In This Episode

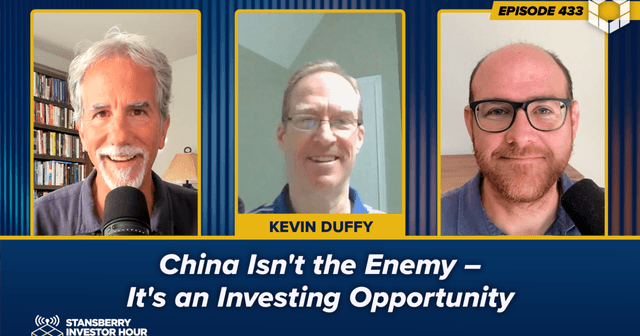

On this week's Stansberry Investor Hour, Dan and Corey are joined by Kevin Duffy. Kevin is the founder and editor of The Coffee Can Portfolio newsletter. He's also co-founder and principal of the investment-management firm Bearing Asset Management.

Kevin kicks off the show by talking about The Coffee Can Portfolio, the investors who have inspired his work, and his outlook on some long-term secular trends, including fiat currencies. He explains that most trends today harken back to the American Revolution, as that was when centralization really began in the U.S. Kevin walks listeners through several key points in history that got us to where we are today. Plus, he explores the false beliefs of the dot-com boom, the market's current euphoria around AI, and the obvious threat to Nvidia that many investors are overlooking...

China is sort of the anti-bubble to the U.S. exceptionalism bubble... This goes back to Trump's first term really trying to attack the Chinese. And they responded to this. It really jumpstarted indigenous innovation in China.

Next, Kevin dives deep on China. He discusses what he has learned by studying the country's stock market, why he's bullish on Chinese stocks, and the 50% discount that these stocks offer. Using Japan as an example, Kevin advises listeners to always question the popular economic narrative, as it can be completely wrong, especially at the end of major manias. He says the biggest culprits behind China's negative narrative today are the U.S. government and misplaced anger over worsening living standards...

There's an agenda here. I think the military industrial complex is basically at the root of a lot of it... The military industrial complex does see China as an existential threat, because if China is successful and we can trade with China, then there are no external enemies... [Then the military industrial complex] can't really justify [its] own existence... [China is] certainly not an existential threat to the American consumer. The American consumer has benefited mightily from China.

Finally, Kevin talks about the flaws in modern economics and financial logic, the importance of educating oneself on economics and learning from past mistakes, and the future consequences of the U.S. isolating itself while the rest of the world comes together. He says there are still some stock opportunities in the U.S., but the best opportunities are in Asia...

Silicon Valley has always been dominant. There has never been another. Well, what we now have going on in China with technology is incredible. We've never seen anything like this... We've never seen a country be able to basically stand up to American imperialism. And China is doing that. I see that as incredibly healthy for the world. So when I get up in the morning, this is what gets me excited.

Click on the image below to watch the video interview with Kevin right now. For the audio version, click "Listen" above.

(Additional past episodes are located here.)

This Week's Guest

Kevin Duffy has published a bimonthly investment letter called The Coffee Can Portfolio since 2020. He's also principal of Bearing Asset Management, an investment-management firm that he co-founded in 2002. The firm manages the Bearing Core Fund, a contrarian, macro-themed hedge fund with a flexible mandate. Bearing gained notoriety during the global financial crisis by betting against stocks like New Century Financial, Fannie Mae, Bear Stearns, and Lehman Brothers.

Prior to Bearing, Kevin co-founded Lighthouse Capital Management and served as director of research from 1988 to 1999. The firm was later sold to Fisher Investments. Kevin earned a Bachelor of Science in civil engineering from Missouri University of Science & Technology.

Dan Ferris: Hello, and welcome to the Stansberry Investor Hour. I'm Dan Ferris. I'm the editor of Extreme Value and The Ferris Report, both published by Stansberry Research.

Corey McLaughlin: And I'm Cory McLaughlin, editor of the Stansberry Daily Digest. Today we talk with Kevin Duffy, editor of the Coffee Can Portfolio.

Dan Ferris: Kevin's an old friend. We have spoken with him a few times over the years but it's been a little bit too long, so we need to check back in. Let's do that right now. Let's talk with Kevin Duffy. Let's do it right now.

Kevin, welcome back to the show. It's always good to see you.

Kevin Duffy: Good to see you, and to meet you, Corey. And thanks for having me back on.

Dan Ferris: It's been a little while. It's been about two and a half years. It's been since about March 23 since we last spoke.

Kevin Duffy: Yeah, I think it goes back to the banking crisis with SVB, Silicon Valley Bank.

Dan Ferris: Yep.

Kevin Duffy: I think that was the last time.

Dan Ferris: It was. No crisis this time. But who knows?

Kevin Duffy: No. And crisis averted last time.

Dan Ferris: That's right. But who knows? You never know what's going to break.

Corey McLaughlin: It's just an ongoing crisis, yes.

Dan Ferris: We can always be hopeful, can't we? So, let's remind our listeners who you are and what you do.

Kevin Duffy: OK. Well, I actually do two things. I run a small hedge fund under Bearing Asset Management, and I also started writing a newsletter called the Coffee Can Portfolio. I started that about five and a half years ago.

Dan Ferris: Yeah, the Coffee Can Portfolio is a fantastic idea. I think I must have used the story of the coffee can. I think it was – was that Robert Kirby maybe – 20 times in the past 25 years. I just sort of trot it out every few years because I figure another generation of subscribers needs to hear it. But that's really – that coffee can story about buying stocks and throwing it in an old coffee can, that's not exactly what you do, is it, in the Coffee Can Portfolio?

Kevin Duffy: No. No. Yeah, it's a little bit misleading. And I actually got that idea – our friend, Chris Mayer, he wrote a book called 100 Baggers, and the Coffee Can Portfolio is a chapter in the book. And that was the inspiration for the idea. But in truth, my process is really a mishmash of a whole bunch of different influences. And I think we're – as investors we're probably all like that. We've all been influenced by different people. With me, it was – first it was John Templeton, the great global investor and contrarian. Then it was Peter Lynch going to the local grocery store or the retailer and coming up with ideas, and is this something that could be rolled out over the nation or over – internationally? And then I discovered Austrian economics. And this was back in the late 1980s. at the time of the Japan bubble. And so, I had the contrarian piece.

And also, I discovered a guy by the name of Marc Faber, who was doing some interviews in Barron's. And I thought, "Well, this guy is a really – he's a contrarian. He's a nonconformist. And he's going against the grain. He's bearish on Japan." And so, I had that piece. And then I discovered at the same time, 1989, right at the top of this crazy bubble – and I was – it was very early in my career. The top of this bubble, I discover Austrian economics. And so, I read Murray Rothbard's America's Great Depression. And I thought, "Wow, this is really interesting" because boom, artificial boom fueled by credit expansion leads to a bust. And then what happens? You get a crisis and you get a response. And the response makes the whole thing worse and they drag it out. And so, he explained how first it was Herbert Hoover with really the pre-New Deal and then it was Franklin Roosevelt who came in. And also it was with the massive government programs. And what they did was they prolonged the Great Depression. They made things worse. Well, the Fed also initially intervened in that, unlike the depression of 1920, 1921, which Jim Grant wrote about, which was basically a kind of a laissez-faire approach. And it's not that the engineers didn't want to get involved but they did get it. But they never got around to it and the thing was over before they knew it.

So, anyway, back to your original question. So, that was another influence. And I've had many influences along the way, I think. So, the Coffee Can Portfolio is a little bit of everything. I think that part of it was really me – I wanted to force myself to think out 10 years and maybe longer, think about some of these long secular trends that are pretty much baked in the cake and then just going along for the ride.

Dan Ferris: Long secular trends baked in the cake. How do you mean?

Kevin Duffy: OK, so some of – I think some of the trends, it's like a movie. Looking at history, it's like this movie that's unfolding. And I think if we understand history, we get a sense for how this movie – maybe it doesn't end, but where it's going. We don't necessarily know all of the plot twists along the way. Those are maybe a little bit more difficult to figure out. But in terms of where things are going – for example, fiat currencies. Where does this end? I think history – and I think economics, especially Austrian economics – teaches us that it's going to end badly. It's going to – these will fail.

I think you can look at another really broad trend. And I know this is going to sound probably a little controversial, but there was in – the Colonies really were a long trend in decentralization. They were – the colonists starting with Plymouth Rock, basically were escaping the oppressive kind of centralizing forces of the Old World, and so they had this long run of decentralization where they were pretty much left alone and freedom flourished. And then the revolution came along. They realized that they had a problem and they needed to get rid of the British. The problem was that the revolution – war is the health of the state. And so, it kind of fired up these impulses towards – not just towards freedom. So, on the one hand, yes, it was about freedom and getting rid of a tyrannical ruler, but on the other hand they replaced the old ruler with a new one. And really, that cemented a change in trend from decentralization to centralization. And really, you could go back – and there were – this is a great book. I brought some props today. This is a great book called America's Counter-Revolution by Sheldon Richman. And I highly recommend it.

And this is – so, to me, it just reminds me a little bit of the movie Planet of the Apes, the original one with Charlton Heston. I'm sure you've seen that, Dan. Have you seen it, Corey?

Corey McLaughlin: I think I've seen parts of it. I don't know if I've seen the whole thing. But yeah.

Kevin Duffy: OK. All right. OK, so in the movie, there's this thing – there's the Forbidden Zone, and it's really about the history of how this civilization evolved where apes are on top and humans are on the bottom. And that – so, I think of that movie and the Forbidden Zone as history. It's almost like you need a red pill and go back and revise history. So, there's this great – there's a tremendous amount of propaganda and spinning of American history, and I think it's important to go back and really challenge that.

So, basically the Constitution started this trend in centralization. And what we're seeing – and then the Civil War, of course, secession would have ended that. The secession of the South would have been a check on that trend. And that was arrested by the Civil War and Abraham Lincoln, who was of course known as the Great Emancipator, but really he was the great centralizer. He gave us fiat currency. He gave us legal tender laws, the greenbacks. He suspended the laws of habeas corpus. He really just squashed secession. All these things were – really led us on the path to the centralized state.

And so, what we're seeing today, I think, is just this trend, this long trend playing out. And I think of countervailing forces. So, what we have here is this very negative trend towards centralization, towards top-down centralized power, but we also have a lot of countervailing forces that have kept living standards rising in this country all this time. So, you have – first, of course, you had the Industrial Revolution and you have now the Information Revolution. I think financialization and capital allocation, Warren Buffett and Charlie Munger, that was huge. But also, over the last 30 years, the rise of China, the productivity miracle of China, and that we have this incredible distribution system, retailers like Walmart and entrepreneurs like Sam Walton and going out in the world and finding the best products at the lowest prices. This has been a boon to the consumer. And of course, what's good for the consumers is good for business. If the consumer is able – if his paycheck is able to go further, he's got more money to spend. That creates more opportunities.

So, I think I see this as a number of trends that are pretty much baked in the cake. And the positive trends – I'm an optimist long term. The positive trends tend to roll along but the negative trends tend to go through this pattern of a long rising trend culminated by a blowoff, a euphoric episode, a bubble, and then a crash and then a reversal of the trend. And I just think that that's what we're experiencing right now.

Dan Ferris: Oh, so we're in euphoria. We're at the – I guess Templeton might call it the, what was it, the optimism, the point of greatest optimism or something? And certainly, I don't know, guys like you and I – I'm going to lump you in with me – are probably looking at the stock market very differently than a lot of other people are right now. I see the euphoria. To me, it looks like euphoria. But when it's happening, most people, they don't see it that way, do they? They just say, "Oh, no, AI is real, and it's going to change everything," or "The dot-com – the Internet is real. It's going to change everything." And so, the trend is right, but the investments are all – they get the trend basically right. The dot-com boom got the importance of the Internet correct but it didn't stop them from making disastrous capital allocation decisions and disastrously bad capital spending on all kinds of stuff that, yes, the usage of the Internet soared but the price people paid for it plummeted, so there were no returns to be had. And to me, it looks like that's where we are with AI and especially the data centers right now. It's just –

Kevin Duffy: Yeah. Right. I agree. And there's the saying that the pioneers take the arrows in the back and the settlers get rich. And this is exactly what happened during the dot-com days. And every bubble has a false belief. So, the dot-com bubble, the false belief was not that the future was the Internet. The false belief was first mover advantage. It was that the Pets.coms and these startups were going to put the old guys out of business. So, the old economy – and this is another symptom of bubbles, is that you see an anti-bubble as the mirror image of the bubble. And so, all the excitement was in these young guys who were going to put the old guys out of business. And there was some truth to that. Certainly, Amazon ended up doing very well and putting companies like Borders out of business and there was a tremendous amount of disruption that took place. But for that to – for the settlers to get rich, first there had to be a shakeout, which took place. And the old economy stocks did very well and they adapted. To a certain extent they adapted to this disruption. Some of them did, some of them didn't.

So, fast-forward the tape today, and is AI – is it going to be as meaningful as the Internet? I don't know the answer to that. I suspect that it's going to be significant. But there's a big question in terms of who the winners and losers are. And right now, investors are absolutely convinced that Nvidia is going to be the long-term winner and that they will basically retain their competitive dominance and that they'll – the profit margins are – I think there's something like 65% operating margins, over 80% of the gross profit is dropping at the bottom line along with Taiwan Semiconductor. So, these companies are very profitable. And I think there are threats that are starting – not being realized. And I think we have to probably bring China into this discussion as well. And I think that China is sort of the anti-bubble to the American/U.S. imperialism bubble – or, U.S. exceptionalism bubble. I'm sorry. That's probably a better description for it. And so, I think that – and this goes back to the Trump's first term, really trying to attack the Chinese. And they responded to this by – it really jump started indigenous innovation in China.

And so, now you can look at what happened with Nvidia. Nvidia was selling the H20 chip to get around the sanctions. That was – and then the Trump administration said, "You can't sell those." And now they're back on as long as long as Nvidia is paying 15% of revenue to the government, which they can absorb, but a company like AMD, of course, cannot absorb because they don't have the margins that Nvidia does.

So, Nvidia – where was I going with all this? They now want to sell chips back to China. Well, the Chinese are saying, "We're not interested. We basically can't trust you." So, you have – that's a threat to their business model. Also, the Chinese are – they're innovating. And they're – Huawei, there were sanctions against Huawei during the Trump administration. And now – and they tried to kill the company. They didn't kill the company. And now, there have been reports that they've got chips that are competitive with Nvidia. Now, I don't – you don't have to believe that but – and I think they don't have the ability to produce these chips probably in the quantities that an Nvidia has. But these are competitive threats that are on the horizon that I think investors are overlooking when they're giving Nvidia a market valuation of $4.5 trillion.

Dan Ferris: Yeah.

Corey McLaughlin: Yeah, that's interesting. This sounds like sort of a symptom of the centralization theme that you're talking about, an unintended symptom of it. But what I'm interested in asking you, you sent us your latest issue, and you don't have to give away the whole thing, but one of the areas you're bullish on, I think, right now is China, right?

Kevin Duffy: Yeah, I'm – and so, OK, China – what got me first interested in China was the private tutoring industry that Xi Jinping was apparently going to just wipe out. And so, as a contrarian, I looked at this and I thought, "All right, let's get our – let's dip a toe in the water and let's learn something here." And so, that's what I did. And so, I recommended New Oriental Education and Training, and the stock was down, I think, over 90% from the high, and they had cash in the bank, more than enough to cover what we were paying for the stock. No debt and a business that was drying up.

Now, what's happened is they've been able to adapt. I think Xi Jinping has backed off somewhat. The Chinese obviously value education. That was part of my original thesis. But what I've learned from this – now, this was back in 2021. What I've learned from this is how adaptive the system is and how these narratives that we hear here about how it's incredibly authoritative and it's just destined to – for the dustbin of history and all that, that there's a little bit of nuance there. There's more to it than that. And so, I just dug in more and more and I started looking at company after company, and what you see are a lot of really exciting qualities.

And you also have to look at China in terms of their stock market. So, 2007 was a huge bubble in China and the retail investor was all in. Well, today the retail investor is gone. They're completely gone from the market. So, you can also look at the foreign investor. Well, the foreign investor has bought into these narratives that you cannot invest in China. It's authoritative. It's the enemy. It's uninvestable. There's no rule of law. All that stuff is all tossed in there. So, that's kept foreign investors out. And so, it kind of begs the question, well, who's left to buy? And what you have, the companies are buying. They're buying their own shares. And what I see – one of the things I like to see – is entrepreneurs, founder-led companies. You're seeing that. And these founders with lots of skin in the game. And we're seeing that.

And the other part about this is the valuations. Of course, the valuations, if I'm looking at an apples-to-apples in terms of the kind of growth that I can get and the compounding and everything, I think the prices are, like 50% – it's a 50% off sale compared to what you can get here in the United States.

Dan Ferris: Nice. It sounds like a bargain.

Kevin Duffy: And you know what – the thing about – so, this, I think, is kind of interesting about China. And I'll bring it back to sort of the big picture and how I kind of got into this business and I sort of – I cut sort of cut my teeth on the Japan bubble and I was one of the contrarians back then along with Marc Faber. And there weren't too many of us. But I – one of the things I learned from that is to question the narrative. So, the narrative back then was that Japan was – it was inevitable. History was on the side of Japan and that all empires die. It was just the American empire's turn to die and to hand over the reins to the Japanese. So, the America's decline theory – so, confidence was very low in the United States. It was very high in Japan. The retail investor got very excited in Japan. You had all these things going on, but it was the narrative. And it was also the people that were driving the narrative and what the people thought.

So, what you would see on the Nightly Business Report would be MIT economists like Lester Thurow, who were telling us that "Look, the Japanese have a superior system of capitalism," kamikaze capitalism or whatever you want to call it – Japan Inc. – and it was this cooperation between business and government and that this was an improvement over the more laissez-faire model of the United States. Well, as an Austrian, I looked at that and I thought, "Well, this is kind of nonsense."

But what they were doing – the people that were behind – pushing this narrative, they wanted more government. They wanted – they were Keynesians. They were interventionists. They wanted more government to step in and save the day. Well, thankfully, it didn't really happen here in the United States for whatever reason. And so, the narrative, what I learned from that was that the crowd was kind of all-in on this narrative. And the narrative wasn't just a little bit off. The narrative was 180 degrees off. That's what you get at the end of major manias. They become – they are major inflection points.

And so the bubble was Japan – the anti-bubble was the United States. And the anti-bubble was really not just the United States but a belief in U.S. technology. And that's a bet that I made in a big way. I mean, we were loaded up – I remember Dell Computer was one of the stocks that I recommended. They went public in 1988 and in early 2020 the stock was trading at four and five eights and they had, I think – they had a whole bunch of cash. No debt. Had some problems in terms of overpaying for [dynamic random-access memory ("DRAM")]. Michael Dell was young and kind of untested. But we were buying this at book value. We bought Dell at book value back then. I don't know how much it went up after that. But that should give you a sense for –

Dan Ferris: Best-performing stock of the '90s, actually.

Kevin Duffy: It was – was it?

Dan Ferris: I think so. I think –

Kevin Duffy: Well, I didn't hold it the whole time. I wish I did. But – so, let's fast-forward the tape to today. Today, it's the narrative – and I think the narrative is that, again, China's the bad guy. China's the enemy. We need to protect ourselves from the Big Bad Wolf and we can't trade with them. We've got to – it's a very antagonistic view of China. And –

Dan Ferris: All Chinese students are spies.

Kevin Duffy: Yeah. And all Chinese companies are working for the government. It's just on and on and on. And so, I've been – my first – my radar, my first thing is to think ,"OK, I've seen this. I've seen this movie before. Question the narrative and start fact checking." Start going into, well, who's behind the Uyghur forced labor narrative? Well – and then you just go into the hyperlinks and you see, well, where are the – where's this stuff coming from? It's coming from the Defense Department. OK? So, there's an agenda here and there's – I think the military industrial complex is basically at the root of a lot – I think it's a combination of a couple of things. Probably, the military industrial complex does see China as an existential threat because if China is successful and we can trade with China, then there are no enemies. There are no external enemies and they can't really justify their own existence. So, I think to the military industrial complex, China is an existential threat. It's certainly not an existential threat to the American consumer. The American consumer has benefited mightily from China.

But you also have – I think there's another force, a very powerful force that is driving the anti-China hysteria, and that's the MAGA Republicans. There is a sense in this country that "Something is wrong with this picture," which is that living standards – young people are really struggling in this country, unlike anything I've ever seen before. It used to be that the next generation would be better off than the previous generation, and we just all took this for granted as Americans. Well, I think that 2000 – 9/11 kind of changed all that. It really set us on a course towards more centralization. The surveillance state, the Patriot Act, the wars in – the forever wars in the Middle East that cost $6 trillion, lives lost, destroyed, running the printing press, gold doing back flips, the Fed's balance sheet expanding whatever – how many times it's expanded since then. We've gotten big – we've gotten crisis, three crises really: 9/11, we got the global financial crisis in 2008, and we got the COVID crisis. And every one of those brought a much greater government response.

So, we've been accelerating this trend towards centralization. As we have been doing that, those forces have been overwhelming the positive forces that I mentioned before. And as a result of that, living standards are having a hard time keeping up. Now, government intervention helps the incumbent. So, older people, the baby boomers that own their homes are somewhat insulated. Big businesses, somewhat insulated. But if you're a startup or you're a small business, or especially if you're a young person starting your career or trying to start families, it's very, very difficult.

So, I think that there's a certain unease that has crept into Americans. And it's expressing itself in this populist movement that Trump has basically tapped into – you could say brilliantly tapped into or maybe he just stumbled into it. I don't really know, but it doesn't matter. So, this force now is trying to diagnose the problem. It's correct. It's correct that we have a problem. But the problem is big government. And the solution is to get rid of it. Start – just wholesale get rid of it.

And look at what's happening right now. They've completely misdiagnosed the problem. There's – none of the solutions on the table or very few of the solutions involve rolling back the state. We've got the "Big Beautiful Bill," which is going to add $3.4 trillion in debt over the next 10 years, and that's a conservative estimate. Some other estimates go, I think, as high as $5 trillion. They are – really, Trump is bullying [Fed Chair Jerome Powell] to come in and kind of rescue the government by lowering interest rates because they know that interest outlays are a trillion dollars a year now and consuming a big part of the budget.

And so, they've misdiagnosed the problem. They think – they're trying to scapegoat. They're looking for other scapegoats. They're scapegoating immigrants. They're scapegoating the Chinese. The Chinese – if I'm correct, the Chinese have been one of the positive forces. Trade is mutually beneficial. If trade is mutually beneficial – you want people to be productive. You want young people to be productive in this country. You want the Chinese. You want the Russians. You don't want them building tanks. You want them pumping oil. You want everybody to be as productive as possible and you want to be able to trade with them. So, I think they have misdiagnosed the problem. And this is something that I think is – we're just on this path. Like I said, the movie's unfolding. Donald Trump – it's not Donald Trump that's doing all of this. Donald Trump just happens to be in the right place at the right time and he's the guy who's steering the ship right now. But if it wasn't him, I think it would be somebody else.

Dan Ferris: Yeah, I maintain that anybody who can get elected to the presidency is – you can't elect a good man to the presidency. They're just – they're always going to be someone who's interested in power, wielding it practically for its own sake. And they get something out of it eventually. But I agree that it doesn't really – it's sort of like the opposite of what Peter Lynch used to say: You want a business that's so good it doesn't matter who's running it. Well, this one is so bad it doesn't matter who's running it. The government is so bad it doesn't matter who appears to be running it. And it's just too big.

I also agree with you that size, anybody – any poor unfortunate souls who follow me on Twitter and are exposed to my ranting and raving know that one of the things I rant and rave about the most is the sheer size. That is the problem. That is the singular greatest problem with government, is its sheer size creates an enormous incentive to anybody who can get in there and get their piece of it. It is like amassing a big pot of gold or a big amount of capital and inviting everyone to come and try to get some. And it's – and the incentives are poor because you are not rewarded for innovation or productivity or serving a need that maybe people didn't even know they had and creating something new and good, nor do you benefit by promoting trade or free immigration. The only thing about free immigration, Kevin, is I agree with you it's a scapegoated thing, but it's probably impossible to have it if you have a massive welfare state, right? Because you'll just –

Kevin Duffy: Oh, yeah, no, I agree. Don't get me wrong. I'm not advocating free immigration.

Dan Ferris: Yeah, we can – yeah.

Kevin Duffy: Yeah.

Dan Ferris: But –

Kevin Duffy: Yeah, I'm just saying – I'm just bringing that up as an example of the scapegoating. I think that the – you and I, I think, agree with this stand, agree on this, that there's really not a lot of difference between the left and the right. And I always – and the thing that – so, you have kind of this charade that's taking place, this illusion that there's actually a difference of opinion. And there are differences. There's no questions there are differences. But I think that the – both of them kind of subscribe to this zero-sum world where one group is exploiting another group. And so, to the left, the oppressor group is the billionaires and the people running businesses and the working class is being – is the victim. On the right, the working class is the victim and it's the foreigners that are exploiting them. So, there's really – in principle, there's not a whole lot of difference. I think the right is more nostalgic. They want to bring back a romantic past that maybe never existed, and the left is more willing to just blow everything up and just jump right into a utopian future because they basically have nothing to lose. The right people have more to lose. They have more skin in the game. But I think it's a sort of a romantic, backward look maybe. So, those would be some of the differences.

Dan Ferris: Right. And –

Corey McLaughlin: And I'm just sitting here – I'm sitting here listening and I'm like "Yes. Yes." Checking off "Yes," agreeing with everything that you're saying. As far as – I haven't heard somebody talk about going – well, some people, but not lately in a financial sense going back to 9/11, the financial crisis, and COVID, especially for a younger generation of people. And I – I'm just – I see it the whole – if I didn't discover Austrian economics myself, I don't know what I would – where I would be right now personally. And so, from that perspective, what is the solution here? What is the – you said just eliminate big government. What can we practically do to just make this a little bit better?

Kevin Duffy: Well, I always – my advice is always, No. 1, grab the oxygen mask and then try to educate yourself, try to be – try to influence other people. The first thing would be – you mentioned Austrian economics. There's Economics in One Lesson by Henry Hazlitt.

Dan Ferris: Oh, yeah. Good book.

Kevin Duffy: It's the must read. If you read this book – my aunt read this book. She loved it and she gave it to all of her grandchildren. It's a pretty easy read. And once you understand the basic principles, basically man acts purposefully with reason. Maybe not always rationally but there's a reason behind actions. If you – self-ownership, these sorts of things. They're the basic building blocks.

Economics, this is something that – maybe we're getting a little too far aside, but economics is not – it's not the physical – it's the social sciences. It's not the physical sciences. So, the rules are different. I think a big part of the problem that we have today is that the economy – the so-called economists, not the real economists, but the ones that claim they are, are trying to apply the rules of the physical sciences, which is induction, which is to try to run a controlled experiment. It's very empirical. So, the Chicago school is – now, there's some agreement between the Chicago and the Austrian school, but the Chicago school is basically an empirical approach. But the problem is you cannot run a controlled experiment with human beings. Human beings interact. Human beings learn from past experience. So, you can't just duplicate – so, it means that things like back testing isn't necessarily going to work. You need a – not an inductive process but you need a deductive process. You need a basic chain of logic. It can't be disproven by empirical evidence. So, for example – it can only be disproven by disproving the logic, finding the flaws in the logic.

So, I think that, like I said, the first thing is grab the oxygen mask. And that's probably where we need to go next, is how do we do that? But the second thing is, yeah, get a copy of Economics in One Lesson and learn about what – what needs to be done is basically it's privatizing things, getting the government – what is the government – you could look at every single thing that the government does. Welfare, for example. Well, does the government – you could look at the morality of that? Is it right to take money from one person and give to another? Well, so these are things that the government – that nobody should be doing. Theft should not be legal. It shouldn't. And it certainly shouldn't be allowed for the government. Well, then you have certain services that are being provided. Roads, education, schools, all these things that the government is doing. Privatize those. Sell off public lands. So, I think the path in terms of – all these things are fixable. They're all fixable if we get the economic piece right, if people are educated in economics. I think if 10% of the country read Economics in One Lesson, we'd probably be well on our way to fixing those problems.

Corey McLaughlin: Yeah, I agree.

Kevin Duffy: But as investors, I think that's really where we need to kind of protect ourselves from this. And just – so, maybe that's where we want to go next, like how do we do that?

Dan Ferris: Yeah, I don't know if everybody reading Economics in One Lesson would have that effect. Lots and lots of people have read Atlas Shrugged and... nothing. So, we're –

Corey McLaughlin: Well, it wouldn't hurt. It won't hurt.

Kevin Duffy: But let me add one thing, Dan. And I think it's a combination of two things. One is we have to learn, we have to study, but the other thing is that bad ideas have to fail. My experience, and not just with other people, but even myself is that if I'm on the wrong path, the only thing that's going to get me to change is I have to fail miserably. And I've done that in my career. And I was a failed short seller and I'm very – I made changes five and a half years ago. I was forced to change. And I think that most people are the same way. So, we need these experiments to fail, basically. And I think if they do – not if. I mean, when they do, then that's probably our best chance that that things will change. And young people are – they're distrustful of these institutions. That's a good start. That's a good start. So, no, I'm an optimist long term. It's just a matter of this is all going to play out. The nature of bubbles is that they do eventually burst, and when they do you get a massive change in trend. And that's in the future somewhere.

Dan Ferris: I agree. The ideas fail. They probably take longer than a 63-year-old wants them to, but to fail – and then longer to fix or whatever. But yes, I agree. In fact you mentioned the start of the United States and how we learned to love liberty and – but it wasn't for lack of trying everything else. This country, it was – in the 17th century, almost practically right up to the time of the revolution, they tried absolutely everything else. They hung people for being the wrong religion. And you weren't allowed to – you could be tortured – your punishment for not swearing allegiance to the Massachusetts Bay Company or whoever the hell it was would be to be dragged behind a cart through all the towns in the territory or whatever. And you – being a Catholic would have been illegal, say, in Virginia, and you're right next to Maryland, which was Catholic, the Catholic proprietary there.

So, they tried everything else. They did absolutely everything else. And if you – you can get this story in Murray Rothbard's book, Conceived in Liberty. Just the first of the five volumes will blow you away with how awful and evil these people treated one another and tortured one another and killed one another, and they went after the Indians, too, and used them in every evil way you could. And yet, Rothbard, at the end of these chapters and sections, he said, "They tried it and it failed. They tried to manipulate everything but the free market will out and it failed." And they sort of gradually – liberty was – I say age thrust a certain amount of wisdom upon me. Well, time will thrust an appreciation for the cardinal virtue of political liberty upon you. That's the cardinal virtue. It's not democracy. We hear a lot about democracy nowadays. It's completely misplaced. The cardinal political virtue is individual liberty. Eventually, nature just forces that revelation upon you in all kinds of ways.

Kevin Duffy: I think there's another force here that – another very positive force that is going to bring an end to this, and that's what's happening in the rest of the world, and particularly in Asia. I'm not going to include Europe because they've got their problems as well. But the more I've gotten into China, the more excited I am. When you look at – so, here's an example of how I think man does learn. Go back to Smoot-Hawley. The reaction to Smoot-Hawley of the rest of the world was to retaliate and trade went down over 60% and kind of sowed – helped sow the seeds for Hitler and World War II and that sort of thing. And I was looking at this originally when Trump was bringing out the big guns with the trade war and I'm thinking, "Oh, my God. Here we go. 1930 again. The rest of the world is going to respond this way. And what a disaster."

And the opposite has happened. I like to be pleasantly surprised, and this is an example of where I didn't see this. This wasn't on my bingo card that the rest of the world would basically say, "You know what? This guy's nuts. Just because he does something stupid to his own people, we don't need to do the same thing. In fact, because he's doing this, we're going to need to band together." So – and who's leading the charge, the free trade charge? It's China. There's no question in my mind. It is China. And so all these countries are now basically forming this bloc, this alternate – so, the United States, while it's isolating itself, the rest of the world is kind of coming together into this big, big bloc. I see that as incredibly, incredibly exciting. And I think also what's going on in China, Asia – to me, the future is Asia. If I were young, I would be learning Mandarin and I would be spending time in China. So, there's always opportunities –

Dan Ferris: You sound like Jim Rogers.

Kevin Duffy: – and you can't allow yourself. What's that?

Dan Ferris: You sound like Jim Rogers. "If you're young, go to go to Asia. Learn Mandarin."

Kevin Duffy: Yeah. Yeah.

Dan Ferris: I'm sorry. I don't –

Kevin Duffy: Yeah, have your kids over there and get them to learn Mandarin.

Corey McLaughlin: Is that the oxygen you're talking about? The rest of the world – that's where we go to seek oxygen?

Kevin Duffy: Yeah, that's the oxygen mask. Exactly.

Corey McLaughlin: OK.

Kevin Duffy: So, yeah, there's always – and I think this is what's exciting right now. Silicon Valley has always been dominant. There's never been another – well, we now have – what's going on in China with technology is incredible. We've never seen anything like this. We've never seen a country – now it's the second-largest economy and they're on their way to being the largest economy, and we've never seen a country been able to basically stand up to American imperialism, and China is doing that. I see that as incredibly healthy for the world.

So, that – this is what gets me – when I get up in the morning this is what gets me excited. It allows me to kind of deal with, unfortunately, the negatives that are playing out in my country, in our country. But – there are ways to protect yourself in the US and there are course companies that are American companies that are doing very well overseas. So, it's not like there aren't any opportunities here in the United States. And I think even in the United States, there's still a lot of really positive things that are going on. There's still entrepreneurial – this entrepreneurial energy. There's pretty good capital allocation that's taking place. I think that the Chinese are sort of sort of learning from that, but there's always something. There's always some opportunity somewhere.

Dan Ferris: Yeah, it reminds me of Peter Cundill. "There's always something to do." Always. You've got to be – it was one of his great pleas. That's the name of his biography, too: There's Always Something to Do. It was one of his ideas that you really should be a global investor because if you are, then there is always something to do. If your home country is a bad bargain, is not a bargain, the opposite of a bargain, a bubble, there's an anti-bubble, which is a phrase I like very much too, somewhere else or in some other asset besides U.S. stocks and bonds. And that's – that alone is to me the reason to become much more interested in other countries. There's always something to do if you are. You'll always find something, even if it's just a single company in a single country that you never considered before, there's always something to do.

Kevin Duffy: And it's never been easier, too. It's never been easier to be a global investor. The balance sheets in China, they have – these are companies that are – they've got American depository receipts. They've got to comply with the American accounting standards. And it's just as easy to read a balance sheet from Alibaba than it is to look at one from Alphabet.

Dan Ferris: Yeah, that's pretty amazing. I remember years ago I bought a book that's still in the shelf back there somewhere called Asian Financial Statements and I thought, "Well, financial statements are financial statements." And it was really – it's a very sort of real in-your-face kind of a book about how things were – you couldn't trust them basically and here's how you figure it all out. Maybe it's not that bad anymore, huh?

Kevin Duffy: Well, look, there's all kinds of ways to invest in China. There's the A shares. I haven't really gotten into that. That's kind of higher – next level. But you've got companies that are – these are global companies that are having to comply with standards. Look, the U.S. government has wanted to kick the Chinese companies out. And they – I mean, any excuse, believe me. If they weren't complying with accounting standards, they would be gone. So – this has been – the last 25 years, all this has been going on in China. It's becoming a – very much a westernized country in many respects. And they're fast learners. They've learned – they're learning capital allocation.

I think what's amazing is how that the Japanese, it's taken them forever to learn capital allocation, and the Chinese – so, China is very different than Japan. China is very – it's super competitive, constantly driving prices down. And I think what the next thing that we're going to see – so, while a lot of American investors are avoiding China, and what we're going to see is that Chinese companies, they're going to start to – they've been exporters and they've done very well exporting, but we're going to start to see more multinational global consumer brands coming out of China. I think that probably the first obvious one is BYD, which is now the largest producer of electric vehicles in the world and an incredible – and Warren Buffett and Charlie Munger invested in that company in 2008. A remarkable success story. Founder-led, lots of skin in the game. I haven't even recommended it yet, so I'm sure I will at some point. But I think that's the next thing. The next act in this play is we're going to start to see the Chinese push. It's going to look – they're going to have multinational companies and brands built up around the world.

Dan Ferris: All right. This is a good place to ask our final question, which is the same for every guest, no matter what the topic. The question is for our listeners' benefit. If you could leave them with a single takeaway, just a single thought today, what would you like it to be?

Kevin Duffy: Well, I've actually thought about this, and I've listened to your show quite a bit, so this time I actually decided to prepare something.

Dan Ferris: I think it's the first time ever –

Kevin Duffy: Never allow yourself to become over –

Dan Ferris: – that anyone ever has.

Kevin Duffy: Why not? Let's break some ground here.

Corey McLaughlin: That's what I'm talking about. Yeah.

Kevin Duffy: Never allow yourself to become overly pessimistic. The dominant long-term trend is the hockey stick of human prosperity. Look for problems. Look for solutions to problems. Bet on entrepreneurs who are passionate about serving consumers. Look for the silver lining in the cloud. There's always opportunity somewhere. The upside of bubbles is that they create anti-bubbles. Defend capitalism. Promote free trade. And never underestimate human resiliency.

Dan Ferris: Well said. That is excellent.

Corey McLaughlin: Nice.

Dan Ferris: Thank you for that. And thanks for being here, Kevin. It's always a pleasure to talk with you.

Kevin Duffy: Enjoyed it. It was good meeting you, Corey.

Corey McLaughlin: Yeah, you, too. Thanks for being here.

Dan Ferris: All right.

Kevin Duffy: And thanks for reading my stuff.

Dan Ferris: Yeah, we're going to keep doing that. And next time we're not going to wait two and a half years to have you back on.

Well, it's nice to check in with Kevin after two and a half years and find out that he is still a sound Austrian thinker and an optimistic guy, which is refreshing, I have to say.

Corey McLaughlin: Oh, yeah, totally. I was sitting there during it and I'm like "I need to talk to more Austrians here over time." Every time I'm – every time it just confirms all of my biases and I feel very good about it. But – and I happen to think it's all correct. So, that's nice. But it's – yeah, it's – I like the way just – if you want to check out his newsletter, you should. It's – I like the way he goes about it. He's got these macro themes that he's – that he kind of has developed or identified as just important or that are emerging over time as the – over a long periods of time, as he says, and then kind of matches up the stock picks to those themes and how they could play out. And I think you got a taste of that here with the centralization theme and China being an opportunity, ironically, to be against that. And so, yeah, I'm happy we had him on. It was a cool talk. And he brought book recommendations, which is always nice.

Dan Ferris: Always welcome, yeah. You mentioned a good point, which is China. He, I think, if I am not mistaken, is the only person who – he's not only said that it's not uninvestable. He says it's a contrarian opportunity. So, he's 180 degrees from – I can't remember anybody else expressing any idea about China except that it's uninvestable, which is always what you hear, right? That's always what you hear when – with the good contrarian opportunities. Everybody else says it's uninvestable. One guy like Kevin says, "Buy."

Corey McLaughlin: Yeah, for sure. It's funny because when he – a couple, I don't know, a month or two ago, when we interviewed Brett Eversole – or I did. It was the week you were out – and we were talking about "cheap, hated, and in an uptrend." And after that episode, I got a message from Kevin on Twitter about "Hey, what about China?" And well, there we go. So, yes, to that point. Yeah. And he brought up a lot of interesting points that I hadn't heard before. And I'm sure other people, a lot of maybe other people won't agree with. But that's the point, right? So –

Dan Ferris: It is. It is. That's how a contrarian – a real contrarian is. They'll say things like "Well, immigrants are scapegoated." And I'm sure a lot of people are going to go "What? We have too many illegal immigrants, etc., etc., etc." And it doesn't – they can sort of both be true, right? You can have a problem with having let too many criminals in your country and it can also be true that you're unfairly scapegoating the entire immigrant population, that both of those things can be true. Yeah. So, for that alone, for his deep contrarianism and his consistency, his intellectual consistency, it's always great to have him around. So, that was really – that was a – to me, it was a great fun interview and a great fun episode. I hope you enjoyed it as much as we really, truly did.

Announcer: Opinions expressed on this program are solely those of the contributor and do not necessarily reflect the opinions of Stansberry Research, its parent company, or affiliates.