big return, even if the market hates it. In fact, if the market keeps hating it, the cash will keep flowing and you won't be able to avoid the return.

That's what I want now. That's what I – that's how I'm trying to get around this because buying, as you say, the top 10 of the S&P 500 at 50, 100 times earnings is just crazy. It's not a way to get returns. Historically, it's just never worked out well. The guys at Research Associates, Rob Arnott, they do their – what is it called – big dogs or top dogs research where they show the biggest companies in the S&P 500 kind of change every so often. Every decade or so, they're different because when they get up there they perform like crap for a decade. So, yeah, same page. Look for cash gushers. I've been looking for cash gushers for years and I think now it's more important than ever. So, cheers to you. Cheers to UPS. Not investment advice, but cheers to the UPS argument, if not the investment.

All right. Well, a guy like you, I could just throw you softballs all day because we see the world similarly, but we've actually – we've gotten to the point where we can ask our final question. Take as much time as you want with this. If you've already said your answer to the final question, by all means feel free to repeat it at length, whatever you want to do. But it's a simple question. It's the identical question for every guest, no matter what the topic. And it's if I could just get you to leave our listeners with one idea, one takeaway today, what would that be?

Chris Irons: Sh*t. You mean like an investment idea or just anything?

Dan Ferris: Anything I've had people say go outside and spend more time in nature and spend time with your family.

Chris Irons: That's a great idea.

Dan Ferris: Yeah. Or "Go to my website," some of them say. It runs the gamut.

Chris Irons: No, I would just say the two things I would remember are that the MMC cycle that we're in, it's accelerating. And as it accelerates, it widens the inequality gap. And at some point, something is going to break from that. It's the problem that everybody is complaining about, which is the haves have more than the have-nots, but both parties advocate for monetary policy as it exists today and all that does is it pries open the wealth gap faster. It makes the rich richer. So, if you look at a chart of the bottom 50% and the top 10% of net wealth in the U.S., the top 10% is quickly moving further away from the bottom 50%. And the same parties that say that they're trying to take care of this one way or the other – it's a little bit more of a talking point on the left, I would say – those same people advocate for MMT and the monetary policy as it exists today.

I really do believe that we're at an insane inflection point right here where the Fed is absolutely cornered. Inflation is at 2.8%. They're going to have – something is going to have to give because they're not going to be able to raise rates without – or, I'm sorry, they're not going to be able to lower rates without inflation starting to tick higher. And they're really at a spot where eventually they're going to have to choose between basically a quick deflationary depression and – or inflation. And it feels like with introducing stablecoins into the system to buy Treasuries and this entire crypto ecosystem that we are quickly embracing and threading kind of into the material of our financial system, specific even to the Treasury, it just feels like we're at this strange point where, OK, we came off the gold standard and now we're at the – we've gone from the gold standard to fiat transition and now we're kind of at this fiat to digital transition where even more rules just kind of fly out the window because we have even more ways to micromanage the money supply with the market where it is so extremely overvalued in my opinion and the Fed basically out of options from – at least from the way that I see it.

I mean, Jim Chanos said to me once – I'll never forget – this is years ago, but he said, "This is an unprecedented experiment in monetary policy and it's just going to have unprecedented results." And so, the more complacent everybody gets, the more non-complacent you should become. The higher valuations get and the more you see other people making money, the more cautious you should become instead of giving into the FOMO. The point is all these great investors – Einhorn, Ackman, etc. – were all great contrarians. And you have to be a contrarian if you want to make money because you have to identify massive trends and massive breaks in trends before they happen. And so, all I'm trying to do is bide my time until the inevitable happens and just make sure that I'm not caught up in that hurricane when it does happen.

And that doesn't mean surrendering gains. I'm beating the S&P this year on my 25 stocks for 2025. I'm beating the S&P by 30% on those names. Why? Because I have nuclear. I have gold miners. I have psychedelics. I have all these other areas that have done extremely well despite the fact. So, you don't need to be in the same dog sh*t that they're pumping on CNBC every day. But just be wary of the fact that things are not as they seem. And it's like COVID. One day it's not a big issue and then you wake up the next day and people are fistfighting over toilet paper. And that's how quickly things can change. So, it's times now when people need that reminder that "Hey, this animal spirits" or whatever bullsh*t you want to label it when somebody buys a stock at 59 times earnings, whatever you want to call it. Animal spirits, market appetite, those things only last for so long, and then when they're done, they're done. So, this is the stairs up/elevator down analogy, whatever you want to call it. But just – and do your own research. That's – I said that in 2019 at the Stansberry conference. The lessons I learned from being a – being in the short-selling world for 10 years is that everybody's a liar. Everybody's a fraud. Nothing is as it seems. There's a whole underbelly to this world that makes things run in the way that they do that the average person would sh*t themselves if they saw even 10% of. And so, just be vigilant about protecting yourself and protecting your family and your community, and just keep your head on a swivel, investing and otherwise.

Dan Ferris: All right. Well, thank you for that. And thanks for being here, Chris. It's been a pleasure to talk with you.

Chris Irons: Yeah, my pleasure. Thanks so much, Dan.

Dan Ferris: Well, it's always fun to talk with Chris Irons. I'm glad we finally got him on the show. A salty fellow, but he speaks from the heart and from the mind. He's a smart guy and he's giving us his unvarnished version of things. As he made clear in his final takeaway, his answer to the final question was basically "This is the way I see things." And he said that a couple times during the interview too. It's – and it's good. He's right. We need more – this is the time when there's sort of a monotone from mainstream media, "Buy, buy, buy," so we need people like him. And if I could add – and you and me to say something different, to say anything different, just to let you know that there's another way to think. And he does have another way.

Corey McLaughlin: Right. And I take it for granted almost at this point hearing this – the other view of – from us and from somebody like Chris. But when I think back to when I first started to get interested in investing, I was trying to figure out why does price go up? And I settled on – somehow I ended up in the Austrian-ish world. And I'm glad I did because it actually makes sense to me. And it's – I do think he's right. It's not easy for us to say, but his last answer there, I think, is important because we keep – I think we know OK, there's this – these features of the market, the speculation involved and what – and eventually it will break. But what's going to break? What's breaking? I feel it's just all the people that don't realize the environment that we're in and think that just it's all going to go so well forever or what you're being told in mainstream media. If that were the case, there wouldn't be all these people all pissed off that they can't keep up with inflation and young people can't buy a house and can't – and tons of debt. And there wouldn't be a WallStreetBets and people going on there to try to bet on real estate stocks so they could actually buy a house if all of this – everything was going well as you're told. So, yeah, I'm glad we had him on. It's – you could follow him at Quoth the Raven online. Fringe Finance – that's his newsletter, which I've actually gotten for a very, very long time. And I had never met him. So, do check that out if you're interested at all.

Dan Ferris: Yeah. Yeah. I read some of his stuff from time to time. I always enjoy it. I enjoy hearing someone – we're talking about a different viewpoint, but I just – I like knowing that there are other people in the world whose different viewpoint is just based on kind of history and reason and what is – figuring out what's nonsense and what's not. And it demonstrates – to me, it demonstrates just a basic understanding of, as we discussed toward the end of the interview, where returns come from and what an asset's price ought to mean, where it's really supposed to come from. And at some point, I just – at some point, I just have such a hard time believing that the world has become completely untethered from that. And it's just nice to hear another mind that thinks that way and expresses himself differently than me and you. So, it's –

Chris Irons: Yeah. Put your earmuffs on. Well, I guess it's too late for that warning.

Dan Ferris: I know. I guess it's too late for that. Do we – I wonder, do we have a beeper? Do we beep out certain words and phrases? But – maybe not. Maybe we'll just publish the unvarnished Chris Irons –

Chris Irons: Well, it's live.

Dan Ferris: – as I believe we should. It's not too terribly offensive, hopefully, for folks. And it's a lot of fun. And it's definitely a viewpoint that you should know about. All right, well, that's another interview and that's another episode of the Stansberry Investor Hour. I hope you enjoyed it as much as we really did. We do provide a transcript for every episode. Just go to www.investorhour.com, click on the episode you want, scroll all the way down, click on the word "Transcript" and enjoy. If you liked this episode and know anybody else who might it, tell them to check it out on their podcast app or at investorhour.com, please. And also do me a favor, subscribe to the show on iTunes, Google Play, or wherever you listen to podcasts. And while you're there, help us grow with a rate and a review. Follow us on Facebook and Instagram. Our handle is @InvestorHour. On Twitter, our handle is @Investor_Hour. Have a guest you want us to interview? Drop us a note at feedback@investorhour.com or call our listener feedback line, 800-381-2357. Tell us what's on your mind and hear your voice on the show. For my co-host, Corey McLaughlin, until next week, I'm Dan Ferris. Thanks for listening.

Announcer: Thank you for listening to this episode of the Stansberry Investor Hour. To access today's notes and receive notice of upcoming episodes, go to InvestorHour.com and enter your e-mail. Have a question for Dan? Send him an e-mail: feedback@investorhour.com.

This broadcast is for entertainment purposes only and should not be considered personalized investment advice. Trading stocks and all other financial instruments involves risk. You should not make any investment decision based solely on what you hear.

Stansberry Investor Hour is produced by Stansberry Research and is copyrighted by the Stansberry Radio Network.

Opinions expressed on this program are solely those of the contributor and do not necessarily reflect the opinions of Stansberry Research, its parent company, or affiliates. You should not treat any opinion expressed on this program as a specific inducement to make a particular investment or follow a particular strategy but only as an expression of opinion. Neither Stansberry Research nor its parent company or affiliates warrant the completeness or accuracy of the information expressed in this program and it should not be relied upon as such.

Stansberry Research, its affiliates, and subsidiaries are not under any obligation to update or correct any information provided on the program. The statements and opinions expressed on this program are subject to change without notice. No part of the contributor's compensation from Stansberry Research is related to the specific opinions they express. Past performance is not indicative of future results.

Stansberry Research does not guarantee any specific outcome or profit. You should be aware of the real risk of loss in following any strategy or investment discussed on this program. Strategies or investments discussed may fluctuate in price or value. Investors may get back less than invested. Investments or strategies mentioned on this program may not be suitable for you. This material does not take into account your particular investment objectives, financial situation, or needs, and is not intended as a recommendation that is appropriate for you. You must make an independent decision regarding investments or strategies mentioned on this program. Before acting on information on the program, you should consider whether it is suitable for your particular circumstances and strongly consider seeking advice from your own financial or investment adviser.